Worries about RIM's quarter snowball amid sluggish BlackBerry sales

Research in Motion has a good chance of missing its quarter for the three months ended Feb. 29 as sales for its low-end and high-end smartphones deteriorate.

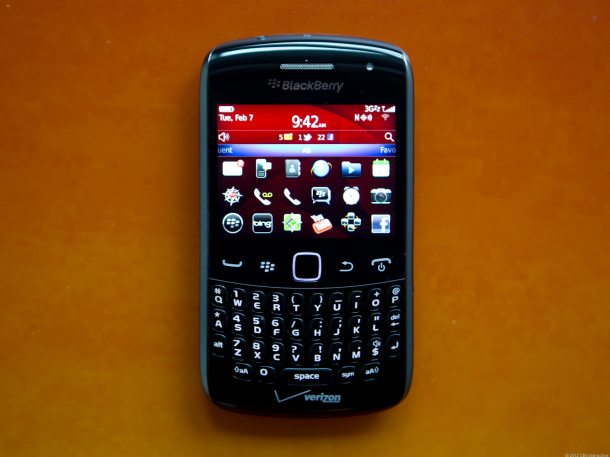

These Curves aren't selling the way they used to.

Jefferies analyst Peter Misek said in a research note that there's "a greater than 50 percent chance" that RIM will warn that it will miss estimates. Misek gave RIM a $12 price target. RIM was trading at $13.55 recently.

Wall Street expects RIM to report fiscal fourth quarter earnings of 82 cents a share on revenue of $4.57 billion.

Misek said:

We believe RIM's low-end handset sales trends have continued to deteriorate in North America, Latin America and Europe. In particular, sales in Europe decreased significantly towards the end of the quarter. We believe this is very negative as sales outside of the U.S. had typically been more resilient. Our checks indicate that sales in Asia seem to be okay.

That comment about the low-end smartphone market is notable. The Curve accounts for a lot of volume for RIM. If RIM can't move low-end BlackBerry devices it's unlikely it can hit its 11 million to 12 million unit target. Misek said if RIM does it hits unit mark it may be only because it is selling into the channel but not moving devices through to consumers.

Meanwhile, the high-end smartphones for RIM aren't doing so hot either. Misek said enterprise sales are ok, but the rest of the market is a disaster. And the iPhone 5 launch ahead of BlackBerry 10 is a big issue. "The BlackBerry 10 will also have to compete head-to-head in the second half with Microsoft/Nokia as the Windows 8 platform attempts to become the No. 3 player," he said.

Misek was just the latest sour puss on RIM's quarter. Other analysts are expecting trouble ahead. To wit:

Shaw Wu, an analyst at Sterne Agee, said:

Our supply chain feedback is that BlackBerry continues to lose momentum to iOS and Android while Windows Phone appears to be gaining some traction.

In a research note proclaiming that sell through at RIM is getting "sluggishier and sluggishier," Morgan Stanley analyst Ehud Gelblum said:

Checks from our colleagues in Asia indicate RIM’s supply chain orders slid 45% m/m in Jan and are expected to be flat in Feb, implying CQ1 units could be down 30% q/q as sell-through is weak. We have picked up mounting anecdotal evidence that RIM continues to lose momentum given its lack of major new phone launches until BB10 devices come out in “latter 2012,” while news flow indicates enterprises from Halliburton to U.S. agencies are adopting alternative devices.