SAS preps cloud computing facility; Bets on on-demand BI

SAS is planning to spend $70 million on a cloud computing facility at its Cary, N.C. headquarters as it expands its on-demand offerings. SAS seems to be making a big bet on business intelligence software in the cloud, a concept that isn't expected to get a lot of traction.

SAS is the largest independent business intelligence software company and remains privately held. It also flies under the radar a bit relative to its formerly publicly traded rivals, which have been gobbled up by the likes of IBM, SAP and Oracle.

In a statement, SAS chief Jim Goodnight detailed the company's plans for a 38,000-square foot cloud computing facility. The details:

- The facility will have two 10,000 square foot server farms with the first one completed in mid-2010. The second will be built when the first reaches 80 percent capacity.

- The facility will be built under Leadership in Energy and Environmental Design (LEED) standards for water and energy conservation.

But what's really interesting is that SAS sees a hosted business intelligence market developing.

This move is notable because a recent report by Forrester indicated that business intelligence will be one of the harder markets to move to an on-demand software model.

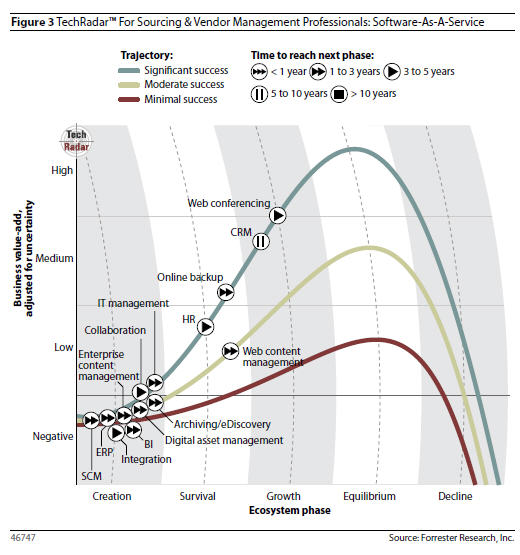

Earlier this week we examined the next 10 years for Salesforce.com. Some of that research derived from a Forrester report on the SaaS market. This chart clearly puts business intelligence in the minimal success category for the on-demand/cloud model.

Here's what Forrester had to say about on-demand business intelligence in its report:

SaaS BI is a relatively new category within SaaS, and numerous vendors have appeared on the market with solutions. There are a few offerings from established vendors like Business Objects (now part of SAP), but many of these vendors are smaller — and potentially riskier. In addition to SaaS BI vendors, firms can build SaaS BI on platform-as-aservice (PaaS) from vendors like LongJump. The potential of SaaS BI is strong, particularly its potential to improve the end user experience and access to analytics as well as its ability to enable collaborative or benchmarking-type reporting scenarios.

And here's a look the business intelligence hurdles in the cloud:

Let's add this up. The on-demand business intelligence market has plenty of skeptics, but SAS is building out its capacity for the next decade. Does SAS know something the rest of the market doesn't?

Update: Gaurav Verma, SAS senior business analytics strategist, made the following comments in response to my post and interpretation of their cloud buildout:

The SAS investment for a new cloud computing facility is driven by increased customer demand for data-intensive business analytics solutions to solve some of their complex business problems within an on-demand model. It's the market that's driving us, not the other way around.

We fully agree with the Forrester findings and look to them and similar research by other industry analyst firms for strategy guidance. Traditional BI, often just ad-hoc query and reporting, is a risky and unproven proposition for SaaS delivery. It fails to address core issues around data integration and effective analytics to solve specific business issues.

We have been providing on-demand Business Analytics solutions for several years, including highly customized hosted applications that leverage our business analytics framework including: solutions, data integration, analytics and reporting, and services. We also continue to have tremendous success with purpose-built SaaS applications like Drug Discovery and Revenue Optimization and continue to grow that portfolio.

Demand for these and other on-demand models continues to grow as it allows our customers to focus on the utility of these business analytics solutions with flexibility to dynamically provision computing resources and not struggle with hardware, infrastructure, funding cycles etc.

The Forrester analysis is correct and has nothing we see that contradicts the SAS vision for cloud computing.