Microsoft's search ambitions are its Vietnam

Updated below: Is Microsoft fighting an unwinnable war with its online business and search obsession?

It's a valid question and one that needs to be asked. At some point you have to wonder if Microsoft's Google envy is its Vietnam. As Mary Jo Foley noted Microsoft's answer to its online woes is to spend, spend, spend. You have to wonder at the returns. Some analysts have dismissed these online investment worries because the Microsoft's broader business is doing fine. But if these online results become a drag just when Microsoft should be at its peak product and earnings cycle it's an issue.

It's not like Microsoft just discovered the Web. It has been there all along. It had its epiphany to squash Netscape more than a decade ago. Its properties aren't half bad. And Microsoft is a top 5 player on the Web in terms of traffic. Good luck turning a profit though. Microsoft is an afterthought in search. Display advertising is hurting the software giant's online revenue. And Microsoft is hell-bent on conquering a market it knows little about--advertising. Of course, Microsoft wants to know more about advertising and has been acquiring accordingly, but where are those returns?

After Microsoft released its fourth quarter results the online unit stood out for all the wrong reasons. The online services business lost $1.23 billion for the fiscal year ending June 30. I quipped that it's no wonder that Microsoft is so hot for Yahoo. Something has to save this online business.

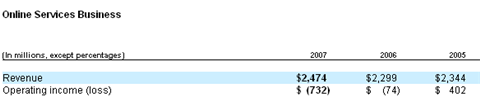

And what's startling about that figure is that Microsoft only lost $732 million in 2007. Microsoft's online services business was actually profitable in 2005.

Now you can argue that the collapse of Microsoft's narrowband dial-up service was the issue, but even so operating income is headed in the wrong direction. What's the explanation? Microsoft is investing in the future. Microsoft will continue to spend heavily on search. Execs told investors it will compete in search--even if it has to pay people for their queries.

But all that spending may not add up to much. Unless Microsoft buys AOL or Yahoo its online business isn't likely to turn a profit in the current fiscal year. Why? The online business is headed for a dry spell. What does that mean for Microsoft, which has an online business that wasn't profitable even during good times?

Indeed, Microsoft is already seeing a slowdown. It noted that "monetization lagged" because of "tightening advertising budgets combined with a more competitive display pricing environment." Sure Microsoft is investing in more premium online content, but that's also more expensive.

CFO Chris Liddell made it clear the online services business is in investment mode. On a conference call he said:

The online services business has a totally different dynamic and is in a period of significant investment. We do not make these investments lightly, as the loss in this division will be a drag on an otherwise exceptionally good performance. Translation: Microsoft's online business will lose money in fiscal 2009 too.

However, we believe that the additional investments of several hundreds of millions of dollars is worth the short-term cost, given the opportunity to participate in a market where the opportunity is measured in the tens of billions of dollars.

Liddell also talked about improving social networking assets across all delivery vehicles--PC, phone and Web. Microsoft also plans to "invigorate our MSN portal experience" and blow two-thirds of its online investing dollars on improving search.

When asked how Microsoft will compete with Google on search with or without Yahoo, Liddell said:

In the search area, clearly that’s the one where, relatively speaking, we are the most behind and that’s why we’re taking a different approach, which again I mentioned in the prepared remarks where we are focusing in particular on the areas of search where there’s a strong commercial intent, our verticals like retail, travel, real estate, local. We’re looking at different approaches where we might potentially take a disruptive and innovative business model, for example, Cashback, and then looking at winning distribution deals.

Now in the short-term, that isn’t going to make the division profitable and I think clearly from our guidance, that’s not the case. So as I said in the remarks, if you look at the operating margin structure of the company, you really have to look at the three distinct businesses. We feel good about the margin structure for our core businesses in particular growing double-digit revenue on. Entertainment and devices will be broadly flat but online is going to be negative

In other words, Microsoft's online business is the appendage that's going to dilute good gains in its core businesses in fiscal 2009. Microsoft wouldn't address fiscal 2010 or 2011 or make any projections about when the online business would be profitable.

Bottom line: Microsoft's online war will continue with no end in sight.

Update: This story removed the image that had previously accompanied it. In no way did I intend to offend the fine folks that served in Vietnam and my art selection stunk. My apologies.