Up to speed: does speed mean market power?

The latest results from the ZDNet Broadband Speedtest show that Telstra DSL speeds are faster than anyone's — but how much of that is a reflection of the telco's dominance in the market?

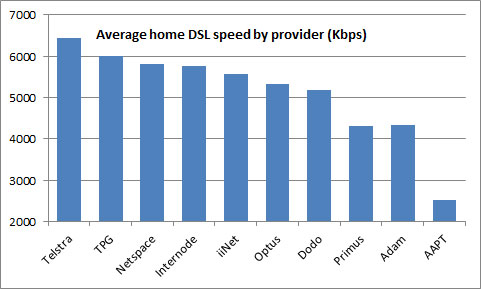

When we first highlighted that Telstra led the pack in terms of average internet speeds, the overwhelming response was, "What do you expect? It's got heaps of customers on cable." Well, from last month we asked users taking the Speedtest to specify their connection type, so we can compare like for like. And when we only look at those using DSL at home, Telstra is still clearly in the lead.

(Credit: Phil Dobbie/ZDNet Australia)

Of course, a faster average speed doesn't necessarily mean one provider has a better network than the others — there might simply be more people on higher speed plans. TPG's competitive pricing for ADSL2+ will certainly have helped it to achieve second spot in the DSL speed league table.

One surprising finding in these results was just how much Telstra dominates regional Australia. It averages faster speeds everywhere, but often the differential is greater outside the capital cities. At 7.2Mbps, the average Telstra speed in regional Queensland is 32 per cent faster than the average for all other providers. In regional NSW the differential is 24 per cent; in Victoria it's 20 per cent.

(Credit: Phil Dobbie/ZDNet Australia)

Yet the more remote the region, the more likely that all providers will be using Telstra's wholesale access infrastructure. If the equipment is the same, surely the speed should be the same, unless one provider is offering more competitive pricing at higher speeds. Does this mean Telstra has more customers on faster plans? If so, it's a difference we'd expect to see reduce over coming months with the equivalence aspect of the interim arrangements within Telstra's structural separation undertaking. Telstra should be wholesaling to everyone at the same price — a price determined by the ACCC.

The other interesting finding in the latest Speedtest results (based on usage from 1 to 29 March 2012) is the difference in the proportion of Telstra customers from region to region. Tests outside the capital cities are far more likely to come from Telstra customers. If we assume that this reflects market share, then it's clear that Telstra has a far greater stranglehold in regional Australia: it accounts for 42 per cent of user tests in regional Queensland, compared to just 23 per cent of tests in Brisbane. There's a similar differential between capital cities and regions in every state. It shows how much less choice there is away from our major metro centres. Again, this should narrow as everyone gets the same access to Telstra's wholesale DSL product.

As it stands, these figures lend support to the argument that Telstra's wholesale DSL customers were facing a price squeeze outside the capital cities. The telco failed to catch the same level of market share it obtained in the cities, and when it did it was at a much lower average speed. This shows that the ACCC was right to introduce measures to regulate the pricing and provision of Telstra's wholesale DSL offering. We'll continue to track this to see what changes occur over coming months.