Social business and enterprise usage: The lessons

Those that put their shoulder to the effort at moving to social business are achieving very real and statistically significant benefits.Fresh off the road and putting the final touches on a new book (more on that in an upcoming post), I've been catching up this week with new reports from several leading research groups as they've assessed how social business has been doing and where it's headed in general. There is good news overall in terms of growth as well as crucial new insights that decision makers looking at updating the way their organizations engage with their workers, customers, and the world should be tracking.

First off is Forrester's new estimate of the size of the social business industry, which they've put at $6.4 billion by 2016, an order of magnitude larger than the (by comparison) paltry $600 million it was just last year. Although the size of the entire worldwide investment in social business has recently been estimated to be as high at $100 billion, Forrester is specifically tracking the investment in the enabling software itself. This includes enterprise social networks, social collaboration suites, and other social business solutions, and not the entire project investment that organizations make as they roll out social software. This does not seem to be a either lowering or raising of previous projections, such as their 2008 forecast that the industry would be $4.6 billion in size by 2013. For a useful cross check, we can see that ABI Research's new figures, which were released today, has lower figures yet shows a very similar 57% yearly growth (compared to Forrester 60%.)

What is interesting, however, is the fairly low estimates of actual adoption by Forrester, citing that only 12 percent of information workers are provided with enterprise social collaboration software, while just 8 percent of them use it once a week. This is one of the lowest estimates I've seen, especially given that Forrester has previously reported here on ZDNet that nearly a third, or 29%, of enterprise workers are using social tools this year.

These numbers contrast with McKinsey's fifth annual report on how social technologies are faring in the enterprise, released a few weeks ago. Their report claims the following:

Seventy-two percent of the respondents report that their companies are deploying at least one [social] technology, and more than 40 percent say that social networking and blogs are now in use.

So while the data on social business adoption, at least for internal use, varies considerably from as little as 8% to as much as 40% (and sometimes even higher as I cited recently in an exploration of all social business adoption trends), the one trend that has been abundantly clear over the years is that uptake and actual use continues to grow year over year. In fact, whatever the actual adoption rate is, it was less than last year and will be greater next year, of that there is virtually no dispute.

However, this does underscore one major issue with tracking enterprise sales for social business: Sales of licenses or seats does not necessarily translate into adoption. In fact, far from it. From my research on social business adoption, I've found that workforce collaboration and business processes which supported by social tools, at least the way they're often deployed, is often perceived as an optional activity and one that's often not well integrated into how work gets done. Workers already have older (though theoretically less effective) ways of getting work done that they know, understand, and are thoroughly and culturally habituated to. In other words, sales of social software doesn't tell us nearly as much about what's really happening with social business in the enterprise as much as those within the organizations themselves actually reporting what they're specifically doing.

This then is what makes McKinsey's latest yearly survey of social technologies in large organizations much more interesting in terms of finding out what's really taking palce. In the 2011 data, they've captured a detailed snapshot from over 4,000 global executives, by far the most ever to have participated in their research. What emerges from their study of not only this year's data, but the information gathered across all five years, is fascinating. In my analysis, I believe there are some very significant new pieces of information that organizations deploying social media across their functional units and lines of business should be acutely aware of.

The lessons of 5 years of social business

Based on this data, the key takeaways from social business and enterprise usage over the last five years of adoption are the following:

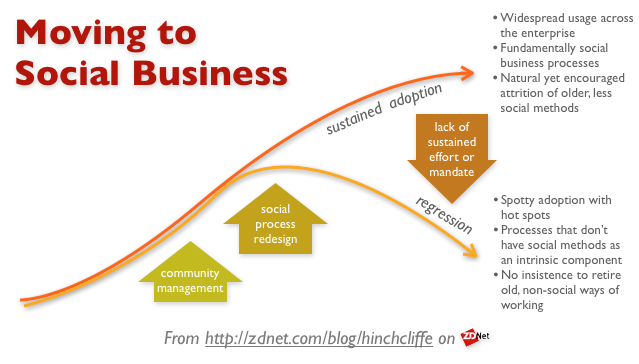

- Adoption requires sustained effort. McKinsey found that companies moved into and out of the developing category (nascent adoption) and into fully networked and back again into developed over the years. In my experience, communities of people behave differently over time, there is a certain ebb and flow to social discourse and interaction, that's not usually present in non-organic systems. More specifically, companies often put most of their effort into an initial effort at socializing an organization, a set of processes, or a group of people. As those running successful online communities will tell you, it's a continual and never-ending process, not an upfront one. Lesson: Being social requires long-term commitment, ongoing investment, and proactive work for as long as it takes place. This is not different really than cultivating any kind of human relationships; they either grow or they wane.

- Social business is statistically correlated with important bottom-line benefits. Better operating margins and market share gains are all closely correlated with companies that are distinctly better networked socially. But more intriguingly, market leadership was generally not correlated with being more socially networked. Lesson: McKinsey feels that market leaders are less inclined to push ahead for more benefits when they are already on top. While this does make sense, I believe the nuance here is that very successful companies in the #1 slot in their industry tend to think they are already doing things right, thus external innovation is less attractive to them. This is generally good news for companies in the challenging position, given that the other correlated benefits then indicate they will become more competitive against the market leaders by adopting social business.

- There's a strong sense that social business will imminently and fundamentally change organizations. A clear signal in the survey indicated that executives believe that social business will transform and remake the way they work across the board, especially how they find new ideas, operate their functions, strategically plan, how they allocate resources, match workers to tasks, and assess worker performance. The consensus seems to be that the bulk of these changes are likely to happen in the next 3-5 years. Lesson: Organizations should prepare for the dislocation such major changes usually entail. This means proactive change management, cultural adaptation, and willingness to tolerate experiments to find the way forward.

- Technology and organizational constraints often hold back social business transformation. Another vital thread that emerged from the data is that respondents generally felt they could do more, that progress would be better, if obstacles such as ingrained culture and predispositions cut be overcome more effectively. Lesson: One of the tough lessons of social business is that though the technologies make connectedness, sharing, and transparency dramatically easier, people have to want it. Many organizations will have to so some soul-searching and blunt self-assessments if they are to achieve the benefits that are now being reported.

The upshot is that sustained success with social business is happening for some organizations, but that most companies are still in the "developing" phase. However, those that have been successful are continuing to report, year after year, compelling benefits and results. Yet it's also clear that social business is yet another technology-enabled change that will have uneven adoption across the enterprise world, and the likely effect is to even further separate the leaders and the laggards. Finally, those that put their shoulder to the effort at moving to social business are achieving very real and statistically significant benefits.

Note: I'll be catching up on my blogging over the holidays and making my round-ups and predictions for next-generation enterprises. Stay tuned for updates on social, next-gen mobile, consumerization, big data, and much more.