SAP: Enterprise software market 'difficult'; Emerging markets weak

SAP's third quarter was a mixed bag. Earnings were a touch better than expectations, but revenue and the outlook disappointed investors. Meanwhile, SAP said the software market showed "signs of stabilization," but remained difficult.

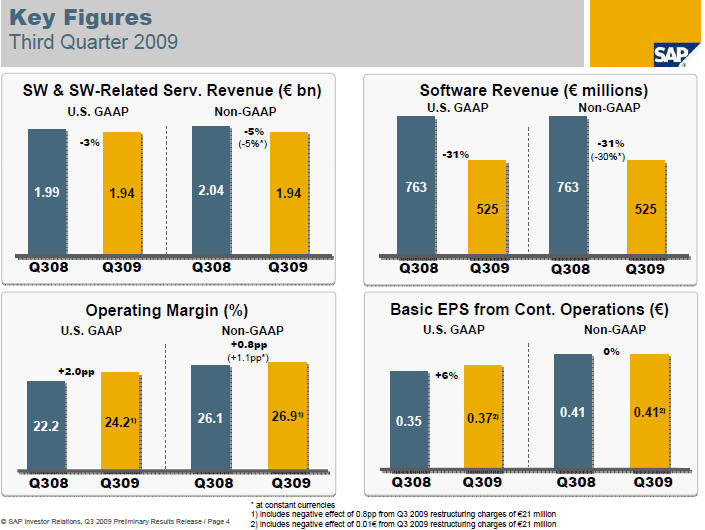

The third quarter breaks down like this:

- Revenue for the quarter ending Sept. 30 was 2.51 billion Euro down 9 percent from a year ago. Estimate: 2.57 billion Euro.

- Software and software related services revenue were 1.94 billion Euro, down 3 percent.

- Software revenue was 525 million Euro, down 31 percent from a year ago.

- Net income was 435 million Euro, up 12 percent from a year ago. Earnings of 0.37 Euro a share were two cents better than Thomson Reuters expectations.

- Add it up and you have a quarter that was roughly in line with estimates, but the outlook disappointed. Non-GAAP software and software related revenue will fall 6 percent to 8 percent for 2009.

But what caught my eye was the commentary. SAP CFO Werner Brandt noted in a statement:

While we are seeing signs of stabilization in the general environment, the market remains difficult. Third quarter software and software-related service revenues came in lower than we expected mainly because of a particularly challenging environment in the emerging markets and Japan.

Emerging markets? The fact that sales are challenged in Japan isn't surprising, but emerging markets are supposed to be resilient to the downturn. I've heard few technology companies talk down emerging markets. Is the market difficult or is it a matter of new markets looking elsewhere beyond the usual enterprise software suspects?

As Dennis Howlett notes, SAP is trying to sell more all you can eat subscriptions. Howlett writes:

SAP has been offering its largest customers an ‘all you can eat’ model which, for a fixed price, allows those customers access to all SAP tools and technologies. This is a form of subscription based model in that SAP recognizes revenue over the life of the agreement. It gives SAP revenue certainty over long periods, typically five years. The flip side is that customers have cost certainty plus the opportunity to consume technology at a pace that suits them without the constraints of long sales negotiation cycles. The extent to which this is a buyer win is not entirely clear.