Workday raises cash possibly for Oracle financial applications war

Workday has floated convertible bonds to boost its cash pile. The big question is how much of that pile will be used for acquisitions and what will go toward challenging Oracle on financial applications.

On Monday, Workday said that it will offer $220 million in convertible bonds due in 2018 and then another $220 million due in 2020. Grand total: $440 million in cash.

The official line from Workday is that it "expects to use the net proceeds from the offering of the notes for general corporate purposes, including potential acquisitions and strategic transactions..."

What would Workday do with the cash? Acquire companies that could help it close the gap with Oracle as they compete on human capital management and financial software fronts. An analytics company like Tidemark, already a close partner with Workday, would be an obvious fit.

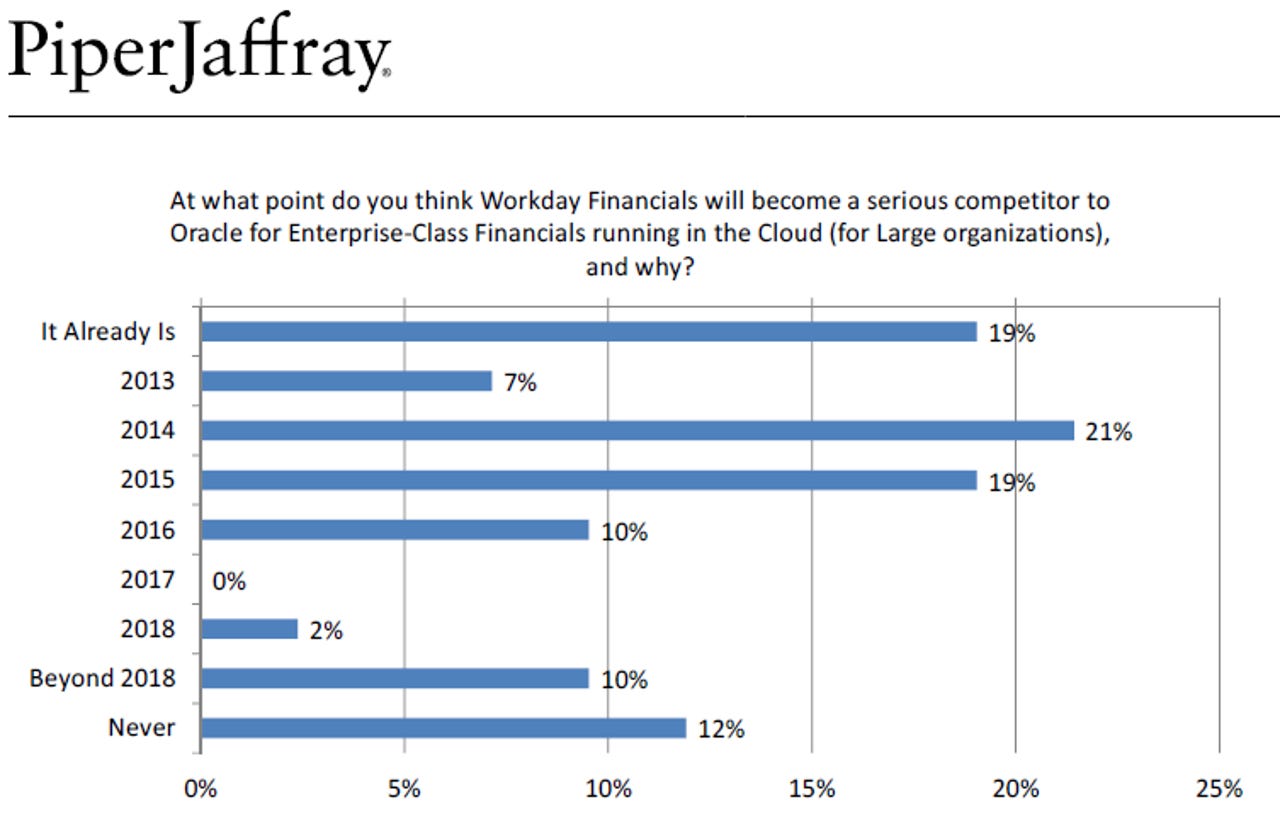

In any case, Workday needs more cash to battle Oracle for CXO hearts, minds and budgets. On the Workday vs. Oracle front it's worth noting that a recent survey found Oracle partners bullish on Workday's prospects for financial software. The survey, via Piper Jaffray analyst Mark Murphy, noted that among 42 Oracle partners, 19 percent think Workday is on part with Oracle today. Another 7 percent say Workday will close any product gaps with Oracle this year. Twenty one percent of Oracle partners say Workday will close gaps in 2014 with another 19 percent predicting 2015.

Murphy said in a research note last week:

Boiling it down, the vast majority (76%) believe Workday Financials will close the gap in the next few years, and 24% believe it will take longer or will never fully close the gap. The data is surprising and non-consensus because thus far Workday only has just over a dozen small companies live on its Financials product (with no multinationals live to our knowledge), and because its Financials product is viewed by investors to be fairly nascent, immature, and unproven at this point.

Murphy's supporting quotes from Oracle partners who think Workday will close the financial software gap had the following points:

- Workday is following a PeopleSoft playbook by moving from HR to financials.

- Workday already has a strong presence in HR that can move to financials easily.

- Oracle's countermove revolves around more sales people, not software and product development.

Add it up and Workday's move to float debt is logical. For starters, rates are low and tech companies have been well received on the bond markets. Note that Cornerstone OnDemand also raised $220 million in convertible bonds on Monday. But the reality is that Workday will need some cash---and sales folks---if it's going to upend Oracle on financials.