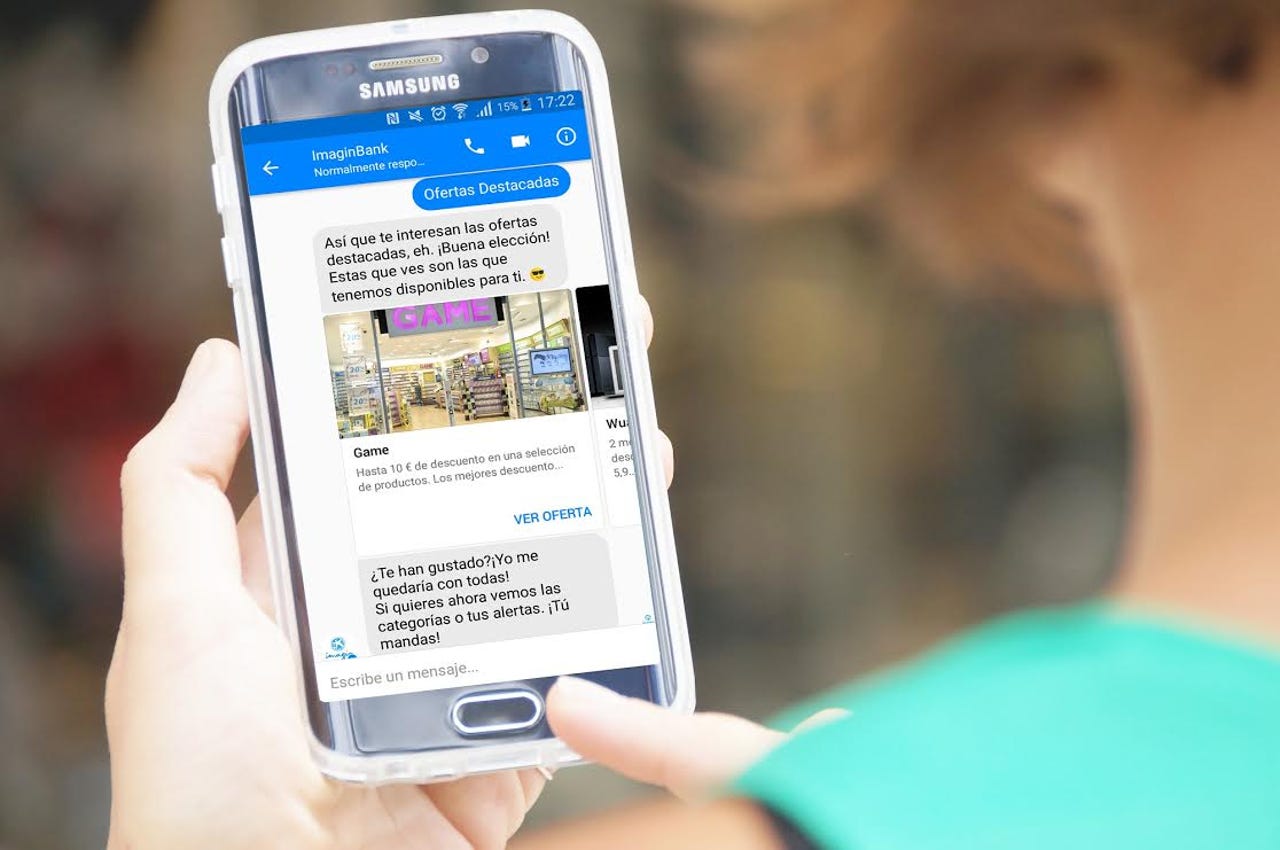

Facebook Messenger chatbots: Mobile-only bank's new app talks discounts and deals

The imaginBank bot helps customers with information and assistance about a discounts program for shopping and leisure activities.

Businesses seem to see chatbots as the next big thing, despite reservations among their customers and some setbacks with the technology.

These apps are designed to improve communication between companies and the public with software that taps into artificial intelligence and natural language processing.

It's a wave of technology that has attracted interest from the Spanish financial sector. ImaginBank recently launched a Facebook Messenger-based banking chatbot, which it describes as the first in Spain. According to American Banker, Spanish bank BBVA is also experimenting with the technology.

ImaginBank is Spanish CaixaBank's mobile-only bank, created in January 2016 and serving about 90,000 customers. According to director David Urbano, the company's target market of millennials registers particularly high levels of smartphone use.

"They utilize smartphones to look for information, talk to friends, and to manage their personal finances. So we thought a chatbot would be the best solution to respond to their questions in a quick and cool manner," he tells ZDNet.

"Twenty percent of Spaniards use the Facebook messaging platform," he adds. In fact, the social network has become a "full service platform" for the mobile-only bank, as it gathers more than 65,000 followers who can check their account through the MyImaginBank page and regularly use other applications, he adds.

Currently, the bot provides information and assistance to help customers benefit from a discounts program for shopping and leisure activities across Spain. Customers can directly ask the chatbot what offers are available in each category or at a specific location, via written messages or voice, in Spanish and Catalan.

Then the robot answers with a selection of offers filtered in accordance with their requests, or it can suggest continuing the conversation to look for similar possibilities that might be more suitable.

The chatbot can also be customized to send daily or weekly notifications to the customer's mobile device.

In addition, it complements the existing imaginBank Twitter bot, which helps clients locate CaixaBank branches and ATMs but cannot hold full conversations.

For the bank, the potential annual savings in customer service cost should be significant. Urbano says further developments are possible, with the bot "implemented in different areas and services, including operations and transactions".

However, it will need to overcome barriers facing chatbots, such as security issues related to encryption, data handling, and storage. For now, the bot technology seems a good solution for very specific tasks, he says.

"Possibly, many people will find it much more convenient to start a conversation with a bot than surf a company's website to find what they need," he says.

Read more about chatbots