Splunk, Palo Alto Networks, Autodesk deliver strong quarters

Splunk reported a strong fourth quarter and raised its outlook for the upcoming fiscal year. Autodesk and Palo Alto Networks also reported.

The machine-data company reported a fourth quarter operating loss of $79 million, or 61 cents a share, on revenue of $220 million, up 49 percent from a year ago. The non-GAAP earnings were 11 cents a share.

Wall Street was looking for a non-GAAP profit of 8 cents a share on revenue of $203 million.

The company ended fiscal 2016 with more than 11,000 customers. Doug Merritt, CEO of Splunk, said he was confident in the company's long-term strategy. In the fourth quarter, Splunk added 600 new enterprise customers.

For fiscal 2016, Splunk reported a net loss of $278.77 million on revenue of $668.4 million, up 48 percent from the previous year.

As for the outlook, Splunk projected revenue of $172 million and $174 million for the fiscal first quarter. For fiscal 2017, revenue is projected to be $880 million.

Both of those projections were ahead of estimates.

Palo Alto Networks also delivered solid results. For its fiscal second quarter, the company reported a net loss of $62.5 million, or 72 a share, on revenue of $334.7 million. Non-GAAP earnings were 40 cents a share, a penny better than estimates.

For the third quarter, Palo Alto projected non-GAAP earnings of 41 cents a share on 42 cents a share with revenue of $335 million to $339 million. Wall Street was looking for non-GAAP earnings of 45 cents a share on $334.6 million in revenue.

Autodesk's results highlighted a company transitioning to a subscription and cloud business model.

The company reported a fourth quarter net loss of $32.7 million, or 15 cents a share, on revenue of $648.3 million, down from $664.6 million a year ago.

Non-GAAP earnings for the fourth quarter was 21 cents a share, a dime better than estimates.

For the year, Autodesk reported a net loss of $326 million, or $1.44 a share, on revenue of $2.5 billion.

Autodesk said it ended the year with 2.58 million subscribers for its software. Annualized recurring revenue was $1.38 billion, up 10 percent form a year ago. CEO Carl Bass said:

Broad-based demand also led to better than expected subscription additions in the fourth quarter with new model offerings representing well over half of the subscriptions. Strong demand also fueled double-digit growth in ARR, deferred revenue, and billings, and we booked a record number of large transactions.

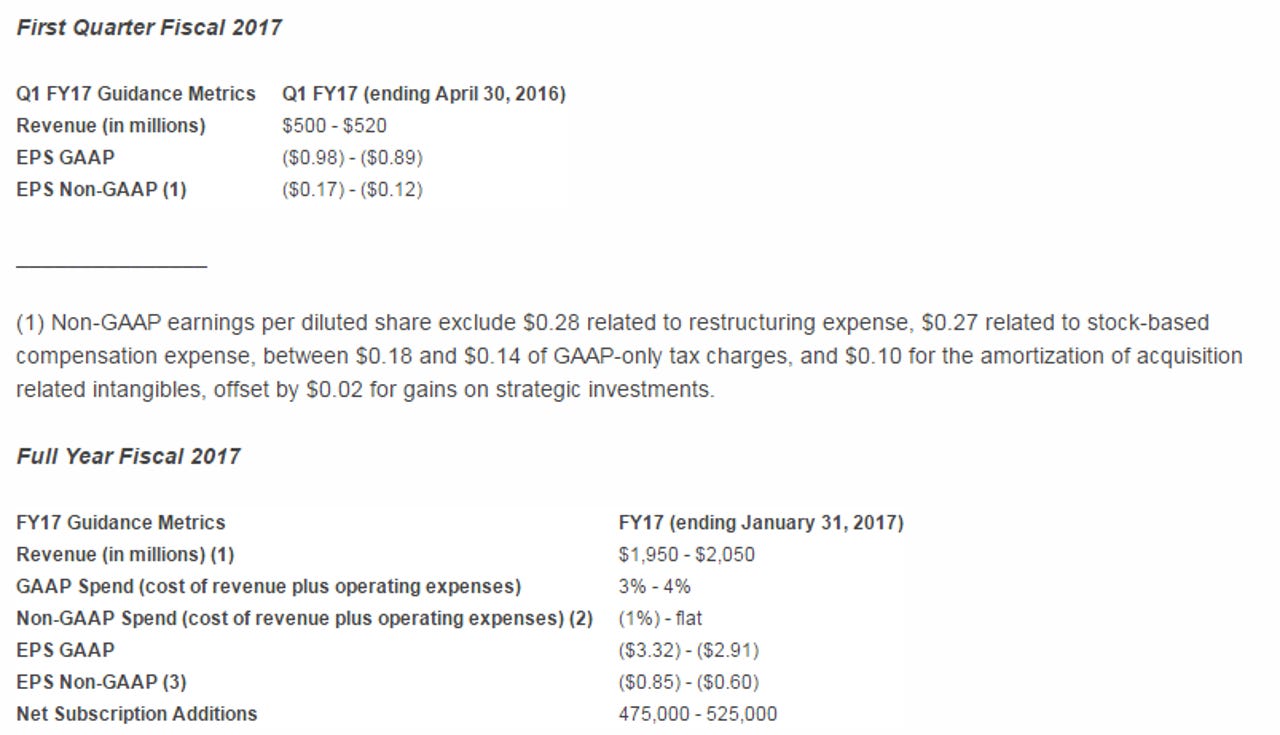

Here's Autodesk's outlook.