The coming wireline business implosion (and how you'll wind up paying for it)

Is the wired telecom business just as doomed as beleaguered automakers like GM and Chrysler and the newspaper industry? It's quite possible a few years down the line. And this wireline fallout will have ramifications well beyond the usual suspects such as AT&T and Verizon.

Simply put, cutting the cord today may mean you're indirectly paying for it tomorrow with your taxes or bailout funds. It's no wonder Verizon unloaded its rural wireline assets to Frontier last week. The compelling wireline-is-doomed case was made by Bernstein analyst Craig Moffett.

Moffett made his case well and likened the wireline telco business to the dodo bird. The problem: Wireline businesses are also bogged down with pensions and high costs. Sound familiar? Sound like a bailout to come? Sound a little like GM?

Here's the backdrop via a Moffett research note:

This is more than just a "what do we do with the stocks" question. The Wireline TelCos are among the largest employers in the country; Verizon and AT&T alone have more than half a million employees between them, and most of those are in their Wireline divisions. Collectively, the Bells support more pensioners than even General Motors. At $60B, their unfunded postretirement obligations amountto $200 for every man, woman, and child in America. They are among the nation's largest providers of health care coverage. And their infrastructure provides any number of critical public policy goods, like carrier-of-last-resort service, first responder networks, and e911 databases. And they are not-so-gradually going away.

In a nutshell, Moffett argues that the slow bleed that is the wireline telecom business will turn into a hemorrhage. Then this wireline fallout becomes everyone's problem since the taxpayer will wind up supporting this legacy infrastructure.

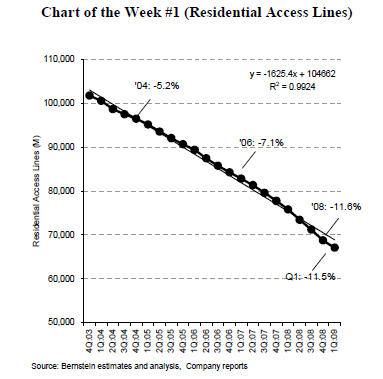

Here's the tale told through graphics.

Wireline access lines:

And high costs and unfunded liabilities:

Take those unfunded pensions and combine them with declining wireline revenue and you have a disaster on deck.

Cyclically, the rate of cord cutting has accelerated over the past six months as the recession has worsened. Access line losses have gapped below an already bleak down-and-to-the-right trend line. But the core issues are secular. The Centers for Disease Control released data two weeks ago suggesting that as of the end of 2008, one in five U.S. Households no longer has a wired phone. Our own estimate, based on bottom-up reporting by U.S. TelCos, cable operators, and third party VoIP providers, puts the number today, one quarter later, at closer to one in four. Wireline industry access line losses have accumulated at the pace of more than 700K lines every month.

Moffett continues:

Zoom out just a little, and the picture becomes unmistakable. As recently as ten years ago, nearly every household in America was connected to the wired phone network (by most estimates, the number was then about 97%). On average, each of those connected homes had 1.3 phone lines, with additional lines commonplace for what the industry refers to as "the teenage girl problem" and the "AOL problem." And the cable industry was essentially nowhere in the phone business, with only Cox having a meaningful voice businesses. In effect, the TelCos were, just ten years ago, operating a high fixed cost business that enjoyed what amounted to almost 125% penetration.

Now look ahead five years. Conservatively, the percentage of families who will have cut the cord will have nearly doubled from today's 25%... let's say to ~40% to be generous. Cable's share of what's left will likely also have doubled, to ~40% of what's left (they would gain another 5 points of share without adding another line, simply through shrinkage of the denominator). And the number of lines per connected home will have returned to 1.0, as wireless has solved the '"teenage girl problem" and broadband will have put dial-up out of its misery.

That translates to effective TelCo penetration only 36%, a 71% decline (89 points) in just fifteen years. To go from 125% to just 36% penetration in a decade and a half is, for any fixed cost business, a death sentence. And perhaps more than any other business in the world, the wireline TelCo is a fixed cost business.

This wireline death sentence will play out differently for various companies. Companies like Qwest, CenturyTel or Fairpoint are directly in the line of fire because they totally rely on wireline revenue. Frontier just bulked up but can cut costs to buy itself some wireline time. However, you can only cut so much to account for wireline access losses. Meanwhile, AT&T and Verizon still get more than half of their revenue from the wireline business so those two budding wireless juggernauts aren't in the clear either.

So why should you care about the wireline business? Isn't it just creative destruction at work? Isn't it progress?

Yes, to all of the above. But here comes the rub. Moffett writes:

For better or worse, however, the Wireline business is too big, or perhaps simply too important, to fail (systemic risk, anyone?). Government agencies, first responders and public safety organizations all depend on the network. So do a huge number of businesses in the U.S., for whom the Wireline network is their very lifeblood. As residential access lines disappear, however, the network’s remaining costs are increasingly being concentrated in the small and medium business lines that remain (it is, after all, one network).

How will this infrastructure be funded? You guessed it: Taxes. Wireless will be taxed more, subsidies (paid for by taxes) will ramp up and those folks deemed non-rural will be paying up too. Your broadband bill will go up. However, "it's simply not feasible to increase collections on the remaining lines" to redistribute the wireline funding.

As tax collections to support the Wireline infrastructure rise, economic growth in other areas of the economy will suffer as consumer spending is diverted from more productive uses.

Penetration rates of advanced telecom services will also suffer, as their effective end user prices rise in order to support legacy Wireline subsidy programs. At that point, the Wireline Problem really will be all of our problem. Taxation of mission-critical wireless and broadband services will be a drag on economic growth. Redistribution will support some, but not all, ambitions of the operators, and the regulators.

That's a bleak picture, but strikes me as a highly plausible scenario. A decade from now we may be talking about wireline bailouts. Thoughts?