Unisys has looming debt, credit pickle

Unisys could lose its credit line at the end of May and that could make it tough to pay off its bonds without issuing a lot of shares.

Unisys' problem is a common one these days with credit tight as numerous companies try to rearrange debt payments and credit lines at high prices.

Bloomberg has a nice analysis of Unisys' credit pickle. The report is based on this nugget from Unisys' annual report last month.

Here's what Unisys says in its annual report:

The company, which specializes in IT services for the U.S. government, also has a revolving credit facility, which expires in May 2009 that provides for loans and letters of credit up to an aggregate of $275 million. Given the global economic slowdown and resultant tight credit markets, the company does not expect to renew or replace its existing revolving credit facility before its expiration on May 31, 2009. In addition, the company’s ability to refinance or exchange its $300 million senior notes due in March 2010 could be affected by the adverse credit market conditions. The volatility and disruption in financial markets could also impact the company’s ability to utilize surety bonds, letters of credit, foreign exchange derivatives and other financial instruments the company uses to conduct its business.

Unisys is officially reviewing its options to repay $300 million in debt due March 2009 2010. Unisys has been cutting jobs and expenses as clients pull back on spending, but it's unclear whether it'll be enough. In any case the debt markets aren't thrilled with Unisys right now. Bloomberg notes that its borrowing costs are 12 times as expensive as Affiliated Computer and 48 times more expensive than IBM.

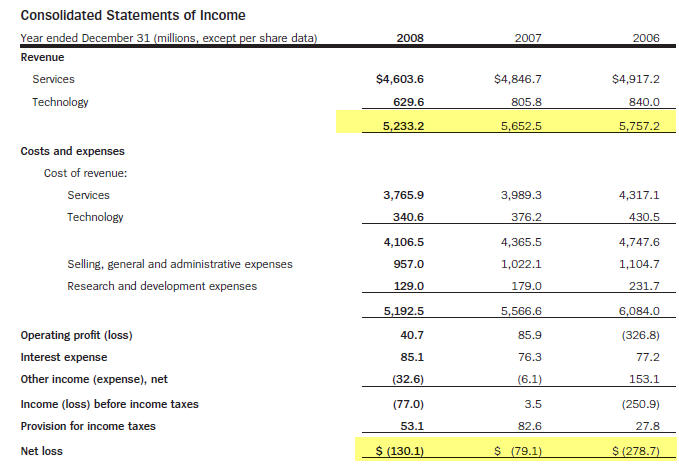

Unisys' top and bottom lines illustrate why borrowing costs are high.

I'd wager that Unisys dodges this credit line bullet, but probably have to pay a heavy price.

The bigger question: What happens to Unisys long-term? One portfolio manager calls Unisys a busted company. However, Unisys is a company with a bunch of lucrative government contracts. And we all know that the U.S. government is one of the few growth markets in the economy (for better or worse). Those contracts would look pretty good to an acquirer such as IBM or HP's EDS unit. Dell could also be a buyer if it wanted to make a services play. In the end, Unisys could very well be a subsidiary of a larger, more healthy player just for the government ties.