Yahoo meets estimates, plans to lay off 10 percent of workforce

Yahoo's third quarter earnings weren't the complete train wreck that was expected as the company met Wall Street estimates and announced a long-awaited layoff. The company plans to lay off 10 percent of its workforce in the fourth quarter.

Yahoo (statement), reported net income of $54.3 million, or 4 cents per share, on revenue of $1.79 billion. Excluding charges, Yahoo reported earnings of 9 cents a share, a tally that was in line with estimates. Wall Street expected earnings of 9 cents a share on revenue of $1.37 billion. Profits are down from the same quarter a year ago when the company reported earnings of $151.3 million, or 11 cents per share, on revenue of $1.77 billion.

The company also confirmed its restructuring. Yahoo said the company plans to cut its annual expense by about $400 million to $3.9 billion or so. The company will also cut "at least 10 percent" of its workforce in the current quarter.

As for the outlook, Yahoo is now projecting revenue of $1.77 billion to $1.97 billion for the fourth quarter. Those figures, which include traffic acquisition costs, give Yahoo a wide range in an uncertain quarter. For the year, Yahoo is projecting revenue on the same basis to be $7.17 billion to $7.37 billion. Operating income will be in the range of $490 million to $570 million in the fourth quarter and $1.86 billion to $1.94 billion.

Those wide ranges reflect an uncertain fourth quarter. To wit: CEO Jerry Yang said:

“As economic conditions and on-line advertising softened in the third quarter, we remained highly focused on our 2008 strategy... We have been disciplined about balancing investments with cost management all year, and have now set in motion initiatives to reduce costs and enhance productivity."

CFO Blake Jorgensen sang the same tune:

“An increasingly challenging economic climate and softening advertising demand contributed to revenues this quarter coming in at the low end of our outlook range. While we are disappointed with our results, we’re pleased that we continue to benefit from the aggressive cost management efforts."

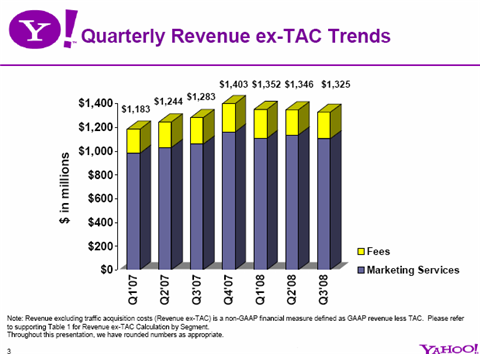

By the numbers (in charts):

Revenue trends:

Detailed revenue breakdown:

And cash flow: