Are these the phrases that will allow Vonage investors damages and buyback rights?

The Wall Street Journal reports this morning that Vonage customer-investors who have been disillusioned about Vonage's stock price after they paid the full IPO price of $17 a share may have grounds to seek damages or require the company to buy back shares at their IPO price.

The grounds would be as a result of technical errors in the Vonage prospectus.

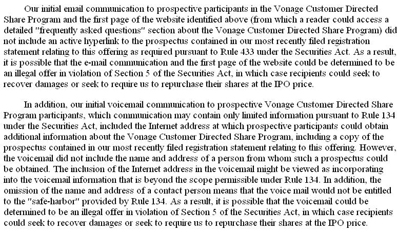

Here are the two erroneous paragraphs, as included in page 140 of the prospectus:

Our initial email communication to prospective participants in the Vonage Customer Directed Share Program and the first page of the website identified above (from which a reader could access a detailed "frequently asked questions" section about the Vonage Customer Directed Share Program) did not include an active hyperlink to the prospectus contained in our most recently filed registration statement relating to this offering as required pursuant to Rule 433 under the Securities Act. As a result, it is possible that the e-mail communication and the first page of the website could be determined to be an illegal offer in violation of Section 5 of the Securities Act, in which case recipients could seek to recover damages or seek to require us to repurchase their shares at the IPO price.

In addition, our initial voicemail communication to prospective Vonage Customer Directed Share Program participants, which communication may contain only limited information pursuant to Rule 134 under the Securities Act, included the Internet address at which prospective participants could obtain additional information about the Vonage Customer Directed Share Program, including a copy of the prospectus contained in our most recently filed registration statement relating to this offering. However, the voicemail did not include the name and address of a person from whom such a prospectus could be obtained. The inclusion of the Internet address in the voicemail might be viewed as incorporating into the voicemail information that is beyond the scope permissible under Rule 134. In addition, the omission of the name and address of a contact person means that the voice mail would not be entitled to the "safe-harbor" provided by Rule 134. As a result, it is possible that the voicemail could be determined to be an illegal offer in violation of Section 5 of the Securities Act, in which case recipients could seek to recover damages or seek to require us to repurchase their shares at the IPO price.

The WSJ noted that Vonage said an active hyperlink to the prospectus was missing in its initial e-mail to prospective participants in the Vonage Customer Directed Share Program.

As a result, Vonage said it is possible that it could be determined that the e-mail and the first page of a Web site about the IPO, vonageipo.com, could be determined to be an "illegal offer" in violation of securities laws.

Recipients could seek to recover damages or seek to require Vonage to repurchase shares at the IPO price, the Journal said.