Saleforce.com's Q1: How's the encore?

Salesforce.com's first quarter results are expected to be strong, but evidence suggest the company will have a tough time following up its fourth quarter blowout.

Piper Jaffray analyst Mark Murphy surveyed 42 Salesforce.com partners and found they finished 3.3 percent ahead of plan. In the fourth quarter these partners were 6.1 percent ahead of plan.

Related: Salesforce eyes international expansion one country at a time | Salesforce integrates Rypple, launches content management effort Site.com | Salesforce.com's monster quarter: Cloud renaissance for enterprise? | Salesforce.com Q4 surpasses revenue target, ups outlook

Murphy said in a research note:

Partners we spoke with were on average 3.3% ahead of plan, versus 6.1% ahead of plan in the prior quarter. The current survey results reinforce our opinion that salesforce.com's partner ecosystem probably saw slight softness in FQ1 due to the sales reorganization efforts, although we didn't sense any panic.

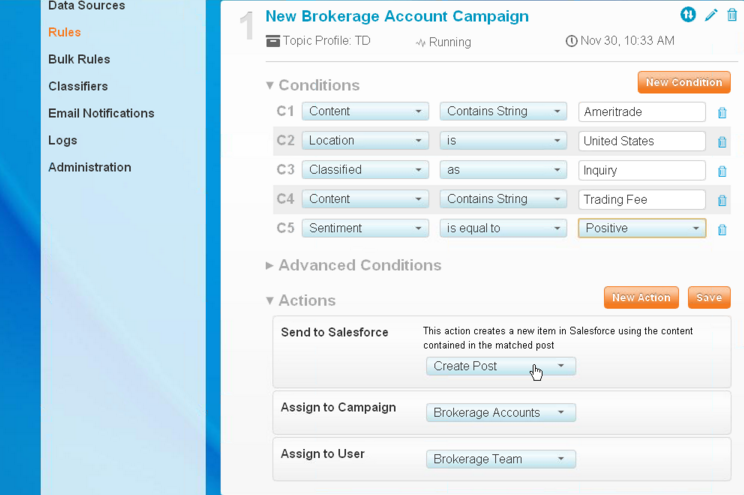

Murphy argued that Salesforce.com will still have a great year as sales surge around Sales Cloud, Service Cloud, Chatter, Force.com and Radian6.

Regardless, Salesforce.com could see some first quarter turbulence. Deutsche Bank analyst Tom Ernst Jr. explained in a research note:

Our checks heading into the quarter indicate that Salesforce underwent a large restructuring within its sales organization, which could be disruptive to near-term results, but should be a positive as we go through this year and to the overall growth profile.

Ernst is projecting billings growth in the first quarter to be 28 percent.

According to analysts, Salesforce.com is going into larger enterprise accounts and focusing on verticals such as financial services and healthcare. Sound familiar? That's the approach SAP and Oracle use.

Not all analysts are sold on Salesforce.com's prospects. Cowen & Co. analyst Peter Goldmacher said in his earnings preview that Salesforce.com has accomplished a lot, but still pays too much to deliver revenue growth. That equation means margins will be squeezed.

Goldmacher said:

Our bearish position on Salesforce.com isn't meant to diminish what the company has accomplished over the past decade. Our concern revolves around how much money it has to spend to drive growth, and our belief that its growth rate is stimulated by distribution expenses and not end market pull. We are open to the notion that the business is hitting an inflection point in the enterprise, but we believe that unless this is the mother of all inflection points, normalized growth will have to slow in order for the company to make the material gains in profitability befitting a $3B software business. Salesforce.com is managing multiple tangentially related business and multiple end markets. While we have no visibility into what products and what markets are and aren't working, we'd like to see the company get more focused and really execute on the three largest opportunities, rather than continue chasing shiny objects with dubious financial returns.