The rise of flash storage: Will it save every one of us?

The bald facts, according to research and advisory project Wikibon, are that in 2012 the amount of flash memory shipped was 1,000 times less than disk storage but the two technologies should hit parity in 2018, with flash ending up 1,000 times greater by 2026.

"The rapidly lowering cost and higher performance of flash will result in a rapid adoption of flash to replace magnetic drives. Flash together with systems of intelligence will enable the integration of big-data analysis into operational systems, and automate many decisions," Wikibon analyst David Floyer said in his report Enterprise Flash vs HDD Projections 2012-2026.

That eventual dominance by the faster flash non-volatile memory will extend from the datacenter to hyperscale cloud services.

"CIO and senior storage executives should be planning to move from HDDs to NAND flash storage over the next few years, and plan completely different organizational and operational environments," Floyer said.

"The ability to provide multiple logical views of the same physical data will be a key capability that will significantly simplify data movement and significantly reduce costs. Most magnetic storage for enterprises will be found in distributed cloud services for mainly archive-type applications."

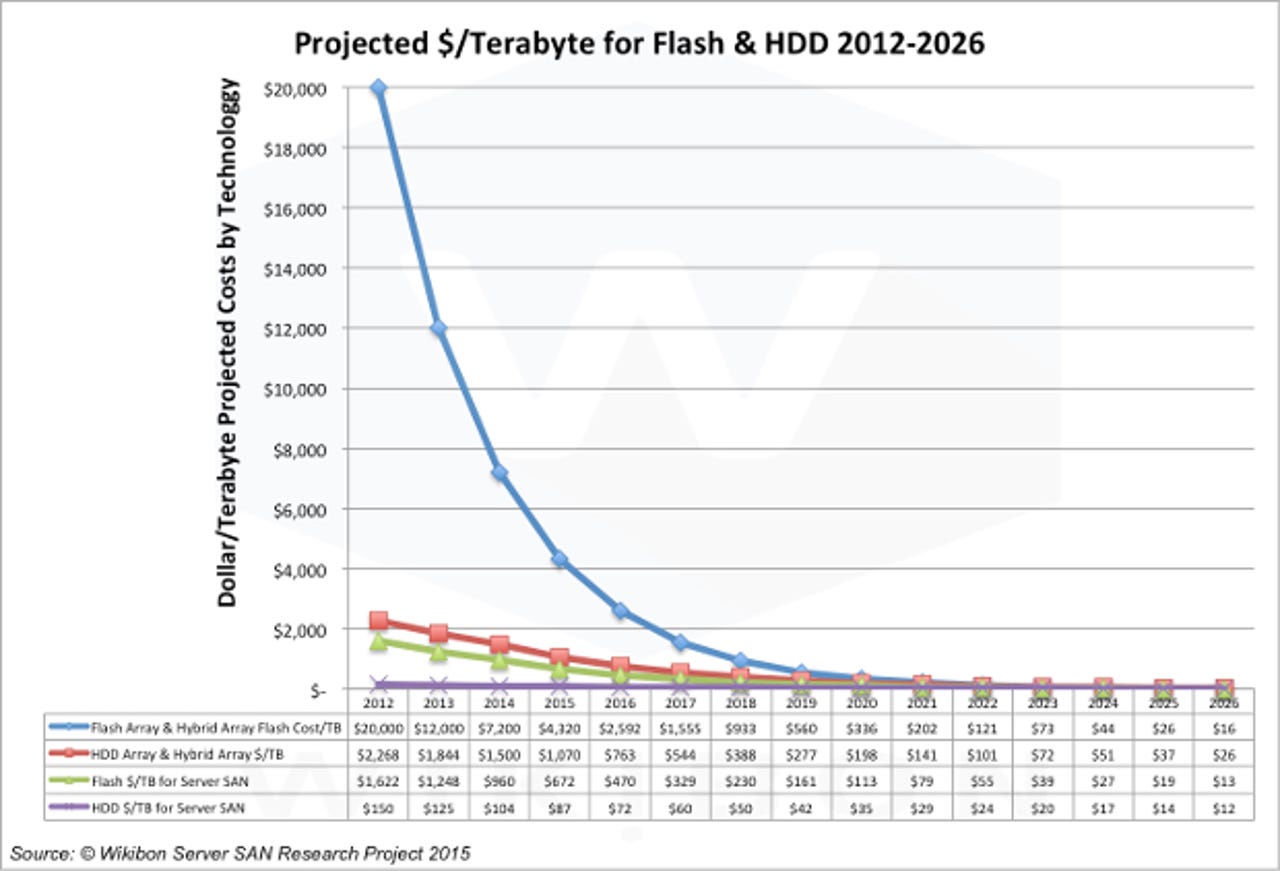

Behind the shift from disk lie the speed advantage and falling cost of flash, which has traditionally been expensive. But Floyer's price forecasts, shown in the graph above, demonstrate the falling per-terabyte cost of non-volatile memory.

"The projections show that the price umbrella of 10 times or greater over the storage media costs that protects the incumbent vendors is under severe pressure," he said.

"The multiplier will come down as enterprise server SAN gains traction, and as more storage migrates to hyperscale server SAN in the cloud. This pressure will have a significant impact on the margins for traditional storage vendors, especially the newer all-flash array and hybrid storage vendors, and reward fewer vendors achieving volume and efficiency."

Wikibon calculates that there is enough flash manufacturing capacity to meet enterprise storage demand.

"Additional pressure on traditional storage vendors is likely to come from new storage vendors who can own the complete stack. Samsung, SanDisk and Toshiba are making significant investment in complete storage offerings," Floyer noted.

"SanDisk has joined Samsung, Intel and Micron in bringing 3D NAND flash into production. The prospect is 10TB thumb drives."

However, it will not be plain sailing for flash, with the technology still facing a number of hurdles.

"The constraint on growth of flash within traditional enterprise storage is because of the lower cost and higher performance of the server SAN model," Floyer said.

"A second major constraint of conversion to flash-only storage is migration of application, middleware and infrastructure software that will support and exploit flash. The third is the slow adoption of changes in operational organization and procedures required for flash-based server SAN."

Although the Wikibon figures show dramatically falling revenues for disk storage, the rise of flash will not spell the end for platters, which were first introduced by IBM in 1956.

"Like all great technologies, magnetic storage in general, and the magnetic disk drive in particular, has a long ride into the sunset. Magnetics are a cheaper way of holding WORN data - write once, read never," Floyer said.

More on storage

- Samsung announces 16TB SSD

- Symantec to spin off Veritas storage business: report

- Diablo's flash DIMMs attack DRAM

- Hybrid storage startup Tintri raises $125 million

- Nexenta: Disrupting the storage market with open-source software

- U2 gets flash storage array as data, video needs balloon

- Dell's latest flash storage aims for low cost with TLC 3D NAND technology