Brex wants to speed up business processes with Brex Empower

Brex announced Wednesday its first foray into the financial software world with Brex Empower, an innovative financial platform that will serve as the foundation for all future Brex products. For now, businesses can use the platform to track expenses, view spending in real-time, simplify expense policy, and create budgets. Additionally, Brex revealed DoorDash as a new client.

ZDNET Recommends

Brex Empower is an evolving platform that will include more features as time goes on. It's launching today with a spend management tool, but the company has plans to integrate other products into the platform that deal with spending, payroll, banking access, and travel, among others. The platform hopes to speed up business processes and save time for both leadership and employees.

A spokesperson for Brex told ZDNet that current Brex Corporate cardholders and clients will gain access to the Brex Empower over the next several months. New clients can sign up for a demo on Brex's website.

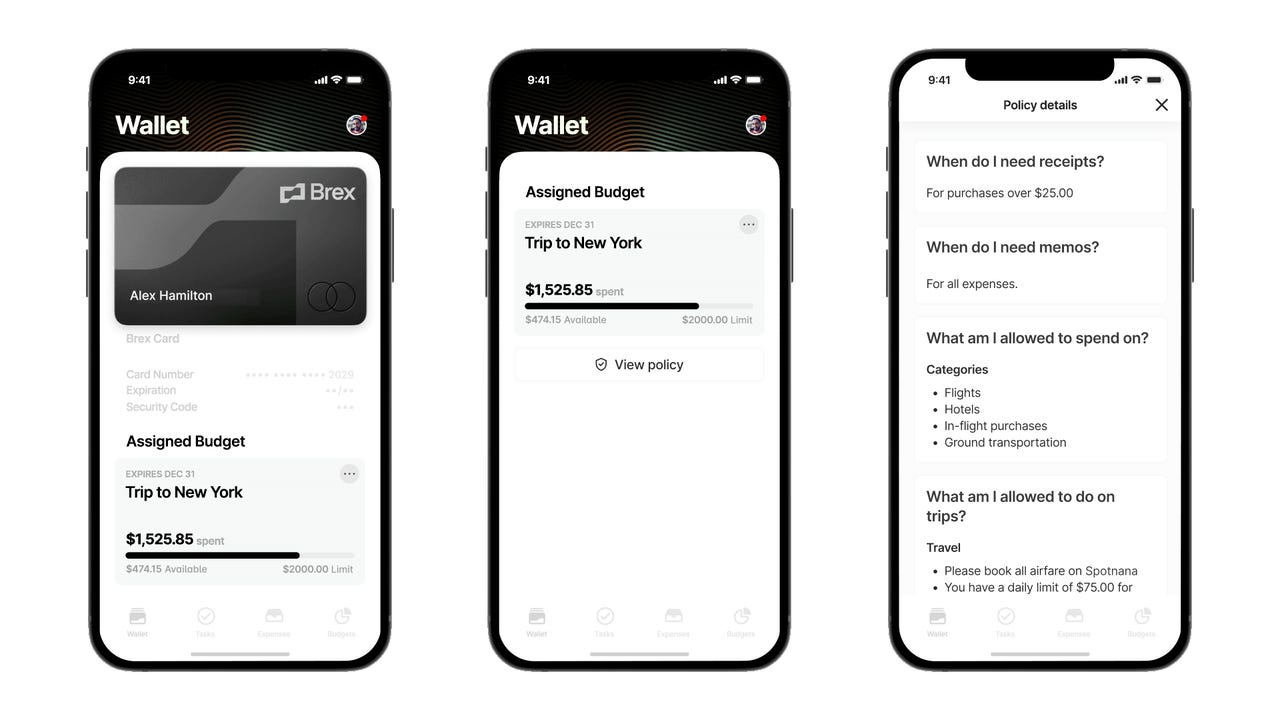

Starting today, clients can track expenses without collecting receipts or using another service to check transactions. By leveraging data from credit card networks and point of sale partners, the software will be able to easily keep an eye on expenses.

The software will also make it easier to trust employees by allowing leaders to monitor spending in real-time. The spend management tool will let leaders request and create budgets for teams with defined expense policies cutting downtime for individual budget approvals. The spending tool offers tips around creating policies and how they affect the company and will help manage company cash flow.

According to the press release, 33% of employees don't read expense policies. To help mitigate this problem, Brex is introducing a new way to visualize expense policies and make it easier to understand across credit cards, bill pay, and reimbursements.

Also: Best business credit cards: Find the right card

"Fast-growing and innovative companies are always looking for ways to fight bureaucracy and speed up the pace of business," said Henrique Dubugras, Brex co-founder and co-CEO, in the release. "We designed Empower to do just that - allowing companies to use spend as a strategic growth lever, unlocking spend in the right way to help drive businesses forward."

The new financial software hopes to cut down on bureaucracy and traditionally slow systems to speed up business processes. DoorDash will be one of the first clients to utilize the new platform.

"Innovation and moving quickly is a key advantage in a competitive market," said Mike Kim, vice president of finance at DoorDash, in the release. "Yet financial tools haven't kept up with a fast-growing, distributed company like ours. Expense approvals can take days and limit our employees' ability to experiment and deliver great experiences to our customers."

The mobile-centric platform will work seamlessly across existing financial systems and hopefully speed business up by giving clients access to multiple tools in one convenient place.