Will Oracle-Sun deal close?

Will this deal go through?

That's not an academic question. Despite offering Oracle a $260 million "break-up fee," Sun is trading at $9.18 per share, a huge jump from Friday but still short of the price Oracle is offering.

With an offer on the table Sun is now officially "in play" and it is not inconceivable that another bidder, such as IBM, could come in with a higher bid. Officially Big Blue is unruffled, but merger fans are already speculating on what might come next.

As noted yesterday, this deal makes Oracle a hardware player for the first time. It complicates matters for IBM, which has long made its money with open source and suddenly finds a rival controlling more face cards.

Avoiding this tectonic shift could push IBM to raise its bid. Or, knowing the real value of Sun's assets, it could look somewhere else.

Second, what about the anti-trust implications? Analysts fingered worry beads for years that Oracle was monopolizing the database market with its acquisitions. Now it would control the open source alternative?

At minimum this deal will take several months to close. This means, for the first time, major open source projects like Java, OpenOffice.org, mySQL and Solaris are in limbo. There is uncertainty, something markets hate, which leaves anyone dealing with Sun hesitant.

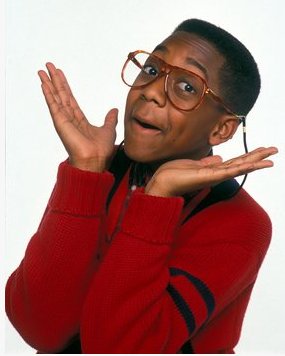

So, how long do you think it will take to create Snorkel? And will it become a real threat to IBM, or more of an Urkel?