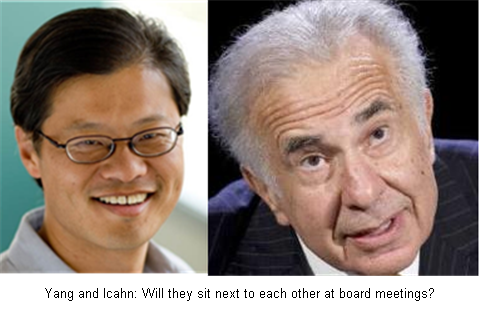

Yahoo, Icahn settle proxy fight: Assessing winners and losers

Updated below: Yahoo and billionaire investor Carl Icahn have settled their looming proxy war.

According to a statement Monday, Yahoo's board of directors will be expanded to 11 members and one of those seats will go to Icahn. The two remaining seats will be filled based on recommendations from Icahn. In return, Icahn will drop his proxy contest and keep his ruminations about Yahoo to himself.

The Icahn-Yahoo settlement isn't totally unexpected. For starters, Yahoo's upped its communications game in recent weeks and was likely to retain board seats--especially after Legg Mason said it would support the company against Icahn.

And then there's historical precedent. In many respects, Icahn's settlement resembles what happened with Motorola. Icahn in 2007 launched a proxy fight for a Motorola board seat. He lost that battle, but remains a shareholder. Motorola in 2008 cut a deal to put two of Icahn's picks on an expanded board. In other words, no one really wants an extended proxy war. The problem: Icahn's proxy maneuvering and Motorola's move to placate him hasn't done anything for the stock.

Eight members of Yahoo's board will run for re-election at the 2008 annual meeting. These members are: Roy Bostock, Ronald Burkle, Eric Hippeau, Vyomesh Joshi, Arthur Kern, Mary Agnes Wilderotter, Gary Wilson and Jerry Yang. Robert Kotick won't stand for re-election.

The current detente definitely removes a distraction for Yahoo as Icahn will vote his 68.7 million shares in favor of the company's slate.

The next question for Yahoo is how long this detente will last. Icahn still wants to sell Yahoo to Microsoft and wants to improve shareholder value by possibly tossing Jerry Yang as CEO. Can Icahn meet those objectives a board seat and two hand-picked sidekicks?

For now, Icahn and Yahoo are pals.

Yahoo Chairman Roy Bostock said:

“We look forward to working productively with Carl and the new members of the Board on continuing to improve the Company’s performance and enhancing stockholder value. Yahoo! is a world-class company with an extremely bright future, and collaborating together, I believe we can help the Company achieve its ambitious goals.”

Icahn replied:

“I am very pleased that this settlement will allow me to work in partnership with Yahoo!’s Board and management team to help the Company achieve its full potential. While I continue to believe that the sale of the whole Company or the sale of its Search business in the right transaction must be given full consideration, I share the view that Yahoo!’s valuable collection of assets positions it well to continue expanding its online leadership and enhancing returns to stockholders. I believe this is a good outcome and that we will have a strong working relationship going forward."

And Yang is just happy to get this over with.

Update: Here's a quick look at the winners and losers of this Icahn-Yahoo detente:

Winners

Icahn: He gets his board seat and will probably force a few corporate changes. He gets into the henhouse so to speak and will get a better feel for how things work.Yahoo: A massive distraction goes away with Icahn muzzled. The revolutionaries have been put off for a bit.

Jerry Yang: He gets to keep his job as CEO for a few more months.

Losers

Microsoft: The software giant has been cuddly with Icahn, but it's unclear whether he'll have the seats to really make much of a difference. He still can be a threat, but Yahoo has neutralized him a bit. Microsoft isn't likely to buy its online strategy--Yahoo--anytime soon.Shareholders that wanted a sale to Microsoft: If Icahn were to dump all of Yahoo's board, he probably would have unloaded the company to Microsoft in a heartbeat. Now shareholders won't see a deal with Microsoft for awhile and when it happens it might be too late. And given history Icahn may not be able to boost Yahoo's stock price. To wit: When Icahn got involved with Motorola in January 2007 shares traded between $17 and $20. Today, Motorola is about $7.

Time Warner: This poor media giant has been trying to unload AOL forever. The best shot for Time Warner was to unload AOL to Yahoo or Microsoft in a desperation deal. Time Warner may be able to swing a deal with Microsoft, but the urgency is gone on the Yahoo side of the equation.