Dell: IT demand has stabilized, but margins pinched

In advance of its analyst powwow on Tuesday, Dell said that demand for its technology gear has stabilized and the company is expecting revenue to be up a bit sequentially in its fiscal second quarter. However, Dell's gross margins will fall short of Wall Street expectations.

Dell made the comments ahead of its analyst meeting, which will be closely watched for business model progress and potential acquisition comments. Wall Street was already expecting a slight sequential increase in the fiscal second quarter. According to Thomson Reuters, analysts were expecting second quarter revenue of $12.5 billion, up from $12.3 billion.

Also see: Dell's analyst meeting: Looking for the big vision

Among other items in Dell's statement:

- The company (DELL) expects a decline in second quarter gross margins due to higher component costs, a tough pricing environment, a mix shift to low-margin products like netbooks and weak enterprise demand. Wall Street was expecting a slight sequential improvement in gross margins for the second quarter to 17.92 percent, up from 17.57 percent in the first quarter.

- The focus is on "optimizing liquidity, profitability and growth in the midst of a still-challenging operating environment."

- The company says it is on course to cut costs by $4 billion by the end of fiscal 2011.

- Sales growth in the long run will be 5 to 7 percent.

All of those aforementioned moving parts depend on IT spending. CFO Brian Gladden said:

“We continue to believe that customers are deferring IT purchases, and that we will see demand return to more typical levels at some point. In the meantime, we continue focusing our energy and resources on the operating initiatives that will improve the company."

Add it up and Dell's outlook for the second quarter indicates more of the same. IT spending surveys have presented a mixed bag for Dell demand. Analysts across the board say the Dell needs to diversify away from PCs and servers, a sector where it is exposed to pricing pressure. Simply put, these analysts argue that Dell needs to look more like HP and IBM with software and services units to improve profit margins. For now, gross margins are lumpy.

Dell's gross margin story goes like this:

- 18.44 percent in the first quarter ending May 1, 2008 (fiscal year 2009).

- 17.2 percent in the second quarter.

- 18.82 percent in the third quarter.

- 17.22 percent in the fourth quarter of fiscal 2009.

- 17.57 percent in the first quarter ending May 1.

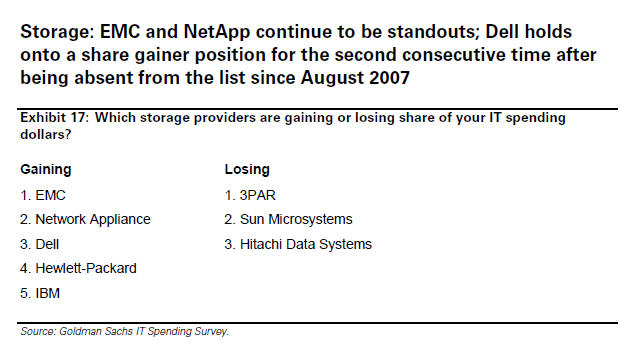

The current wallet share snapshot for Dell is also mixed. Here are a few findings from Goldman Sachs IT spending survey released last week: