BlackBerry can ride Q10 in first quarter, but sell-through sketchy

BlackBerry's first quarter is expected to be strong as the company filled its channel with Q10 devices, but analysts are wary about how those devices will sell in future quarters.

Simply put, the jury is out on Q10 and its prospects going forward. Some analysts did surveys that revealed lackluster U.S. demand. However, the Q10 does court the die-hard Qwerty-BlackBerry fan. In addition, the Q10 may do better in emerging markets and internationally.

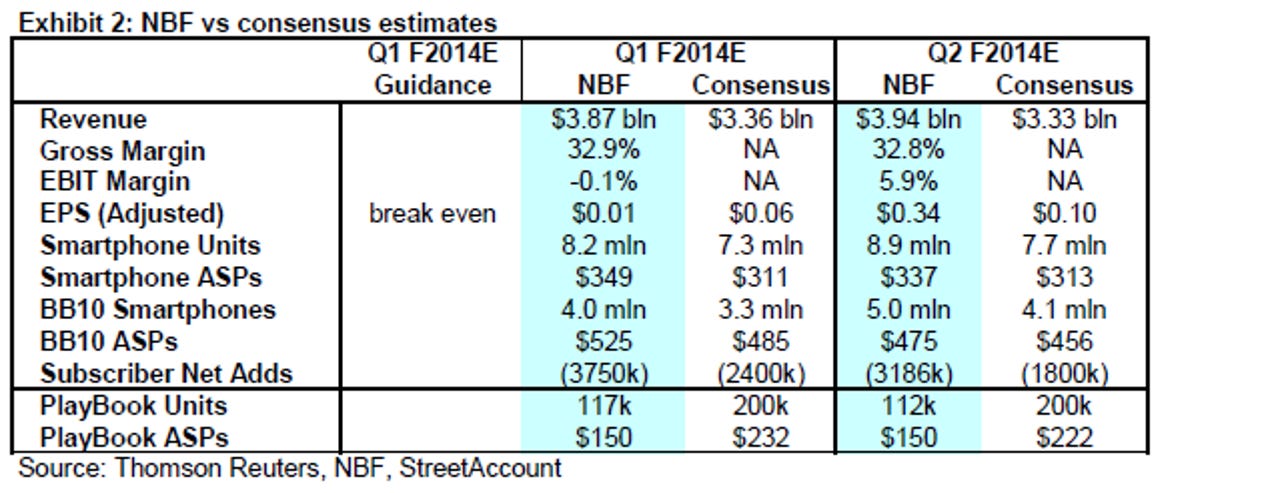

Wall Street is expecting BlackBerry to report first quarter earnings of 6 cents a share on revenue of $3.36 billion. National Bank analyst Kris Thompson is projecting that BlackBerry will ship 8.17 million smartphones with 1.25 million BlackBerry 10 devices going to the enterprise and 2.75 million sold to consumers. BlackBerry is expected to sell 4.17 million BlackBerry 10 devices.

It's worth noting that Thompson is a bit more optimistic than consensus estimates.

Like all things BlackBerry, there are many prognosticators at the extremes, but few who are neutral to middle-of-the-road.

More: BlackBerry launches Secure Work Space for Android, iOS | BlackBerry Q10: Hardware QWERTY and long battery life have a place in mobile | BlackBerry quietly launches BES 10.1 in the cloud | New BlackBerry full-touch A10 on the horizon, BBM to come preloaded on rival handsets? | Two-thirds of BlackBerry converts tempted to return by Q10 | How BlackBerry is riding iOS and Android to power its comeback

Consider the following outlooks for BlackBerry's quarter. Deutsche Bank analyst Brian Modoff said:

We conducted a round of carrier store checks on the Q10 during its first weekend of sales in the US. In total, we surveyed 60 stores — 20 AT&T and 40 Verizon — and the results were broadly poor. In short, it was the most negative survey result we have tallied in all five that we have completed. We think the results of this survey align with our longer-term view of the company.

Modoff added that the Q10 wasn't outselling the Z10 in most cases. Cowen & Co. analyst Matthew Hoffman also found weak demand for the Q10.

Despite those worries, Modoff said that BlackBerry's first quarter may surprise to the upside.

Jefferies analyst Peter Misek is more optimistic about BlackBerry. Misek is focusing on enterprise demand for the Q10 as well as the company's software focused on mobile device management. Misek said:

Standard pricing for Secure Work Place (the BYOD offering) is $99/year/user; combined with bulk discounts and data savings, we think this is a very attractive option for companies. BES 10 remains a free upgrade for existing BlackBerry enterprise customers. The standard pricing for BBRY devices is $59 per year (or ~$5/month)... We were pleased with our trial of BES 10.1 on our iPhone and a beta of a new desktop VPN service. We believe enterprises could save $3-$10/month/user on data charges as email traffic is especially compressed. We estimate that there are currently 18K BES 10 servers (vs. 12K a couple months ago).

Misek has a point about BlackBerry's mobile device management potential, but those positives will quickly be negated if the company finds itself with a BlackBerry 10 device inventory issue due to weak demand.

Hoffman said BlackBerry 10 devices may lack staying power. He said in a research note:

Our checks show there have been two issues with the BB10 OS that we believe could gate sell-through and lead to lower-than-consensus August results. We have spoken with multiple industry participants over the past month about BB10 and we have two primary take-aways: 1) BB10's limited app support (no Instagram or Netflix, to cite a few) is creating a higher percentage of consumers that are not satisfied with the BB10 experience than some dealers are seeing with Android or iOS and 2) the BB10 OS as adapted on the Q10 is confusing.

Add it up and BlackBerry's first quarter is almost besides the point. BlackBerry will field a lot of questions about the second quarter and the company's future will depend on consumer sell-through.