Oracle's Q4 and beyond: Five big issues

Oracle's fourth quarter results are expected to be seasonally strong and erase worries about the company's sales execution. However, there are multiple issues surrounding Oracle and there won't be definitive answers for a while.

The company is expected to report fiscal fourth quarter earnings of 87 cents a share on revenue of $11.12 billion. Most analysts expect Oracle do well in the fourth quarter or at least meet expectations, but questions about the company's future remain.

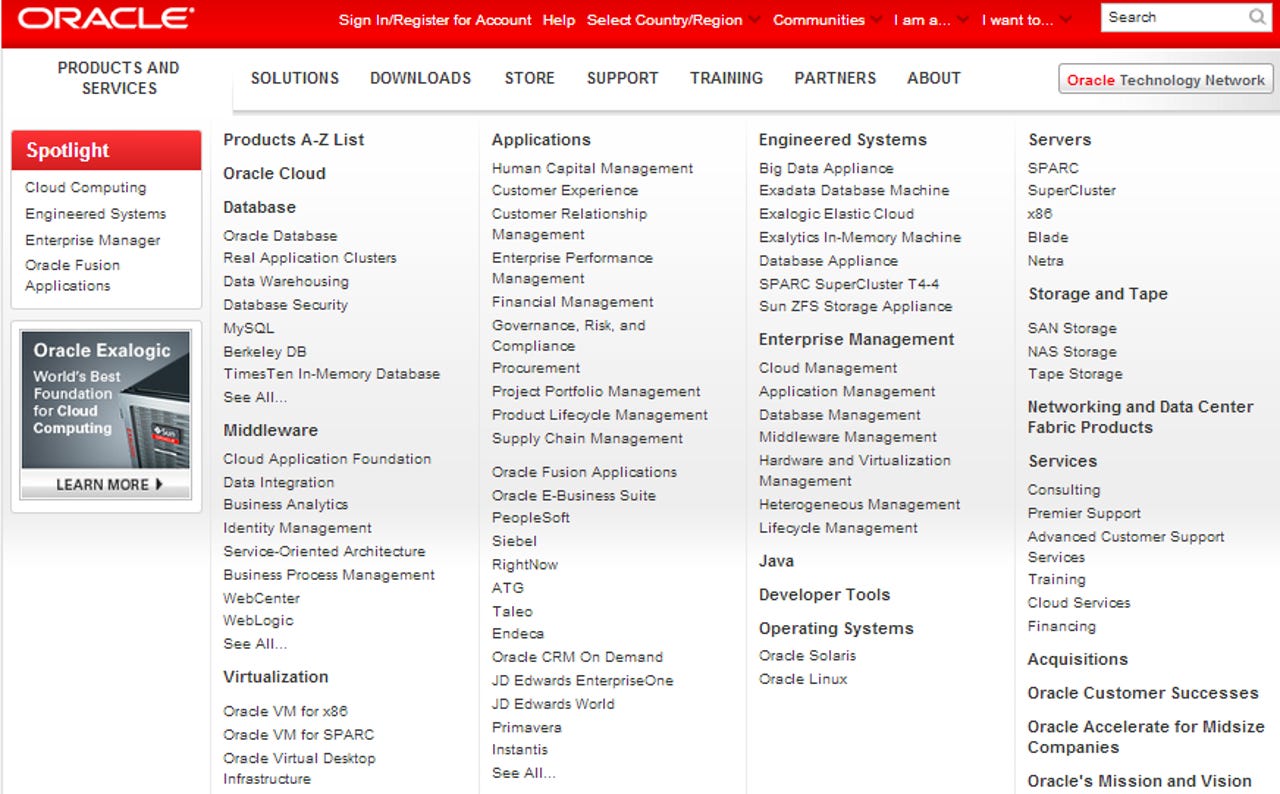

Can Oracle fight multiple wars at once? Oracle executives are likely to pooh pooh worries about little things like open source database migration, software as a service vendors and whether hardware will ever bottom, but the company faces more challenges than ever. On the database side, enterprises are moving to open source rivals such as PostgreSQL. On applications, Oracle has the likes of Salesforce and Workday, two companies bulking up their sales teams, along with SAP. As for maintenance, Rimini Street continues to be a threat. "We continue to believe that virtually every product line at Oracle is under increasing competitive pressure and heading into fiscal 14, many historically smaller threats will continue to grow and have an increasingly negative impact on Oracle," said Cowen & Co. analyst Peter Goldmacher.

Hardware and Mark Hurd. Co-president Mark Hurd has been the front man for Oracle's hardware strategy. The problem: Hardware revenue has been trending down since Oracle bought Sun. The company is going to talk Exadata successes, but at some point revenue has to bottom out. It's also unclear whether technology buyers are broadening out pilots of Exadata systems. If not, Hurd could take the blame. After all, Oracle should show some benefits from new server launches. In addition, Hurd is in charge of sales at Oracle. Sales execution has also been lacking.

Cannacord Genuity analyst Richard Davis summed the Hurd and hardware connection up well:

We were quite laudatory when Oracle snagged Hurd from HP. After all, Oracle was pivoting quickly into hardware and the fact was that the firm had no real account relationships on this side of the customer base. We suppose the first sign of trouble was when Oracle kept missing its revenue estimate for hardware (although doing fine on the margin front)... We are now more neutral on the execution of Oracle’s sales management. Indeed, some investors have asked us if Oracle shares would go up if Hurd left. Our answer is “yes” if Oracle misses another quarter, and “no” if the May quarter results indicate that the recent scuffles were simply product transition growing pains.

What is the state of IT spending? Oracle's third quarter was a disappointment, but the company said deals closed late and bled into the third quarter. Oracle also positioned its miscues on internal issues and not the broader economy. Other vendors, however, have noted a slowdown in enterprise demand. Where will Oracle fall this time? Davis noted that IT spending may not be as bleak as forecast and boost Oracle results in upcoming quarters. Wedbush analyst Steve Koenig said:

We continue to see a risk that a difficult macroeconomic climate could impact near-term results. Software vendors have been generally seeing license deceleration in the last several quarters, as enterprise buyers exercise caution in the face of an uncertain U.S. economy and longer-running factors such as the European sovereign debt crisis.

Fusion as revenue driver? A few analysts noted that software demand looked solid for Oracle. That thinking was based on various reseller surveys and channel checks. Koenig noted that he "heard from integrators this quarter that Fusion applications have stabilized and Oracle is winning more HCM deals."

Can Oracle deliver and sell cloud services? Oracle boasts that it has the most cloud applications via acquisitions and internal development, but the company faces a core channel conflict internally. The problem: Oracle's sales army makes more money from hefty licensing and maintenance deals. Cloud deals deliver returns to the company over time. Eliot Colon, president of Miro Consulting and an Oracle licensing , recently noted on a Macquarie conference call that Oracle has put together dedicated cloud sales teams and they're going after smaller accounts. However, Oracle doesn't have its pitch down yet. Colon said:

We’re still seeing proposals going out to clients with software agreements attached to them with also a software rep on tow, then trying to upsell software to go along with a Taleo offering as an example. So we’re still seeing kinks being worked out there. So far we haven’t seen much traction in those offerings at all though because even in the, say, half dozen clients who looked seriously at those offerings in Q4 that we had, not one pulled the trigger.