By the numbers: iiNet's Malone knew when to sell

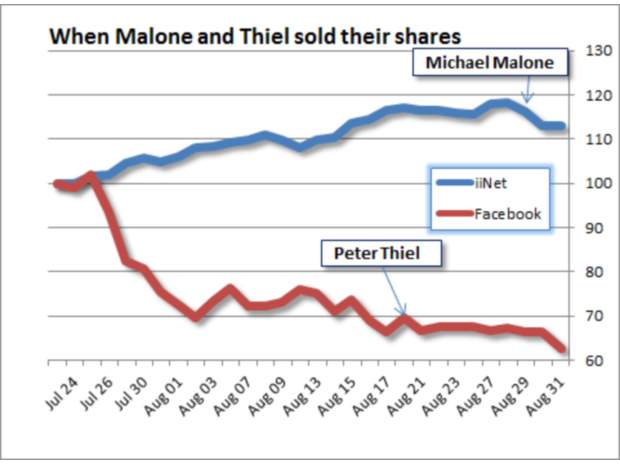

When Peter Thiel sold his shares in Facebook, he knew a bad situation was going to get worse. iiNet's Michael Malone chose a more stable time to claim a little bit of his just desserts.

In 1993, Malone founded iiNet in a garage, located in suburban Perth. Almost nineteen years later, it's about time he took out a few extra million dollars for his efforts. And it seems like a sensible time to do it — he sold four million shares (through his Perth Internet investment vehicle) when the share price was at an all-time high. As to the timing, the decision is restricted to two trading windows each year, after the full year results announcement.

"In this case," Malone said, "we let investors absorb the result for a couple of weeks, then organised the sale. There was a lot of demand from interested buyers."

Compare that to Peter Thiel, the one-time PayPal CEO, who sold 20 million of his Facebook shares at the first opportunity. The price had already bombed and Thiel was just the first of the rats deserting the ship, helping the price slide further, still. On Friday, it was at AU$18.06, down 76 percent from its peak just three months ago.

(Credit: Phil Dobbie/ZDNet)

Malone's selling spree is small, in the scheme of things — Perth Internet still has 14 million shares left in the company. That's part of the reason the move didn't really hit the share price much, at all. Malone said that there was plenty of demand from buyers, probably because the company is performing well. When you look at earnings per share, and apply that to the price of shares, you can see that it performs alongside other telcos, including major players, like Vodafone.

Although scale and investment is often touted as essential in the telco sector, iiNet — along with TPG and the UK's TalkTalk — has shown that they can perform as well as the big guys, without the high level of market capitalisation.

(Credit: Phil Dobbie/ZDNet)

The danger is, of course, that the low investment approach can only take you so far. The level playing field of the NBN will increase competition in the fixed line space, and demand for greater integration with mobility could place fixed-only network owners in a precarious situation. Owning a mobile network might become essential in the future.

Perhaps Malone knows this. Maybe those remaining shares are worth holding in case there's a buyout from Vodafone. Or from TPG, whose boss David Teoh, with 6.6 per cent of iiNet now owns more of the company than Malone (who has a joint share in 8.7 per cent).

Whatever his long term plans, Malone took out a little money because he could; unlike Thiel, and those early Facebook investors who acted quickly to save themselves from a disaster.