NetApp hovers around fiscal Q4 revenue target; cutting 900 jobs

Analysts were skeptical about NetApp's fourth fiscal quarter earnings report published after the bell on Tuesday -- especially amid fears regarding major layoffs.

The network storage business reported fourth fiscal quarter earnings of $174 million, or 47 cents per share (statement). Non-GAAP earnings were 69 cents per share on a revenue of $1.717 billion.

Wall Street was expecting non-GAAP earnings of 68 cents per share on a revenue of $1.76 billion.

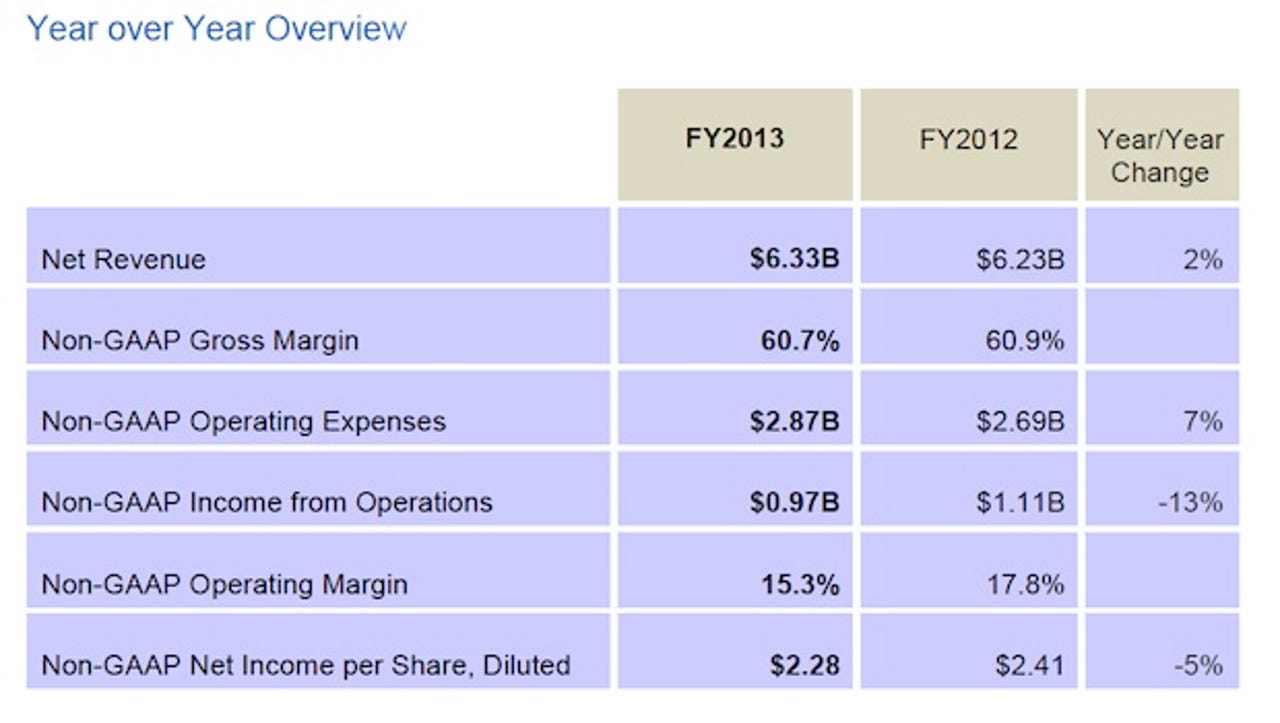

For the entire fiscal year, NetApp posted a revenue of $6.332 billion with non-GAAP earnings of $2.28 per share. That's up from $6.233 billion for fiscal year 2012.

Product revenue was NetApp's biggest unit for the quarter, accounting for 66 percent of total revenue.

Despite the mixed bag, things still aren't good for NetApp as the company slipped in the confirmation about a huge round of layoffs:

The Company has undertaken a realignment of resources and restructuring which includes a global workforce reduction of approximately 900 employees. The Company expects to recognize an estimated aggregate $50 - $60 million pretax charge relating to employee severance and other restructuring charges.

CEO Tom Georgens reflected on the quarter in prepared remarks:

The fourth quarter was highlighted by a continued strong uptake of clustered Data ONTAP, an expansion of our leadership position in Flash, and double digit growth in branded bookings. We are also pleased to announce enhancements to our capital allocation program, reflecting our confidence in our underlying business as well as our commitment to enhancing shareholder value.

For the outlook, analysts are looking for first fiscal quarter earnings of 53 cents per share on a revenue of $1.60 billion.

NetApp provided slightly lower Q1 guidance, projecting a revenue range of $1.475 billion to $1.575 billion with non-GAAP earnings projected to fall between 45 and 50 cents per share.

The Sunnyvale, Calif.-based company also announced that it is increasing its current stock repurchase program by additional $1.6 billion. That would bring the total value to roughly $3 billion, which NetApp plans to complete over the next three years.

In the more immediate future, NetApp outlined that $2 billion of repurchases should be completed within the next year, of which $1 billion is planned to be completed during the next four months.

UPDATE: Georgens discussed a bit more via telephone ahead of the quarterly conference call on Tuesday afternoon.

The CEO explained that NetApp spent much of last year introducing “the biggest technology in the history of the firm,” essentially taking its storage operating system and merging that with clustering.

Georgens outlined that the transition began early last year, but he asserted that the momentum continues up until now.

Since the last earnings call, Georgens continued, NetApp flushed out the remainder of its flash product strategy, but he added that will continue to be a “high-growth sector going forward.”

As for the layoffs, Georgens replied that they will impact all geographies and will be as immediate as each country’s laws allow.

“It’s not something we want to drag out. We want to do it with respect, dignity and compassion for the employees,” Georgens explained.

While he didn’t specify exact departmental units, Georgens affirmed that the job cuts will be used to realign core avenues throughout NetApp and focus on innovation, building industry alliances, go-to-market strategies and professional services.

Charts via NetApp Investor Relations