Yahoo's board under fire after speculation

Jerry Yang is reportedly trying to buy Yahoo, and big shareholders want to toss the board of directors.

(Credit: Yahoo)

Speculation about Yahoo's future has kicked off in earnest, and who takes over as CEO is taking a back seat to boardroom feuds. The consensus view is that the board needs to be tossed.

Business Insider noted a rumour that co-founder Jerry Yang is trying to buy Yahoo. Apparently, Yang and Yahoo chairman Roy Bostock are duking it out.

The Yang thesis will be one of many floated as folks ponder whether Yahoo should go private. Going private would have some advantages. The biggest edge for Yahoo is that it wouldn't have to restructure and reinvent itself in the public eye, and, should Yahoo's revamping be successful, there would be a nice cash-out IPO moment at some point.

Indeed, the chances of taking Yahoo private are probably pretty good. The chances that Yang could round up funding are slim.

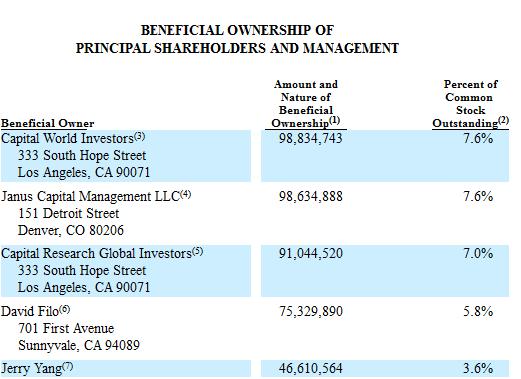

However, before any of these takeover talks get rolling, investors want to toss the board, starting with Bostock. In a letter to Yahoo, Third Point, a hedge fund that owns 5.1 per cent of the company, said that it wants to toss the board. Third Point is now one of Yahoo's top shareholders (as of April).

Third Point's case goes like this:

- The board was dumb enough to hire former CEO Carol Bartz in the first place.

- Bostock and the gang stood by Bartz too long.

- The board "made a gross error" when it turned down a US$31-per-share bid from Microsoft in 2008 — today, Yahoo is US$13 and change.

- "Merely replacing the company's CEO — yet gain — will not be enough to alter the direction of the company."

- Yahoo's entire board should be tossed. A new board is needed to recruit a new CEO or "strategic counterparty with a stable and responsive governance structure".

Third Point comes off as Captain Obvious in its letter, but other shareholders are likely to feel the same way. Add it up, and there needs to be more than a CEO change. Toss the board. Hire a new CEO. Then maybe fix Yahoo enough to sell out to generate some shareholder value.

These needs are probably the main reason that a lot of CEO candidates haven't surfaced — everyone realises that more than just Bartz need to go.

Via ZDNet US