Verizon keeps wireless churn lead in second quarter; Palm Pre coming 2010

Verizon delivered second quarter results Monday that were a bit better than expectations, but the company added fewer net wireless customers than some analysts expected. Verizon's wireless churn rate continues to lead the industry. In addition, Verizon also confirmed that it will add the Palm Pre to its lineup early next year.

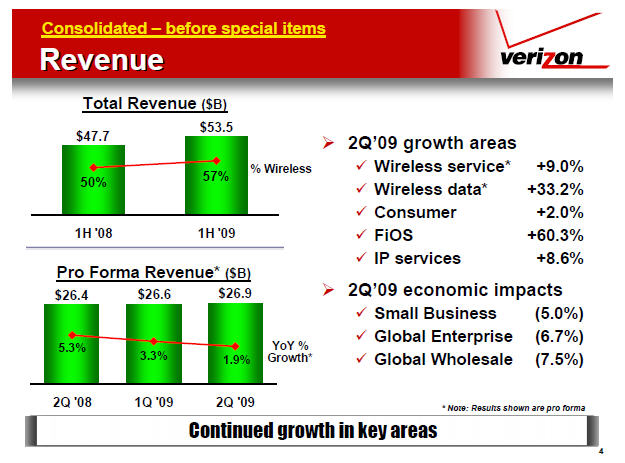

Verizon reported second quarter net income of $3.16 billion, or 52 cents a share, on revenue of $26.9 billion, up 11.3 percent from a year ago courtesy of the Alltel acquisition (statement). Excluding the Alltel purchase revenue was up 1.9 percent. Non-GAAP earnings were 63 cents a share, a penny better than Wall Street estimates.

On a conference call with analysts, Verizon CFO John Killian said the company plans to cut costs further with plans to cut an additional 8,000 jobs in the second half. The job cuts will occur in Verizon's wireline unit. Executives also said that Verizon Wireless will offer the Palm Pre early next year.

The main item to watch for Verizon was its wireless churn rates and net customer additions relative to AT&T. On the churn front, Verizon delivered a retail postpaid churn of 1.01 percent to keep it in the industry lead. That rate compares to AT&T's second quarter churn of 1.09 percent. Verizon's total churn in the second quarter was 1.37 percent.

However, Dennis Strigl, chief operating officer for Verizon, said the company has noticed an impact from the iPhone 3GS launch and customers moving toward AT&T. However, Strigl also said that Verizon Wireless will offer a competitive handset lineup.

Indeed, Verizon Wireless is doing a nice job retaining customers, but its additions appear to be on the weak side of some analyst estimates. The 1.1 million net customer additions was in line with estimates, but lower than the 1.25 million expected by Piper Jaffray analyst Christopher Larsen. Larsen said in a research note that Verizon Wireless' net customer addition tally was the lowest quarterly result since 2003.

On a proforma basis---excluding Alltel---Verizon Wireless retail gross customer additions were down 0.6 percent due to weak business demand. Verizon ended the quarter with 87.7 million total subscribers with 85.2 million of them retail customers.

Meanwhile, Verizon also showed some progress on the FiOS TV front. The company said it added 300,000 net FiOS TV customers with 303,000 FiOS Internet customers. Verizon has 2.5 million FiOS TV customers with 3.1 million FiOS Internet customers.

By the numbers:

- Verizon Wireless revenue was $15.5 billion, up 27.7 percent from a year ago. Excluding Alltel revenue would have been up 7.6 percent. Of that revenue tally, service revenue was $13.3 billion and data revenue was $3.9 billion.

- Average monthly service revenue per user (Service ARPU) was $51.10, down 0.8 percent from a year ago. Excluding Alltel, it was up 0.6 percent.

- FiOS was available to 11 million premises at the end of the quarter. Consumer ARPU for broadband and video services was $72.59 in the second quarter, up 13.7 percent from a year ago.

- Total broadband connections (FiOS and DSL) were 9.1 million at the end of the second quarter.

- Verizon spent $8.1 billion in capital expenditures in the first half. Free cash flow was $6 billion in the first half.