Apple June quarter earnings: A lull before the big bang

Apple is facing high expectations for its fiscal third quarter earnings results, but in many respects the three months ending June 30 are really just a warm up for big gains ahead.

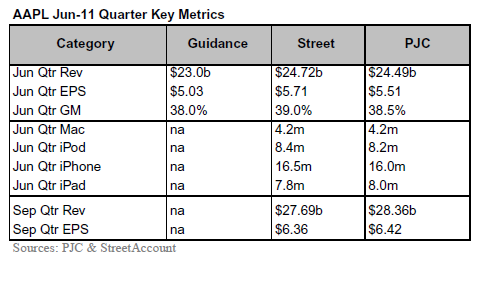

The company is expected to deliver third quarter earnings of $5.85 a share on revenue of $24.99 billion. Consensus estimates have been creeping higher in recent days and remain fluid based on Thomson Reuters' real-time tracking. There are significant wild cards as Apple's latest quarter will be a lull before a new iPhone, back-to-school shopping, a likely iPod refresh and the holiday season. For instance:

- Piper Jaffray analyst Gene Munster noted that Mac sales may be a bit below expectations as consumers await new products in July. That view was due to NPD's recent sales estimates.

- The iPhone tally is a bit of a mystery given the trade-offs between the device's first full quarter at Verizon, AT&T's $49 iPhone GS and the launch of the white iPhone.

- iPad shipments missed some expectations last quarter, but Apple said June 6 that it sold 25 million iPads. Munster said that tally indicates about 8 million iPad units for the June quarter.

Here's a look at the metrics and expectations.

Analysts across the board are viewing the June quarter as a warm up act for the quarters ahead. Among the key items for Apple over the next six months.

- Mac growth after June. The June NPD data for Mac sales indicate a bit of a pause before new products. Mac should be a larger contributor with back-to-school sales.

- Additional carriers to distribute the iPhone around the world. Peter Misek, an analyst at Jefferies noted that Pegatron's June sales surged and that indicates strong CDMA iPhone demand. A new iPhone model is also expected.

- The launch of iCloud could ultimately drive device sales.

Meanwhile, Sterne Agee analyst Shaw Wu predicted that Apple can benefit from better component costs. "We continue to believe that Apple is positioned to outperform in this tough macroeconomic environment with its defendable strategic and structural advantages and its vertical integration," said Wu.