Commonwealth Bank reports AU$9.4b profit after spending AU$1.7b on IT in FY18

The Commonwealth Bank of Australia (CBA) has reported 12-month statutory net profit after tax of AU$9.4 billion, a 4.7 percent decrease from FY17, in a year the bank would rather forget.

Operating income for the year ended June 30, 2018, was AU$25.9 billion, up 2.6 percent year on year, and operating expenses totalled AU$11.6 billion, up 9.2 percent over the prior year.

CBA said the increase in operating expenses was due to civil penalty proceedings, and one-off expenses such as financial crime compliance and higher technology costs.

IT services spend was up 13 percent in FY18 to AU$1.7 billion.

The bank said this was mainly due to a AU$65 million increase in capitalised software impairments, which was driven by a decision to implement a new AU$51 million institutional lending platform, and a AU$58 million increase in amortisation of software assets, higher software licence costs, and lower vendor rebates.

During the year, the bank replaced its CEO with Matt Comyn after Ian Narev exited the bank amid investigations from Australia's financial intelligence and regulatory agency, Austrac.

CBA in June entered into an agreement with Austrac to end civil proceedings initiated in August 2017. The agreement sees the bank admitting to 53,750 breaches of the Anti-Money Laundering and Counter-Terrorism Financing Act (AML/CTF), which included failing to hand over 53,506 threshold transaction reports (TTRs) for cash transactions over AU$10,000 to the regulator through intelligent deposit machines (IDMs) for almost three years between November 2012 and September 2015; and for a period of three years not complying with its AML/CTF program across 778,370 transactions.

The terms of the agreement will see the bank pay AU$700 million -- of which AU$375 million was accounted for in H1 and AU$325 million in H2 -- along with Austrac's legal cost of AU$2.5 million, and the regulator's proceedings dismissed.

The bank also copped a AU$389 million "risk, compliance, and regulatory costs" charge, comprising new provisions of AU$234 million and one-off regulatory costs of AU$155 million. CBA described the provisions as relating to financial crimes compliance, the ASIC investigation, the shareholder class actions, the Austrac proceedings, the Royal Commission, and the APRA Prudential Inquiry.

CBA on Wednesday told shareholders that it has invested heavily in AML/CTF compliance through new technology and updated process documentation.

"Despite the challenges we have faced this year, the fundamentals of our business remained strong," Comyn said, delivering the bank's results on Wednesday. "Operating momentum was driven by our core franchise which delivered good volume margin management in home and business lending, ongoing growth in transaction accounts and deposits, and continued uptake of our technology offering.

"We are building a simpler, better bank ... this will be underpinned by stronger capabilities in operational risk and compliance management, cost reduction, data and analytics, and a continuing commitment to innovation and customer service."

In addition to the Austrac investigation, CBA found itself in hot water on a number of issues throughout Australia's Banking Royal Commission this year, with one being the practice of the bank overcharging customers for financial advice they did not receive.

It was revealed that the bank was made aware in 2012 by Deloitte that it did not have the systems and monitoring in place to ensure clients were getting financial services they had paid for; that clients were habitually charged services that were not provided; and that there were ad hoc systems in place to store data that could only be checked manually.

As also reported by the ABC, CBA, alongside Westpac, the National Australia Bank, ANZ bank, and AMP, had taken more than AU$220 million from clients for services they never intended to provide.

The Australian Securities and Investments Commission (ASIC), the country's corporate regulator, came under fire during the Royal Commission for not appropriately punishing the banks. ASIC let off CBA with an enforceable undertaking for overcharging clients AU$118 million, with the commission handing down the undertaking days before the Royal Commission heard of the bank's practices.

The commission also heard that advisers at a CBA financial planning business continued to charge fees to customers they knew were deceased.

The bank additionally admitted in May that it is unsure of where data on 19.8 million customers has gone, after it was revealed that magnetic tapes comprising information used to print account statements may not have been properly disposed of.

In addition to a new CEO, the bank in June reshuffled its structure, hiring six new executives to lead its digital and cultural transformation.

Leading the bank's enterprise services, as well as assuming the role of chief information officer from October 1, is Pascal Boillat, who will be charged with the responsibility of all technology and operations across the bank.

Boillat -- who will join CBA from Deutsche Bank, where he was global group chief information officer after also serving as Fannie Mae's head of operations and technology -- will replace David Whiteing, who departed in March as one of the casualties of CBA's executive reshuffle.

The bank also lost its group executive of financial services and chief financial officer Rob Jesudason, after he announced he'd be joining blockchain-focused Block.one.

Block.one, headed out of the Cayman Islands, develops open-source technology solutions including the EOSIO blockchain software. It also sells the EOS token.

As CBA's group executive, financial services and chief financial officer, Jesudason was responsible for overseeing group finance, audit, treasury, security, property, and investor relations.

Blockchain and CBA: Commonwealth Bank tracing almond supply chain via blockchain | Commonwealth Bank to deliver 'world-first' issuance of a bond on the blockchain | CommBank looks to commercialise blockchain solution down under

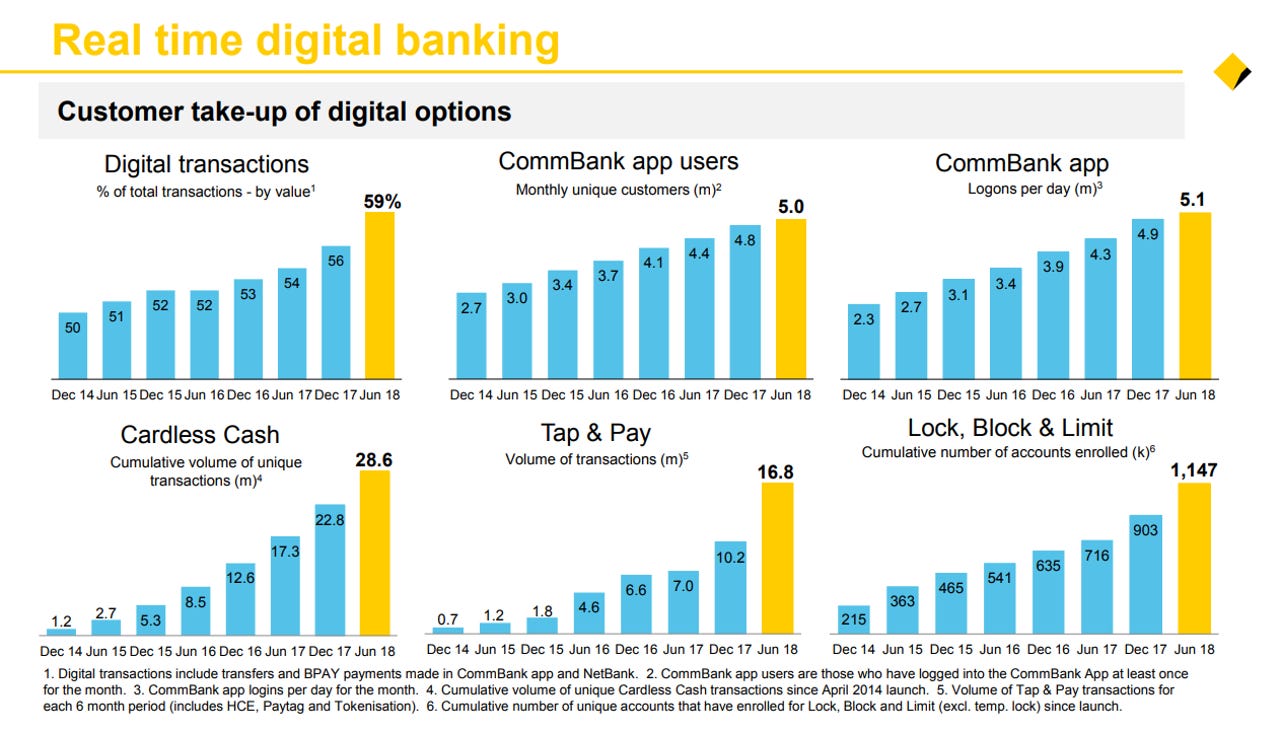

The bank also said on Wednesday that it boasts 27 billion data points, refreshed daily; 21 million customer interactions; 6.5 million active digital customers; and 5.1 million mobile logins.

Bankwest

For the 12-month period, wholly owned subsidiary Bankwest posted AU$681 million in after-tax profit, an 18 percent year-on-year increase.

The Western Australia-based bank this financial year launched a new way to pay, a ring dubbed Halo that allows customers to "tap and go" at locations where they would otherwise use their card.

According to Bankwest, the speed in which it brought Halo to market is the result of Bankwest's adoption of new ways of working, which was described as a "customer-obsessed, agile approach", as traditional waterfall methodology would have delayed the delivery of such products.

PREVIOUS AND RELATED COVERAGE

CBA preparing for 'digital gorillas' to join fintechs as competitors

The Commonwealth Bank of Australia knows it is not immune to the threat of disruption, so it is redefining how it structures its organisation and how it consumes technology to keep the Amazons and Googles, as well as fintechs, at bay.

Commonwealth Bank looks to three-hour code release nirvana

The bank's CIO wants to split his teams into smaller teams, give his staff more decision-making opportunities, and push releases out every three hours.

Commonwealth Bank wants to take banking back to the 1970s

Using technology, the banking heavyweight wants to get to know its customers better by restoring the relationship people had with banks over 40 years ago.