Asia's next hot spot: Vietnam

The red-hot Chinese economy may be the darling of global investors, but neighboring Vietnam is getting its fair share of attention, too.

With an economy growing at nearly double-digit numbers, Vietnam is also beginning to face shortages in manpower, like China and India. The country's impending entry into the World Trade Organization (WTO) by the end of 2006, coupled with its pro-business policies, looks set to shore up more investments in the days ahead.

While Vietnam's economy is largely driven by manufacturing, the technology and services sectors are fast catching up. According to a recent New York Times report, salaries of white-collar and other professional workers are soaring at up to 50 percent a year.

In the technology space, global corporations like chipmaker Intel have given Vietnam their vote of confidence. In October this year, Intel and a U.S. investment group announced plans to pump US$36.5 million in FPT Corporation, Vietnam's largest IT company.

Phu Than, Intel's country manager for Vietnam, said the chipmaker's decision to invest in FPT stems from the Vietnamese company's local market leadership in several segments that directly influence Intel's growth, such as systems integration and software services. The investment comes at a time when the government has made good strides to improve capital markets and made it easier for foreign investors to invest in local companies.

"Such investment wouldn't have been possible a few years ago," Than said.

Vietnam's technology market is worth US$800 million today, and is expected to grow at around 20 percent each year. The country is also Asia's second fastest-growing economy. Last year, Vietnam's economy grew at 8.4 percent, behind China's 10.2 percent.

In February this year, Intel said it would pour in US$300 million to build a semiconductor assembly and test facility in Ho Chi Minh City. This marks the first such investment by the semiconductor industry in Vietnam.

Than said that with 60 percent of Vietnam's population under 30 years old, and its high literacy rate of 96 percent, Intel is certain Vietnam will grow its market importance.

"Our business model is one of close cooperation with the Vietnamese government and local hardware and software companies with technical training and marketing programs to provide the local market with local IT solutions," he revealed.

Intel's investments are working, Than said. He noted that the Vietnamese PC market has grown five times since Intel established itself in the country, and will continue to grow at about 15 percent to 18 percent each year.

Sales in Vietnam's technology sector, however, has been dominated by hardware, which made up some 80 percent of total IT spending in the last five years, according to a U.S. government report on Vietnam's IT industry.

The report noted that Vietnam's IT industry is hardware-focused, largely due to the widespread software piracy, and the lack of effective intellectual property protection in the country. The Business Software Alliance put Vietnam's software piracy rate last year at 90 percent.

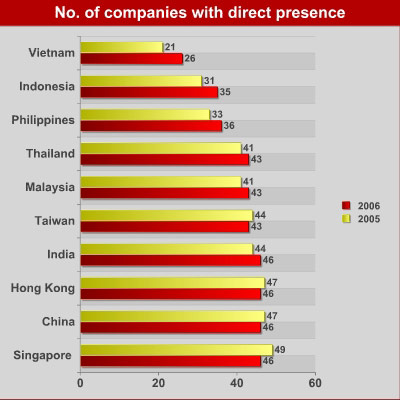

Comparing the profiles of ZDNet Asia's Top Tech 50 companies of 2005 and this year, the number of companies with offices in Vietnam jumped from 21 to 26 this year. But the majority of them are still hardware vendors including Huawei, Dell, Ericsson, Lenovo, Juniper Networks, and Cisco Systems. Clearly missing a local office in Vietnam are software players such as Symantec, SAP and Trend Micro, though Microsoft, Oracle and Compuware already speak the local language.

While SAP does not have a Vietnamese office, its business interests in the communist country is managed in neighboring Thailand.

SAP spokesperson Jittiporn Chaisoonthornsiri told ZDNet Asia: "SAP Thailand has penetrated the Vietnam market in the past two years. But this year, we had the great opportunity to work with Vietnamese partners such as FPT and Vina Systems to gain greater market share in the country."

Jittiporn did not comment on the possibility that SAP might establish a Vietnamese office, but noted that the company already has almost 40 clients in Vietnam. These include multinational companies, as well as local firms such as Boa Minh Insurance and Binh Minh Textile.

Likewise, Symantec has chosen to work with local partners instead of establishing a Vietnam office.

Eric Hoh, vice-president of Symantec in Asia South, said Vietnamese companies are now aware of the need for security.

He added: "We are also working with partners to educate the market on the importance of security and availability. Through an extensive network of distributors and resellers, Symantec will continue to expand our presence in both security and availability."

In any case, the liberalization of Vietnam's financial industry is likely to boost demand for hardware, software and IT services in the country.

Financial Insights, a subsidiary of research company IDC, noted in a report early this year that state-owned commercial banks and the smaller joint-stock banks, which together make up 91.7 percent of the Vietnamese banks, are investing heavily in IT modernization.

The Vietnamese government is also leading the charge when the Ministry of Finance announced in October that it would build a new Treasury & Budget Management Information System (TSBMIS) together with IBM.

The US$49 million project was funded by the World Bank. It is aimed at integrating and centralizing the government's financial management systems into a single platform to improve transparency and accountability of public financial management.

According to Krishna Giri, public sector leader at IBM Global Business Services in Asean and Asia South, the new systems will be operational in pilot sites from April 2008.

Apart from IBM, which is providing consulting services, hardware, software and support services, FPT and Oracle will also be involved in systems integration throughout the project.

Perhaps the strongest sign of Vietnam's booming tech sector comes in the decision by the organizers of CommunicAsia, Asia's largest communications industry trade show, to stage a similar event in Vietnam in 2007.

Vietnam's telecoms market was worth US$2 billion in 2005. Its teledensity--at just 18.41 per 100 people--means that Vietnam's telecoms industry is expected to balloon.

Between 2001 and 2004, the country's telecoms sector grew 47.8 percent each year. By 2008, the number of cellphone users in Vietnam is expected to increase to 21 million. The International Telecommunication Union has also named Vietnam as the world's second fastest-growing telecom market, after China.