Comcast's quarter shows the ebb and flow in telecom vs. cable war

Comcast's first quarter results reveal a few interesting cross currents. The cable giant added fewer digital video subscribers than expected. Added more Internet subscribers. And appears to be poaching voice customers from the likes of AT&T and Verizon.

What a mixed bag (statement). Verizon and AT&T are trying to swipe TV customers from cable, which is happy to offer voice services as an add-on. The Internet subscriber battle is fluid. In the end, it's not clear who emerges as the winner. One thing is clear though: AT&T and Verizon seem to have more levers--wireless, broadband and enterprise revenue streams--to weather a downturn.

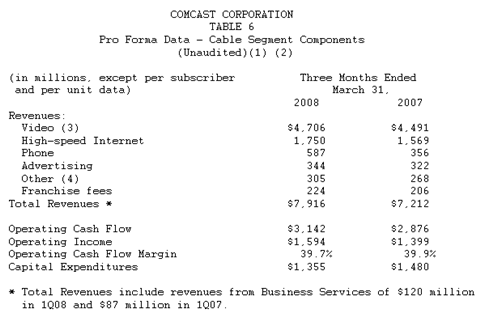

Comcast's results tell the tale. The cable company met expectations with earnings of $732 million, or 24 cents a share, on revenue of $8.4 billion. Adjusted earnings were 19 cents a share.

But where things get interesting is Comcast's subscriber tally in the first quarter. Here's the breakdown:

- Basic video subscribers declined 57,000, or 0.2 percent. Deutsche Bank expected a loss of 100,000 subscribers. This isn't necessarily good news because it may show that consumers are reluctant to add higher priced digital video services.

- Comcast added 494,000 digital cable subscribers, compared to Deutsche Bank estimates of 502,000. Comcast has 16 million digital video subscribers in total.

- Comcast added 492,000 high-speed Internet subscribers in the first quarter and ended with a penetration of 28 percent, or 14.1 million customers. That tally was well ahead of Deutsche Bank estimates of 350,000 and handily topped every other Wall Street estimate I found.

- The cable giant added 639,000 digital voice customers to hit the 5.1 million subscriber mark. That total was also well ahead of estimates. Deutsche Bank projected 590,000 voice customer additions.

So what do these metrics tell us? Consumers are shifting their budgets around to save money. In this environment, you can play Verizon, AT&T and Comcast off each other to save some dough. Comcast is poaching voice customers. Verizon is poaching TV customers. Internet services can also be swapped. In any case, the marketing is intense. I get pitched at least once a month to come back to Comcast from Verizon.

Comcast reiterated its outlook for 2008 and noted that it will deliver revenue and operating cash flow growth of 8 percent to 10 percent.