Why SaaS should not frighten megavendors

It has always been assumed that traditional vendors would resist the move to SaaS because the SaaS business model doesn't work with the maintenance driven model. That may not be true.

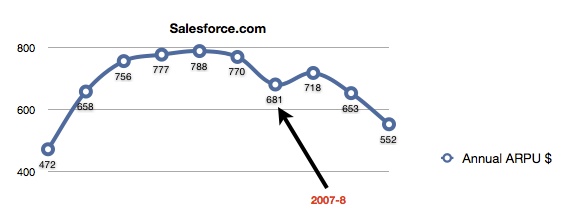

When assessing SaaS vendors, average revenue per user or ARPU is a favoured measure. Over time it provides analysts with a way of assessing a vendor's ability to hold or improve revenue per user. I've always felt this is an imperfect measure once a vendor moves beyond a single service because you lose sight of where individual contributions are coming from.

Despite its limitations, ARPU does provide the opportunity to gain valuable insights into how a particular business model is working out. Check this ARPU chart for Salesforce.com

The period in question covers numbers announced at the end of fiscal 2002 through 2011. It assumes that churn is relatively constant and that end of year figures can be taken as the basis for calculating a trend. The curve reasonably reflects what you'd expect to see in the economic cycle. But look at the numbers more clsoely. At its height, Salesforce.com was getting $788 per user. At 21st January 2011 that number had dropped to $552. Now look what it was getting in revenue per customer:

Do you notice that even while prices may have been under pressure, Salesforce.com was increasing revenue per customer. That measure dipped after January 2008 and the gap has since widened. But Salesforce.com compensated by increasing the reach it has inside its growing customer base. In 2002, Salesforce.com counted 15 users per customer on average. Today, that number is around 33. At the end of fiscal 2011, (31st January, 2011) Salesforce.com boasted 92,300 customers and revenue of $1.66 billion.

Now contrast that with SAP. I'm using their data because it is the most complete set I have available. It is not perfect for reasons that will become obvious but it does provide some pointers.

SAP claimed 109,000 customers for year ended 31st December 2010. Its customers were spending an average of $153,200 with the company. That's 8.5 times the spend with Salesforce.com. Of that figure 49% represented support revenue.

In September 2007 I wrote in relation to SAP's aspirational claim to reach 100,000 customers by 2010:

Salesforce.com continues to impress, tracking at $1 billion in annual revenue and a bank of 35,300 customers accumulated over eight years. They’re within striking distance of SAP’s 43,000 customers, a number that has taken 35 years to achieve.

By the end of 2007, SAP had reached revenue of about $14.5 billion. That equates to each customer spending around $337,000 with the company. What happened in between such that revenue per customer fell a whopping 55%.

January 2008 SAP acquired Business Objects. At the time of its final earnings release for year ended 31st December 2007 BOBJ claimed 46,000 customers worldwide and $1.5 billion in revenue. That's around $32,600 per customer. According to Wikipedia, Sybase, which was acquired by SAP in May 2010 had 1,300 customers and at the time had reached revenues of around $1.2 billion. That's around $923,000 per customer. The combination had a naturally dilutive effect upon the per customer revenue measure.

We have no idea how many users there were in each of these customer bases and so it is almost impossible to calculate the value of each seat. And as you can see, different components in the applications 'stack' attract different values. Neither do we know how many of Business Objects customers were common to SAP at the time of acquisition. Neither do we know the rate of attrition during the downturn.

What we can deduce from the bare numbers is that since SAP acquired BusinessObjects, its increase in revenue has only been around $435 million in real terms. We can also say that net-net and since 2007, SAP/BOBJ/Sybase has added something around 18,700 customers.

In recent calls and webinars, SAP has been at pains to point out that the vast majority of its customers are SMEs which it defines as customers with revenue below $350 million. If my calculations are anything like right then that assertion would seem to hold true. What's more and despite the fact SAP still does mega deals, the average annual value of net added customers looks to be something around $23,200. I suspect that figure to be on the low side but I do not have enough additional data to correct for the factors that would impact the totals.

So what's the problem for companies like SAP?

It should be immediately obvious that despite its huge size, SAP is not growing revenue at the same rate as Salesforce.com. Not by a country mile. But, it could easily compete on a per customer basis with Business ByDesign alone. Priced at $149 per seat per month with a minimum user count of 10, that works out at around $17,880 per customer. Which is exactly in line with what Salesforce.com achieves with only CRM and now some platform plays.

Most recently, SAP has made much of the fact it is adding customers at the rate of 272 per week. Looking at Salesforce, it was adding at the rate of 380 per week in 2010/11. SAP has some catching up to do. But it is do-able in large part because SAP controls so many of the world's large customers that between them have many thousands of subsidiaries that could benefit from ByDesign.

SAP's large pool of maintenance revenue is not going away any time soon which provides it with a huge cash engine with which to fund growth. It wont be the mega growth we see at Salesforce.com but it allows the company to exercise greater potential marketing power. That would have to come at the expense of margin and a determined effort to rid itself of its Big, Bad, Expensive image among SMEs. But it is do-able. Ironically, I believe Wall Street would like that. It certainly does when evaluating Salesforce.com so why not?

As I said at the top of this post, perceived wisdom says SAP (and Microsoft, Oracle, Infor and others) can't make the jump. The DNA switch is too great and the as yet to be felt pain from Wall Street too much to bear. This analysis would suggest otherwise. The demand is there. All SAP have to do is get the component pricing right inside ByDesign, make the deals attractive to partners and make volume building a priority then your job is done. Easy isn't it? (sic)

As I head off to NetSuite's user conference to be immediately followed by SAPPHIRENow, questions around how these numbers stack up and how the different strategies play out will be top of mind. What do you think? Answer in Talkback.

Endnote: it is doubtful whether my figures are entirely accurate. Financial statements are usually OK but supplemental information, while instructive, is not always accurate, neither can it be considered wholly reliable. SAP is a complex company with many lines of business and we don't have breakdowns across the product lines as guidance.