Best Buy earnings miss targets

Best Buy's second quarter earnings fell short of expectations.

Best Buy on Tuesday reported earnings of $158 million, or 37 cents a share, down 22 percent from a year ago. Wall Street was expecting earnings of 42 cents a share. Revenue was up 12 percent to $11 billion, which was ahead of Wall Street estimates calling for sales of $10.78 billion.

For the quarter ended Aug. 29, Best Buy said same store sales were down 3.9 percent from a year ago. In a statement, the company said it gained market share in its category.

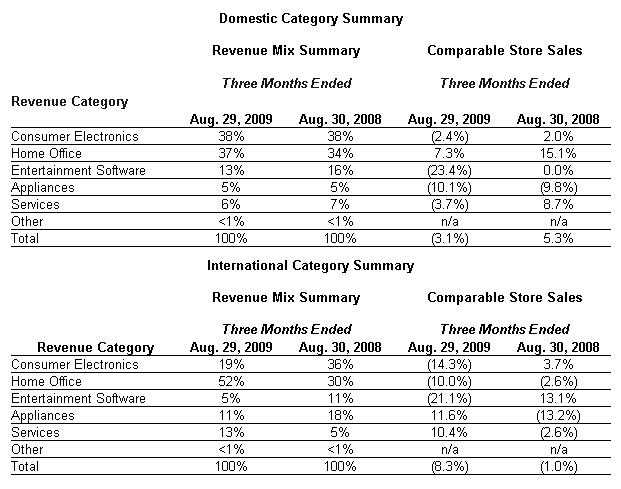

In the U.S., second quarter revenue was $8.3 billion, up 2 percent from a year ago. However, Best Buy said traffic increased in its store but average ticket sales fell. Sales gains in notebook computers, mobile phones and flat-panel TVs were more than offset by gaming, digital cameras, movies and music. Gross margins were 24.4 percent, flat with a year ago.

Looking ahead to the fiscal year ending Feb. 27, Best Buy said it expects same store sales to be down 2 percent to flat. Revenue will be between $48 billion and $49 billion, up 8 percent. Annual non-GAAP earnings will be $2.70 to $3 a share. GAAP earnings will be $2.64 a share to $2.94 a share. Wall Street was expecting earnings of $2.87 a share.

Here's the breakdown of Best Buy's categories. The main takeaway is that the gains in the home office category are slowing.