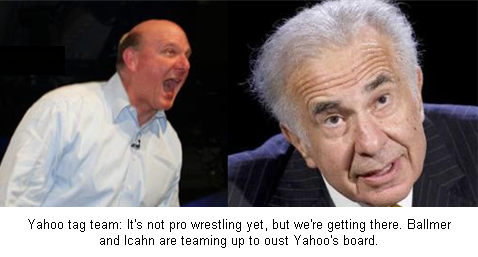

Yahoo rejects latest Microsoft-Icahn proposal; Calls Microsoft 'erratic'

Yahoo says it has rejected another offer from Microsoft and Carl Icahn. The latest offer, delivered Friday, was another gambit to acquire Yahoo's search business.

Yahoo's overall message: If Microsoft is serious step up and buy the whole company "for at least $33 per share." Yahoo also said that it offered to negotiate an "improved search only transaction." According to Yahoo, Microsoft rejected both offers.

Update: The Wall Street Journal outlines some of the details of Microsoft's offer. Among them: Yahoo would hand over its search business to Microsoft for $1 billion in addition to a guaranteed annual payment of $2.3 billion for five years. Microsoft had offered a guarantee of three years before. Microsoft would also buy $3.9 billion worth of Yahoo shares and buy $2.8 billion in Yahoo's debt to issue a dividend to shareholders. Yahoo would keep all of its content properties.

Someone at this awkward 8th grade dance needs to step up. Microsoft is allegedly interested, but I'm beginning to wonder. Icahn just wants to flip his stake for a profit. And Yahoo wants to remain independent--sort of. Yahoo's statement on the latest offer leaves the door open for a sale. Simply put, all three parties--Yahoo, Microsoft and Icahn--need each other, but the relationships are such a mess that it's unlikely they can bridge their differences.

Is there an arbitrator in the house?

Key points from Yahoo's statement:

- Microsoft and Icahn offered Yahoo a search only deal on Friday and gave CEO Jerry Yang and his board 24 hours to reply. Yahoo said its deal with Google on search is still a better deal.

- Microsoft and Icahn didn't want to negotiate beyond the latest offer, which according to Yahoo would immediately replace the company's board, remove current management, underestimates traffic acquisition costs and undervalues the company's intellectual property. And perhaps the largest kicker: The Icahn-Microsoft bid was "critically dependent on Microsoft's ability to effectively monetize search."

Do you think Microsoft could better monetize search than Yahoo? I don't.

Yahoo Chairman Roy Bostock said:

"While this type of erratic and unpredictable behavior is consistent with what we have come to expect from Microsoft, we will not be bludgeoned into a transaction that is not in the best interests of our stockholders."

A few observations:

- It appears that Icahn and Microsoft are playing the desperation card. Icahn and Microsoft are playing hardball hoping that Yahoo's second quarter will be a disaster. As shares keep falling both Icahn and Microsoft are hovering like vultures for the best deal.

- The latest offer would seek the replacement of Yahoo's board and management. The big question here is whether Icahn has enough momentum to toss Yahoo's board Aug. 1. And even if Icahn succeeds does he really want to run Yahoo.

- Microsoft is looking erratic. First, the whole tag team thing with Icahn may be good strategy but could backfire. Second, Microsoft said it wouldn't do a deal with Yahoo's current board and management. So what's with another offer? Microsoft is flip flopping.

- All these parties need is an elegant way to get out of this pickle and Yahoo is leaving a door open. Yahoo noted:

Yahoo!'s Board points out that a transaction to acquire the whole company would be much more straightforward and involve far less risk than the new proposal or any similar alternative. The Board believes a whole company transaction could be negotiated and executed prior to August 1st. In rejecting the Microsoft/Icahn proposal, Yahoo! not only repeated its offer to sell the entire Company to Microsoft for at least $33 per share.

Also see: Yahoo’s desperate search times call for open source