FCC report: Wireless competition needs a nuanced view

The Federal Communications Commission released its annual wireless competition report on Thursday and there may be a ruckus over what was omitted.

For the first time since 2003, the FCC declined to conclude that the wireless marketplace was "effectively competitive."

The report has a lot of the basics of the industry---the state of the industry, upgrades to new technologies like LTE and consumers who are relying solely on wireless phones. However, that omission about competition instantly got Verizon Wireless rolling.

In a statement, Verizon said:

The U.S. has the most intensely competitive wireless market on the planet, and it's becoming more competitive by the day. New devices and new apps hit the market constantly. Prices keep falling and usage keeps rising. Competition is bringing enormous benefits to consumers, as reflected in the American Customer Satisfaction Index's new report showing wireless customer satisfaction is at an all-time high. The facts and the record establish conclusively that the wireless marketplace is 'effectively competitive,' as the FCC has found in the previous six wireless competition reports.

Two FCC commissioners did question the omission. However, the FCC report indicates that figuring out whether the industry is competitive can be a big complicated.

From the report:

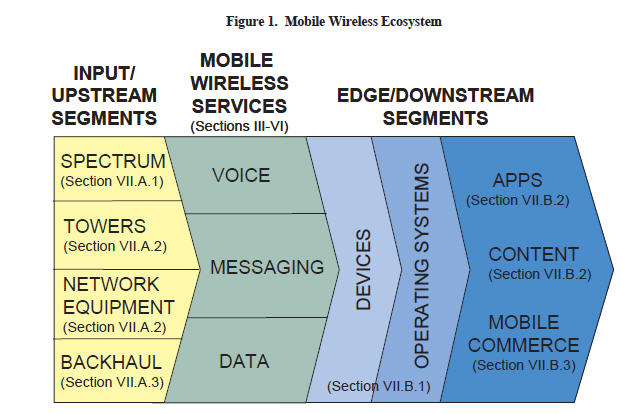

For the first time, the Fourteenth Report analyzes competition throughout the entire mobile wireless ecosystem, expanding its analysis to include key mobile wireless service inputs – such as spectrum and backhaul facilities – as well as downstream products, such as handsets/devices and mobile applications.

In other words, the FCC is arguing that competition depends on local dynamics and where you sit in the food chain of the wireless industry. Here's the ecosystem the FCC outlines.

The FCC continues:

In this Mobile Wireless Competition Report to Congress (Fourteenth Report or Report), we incorporate several important new forms of analysis that reflect fundamental shifts in the mobile marketplace. For example, whereas previous reports analyzed Commercial Mobile Radio Service (CMRS) competition and discussed a variety of metrics – including number of providers, subscribers, usage, and prices – this Report integrates an analysis of CMRS into an analysis of all mobile wireless services, such as voice, messaging, and broadband. This Report also goes beyond previous reports in reflecting the transformative importance of mobile wireless broadband, which has resulted in a shift from devices that can place traditional phone calls to pocketable devices that can access the entire Internet. Because each of the interrelated segments of the mobile wireless ecosystem has the potential to affect competition, this Report analyzes competition across the entire mobile wireless ecosystem, including, for the first time, in-depth analyses of “upstream” and “downstream” market segments, such as infrastructure and devices.

As described in this Mobile Wireless Competition Report, the mobile wireless ecosystem is sufficiently complex that any review or analysis of competitive market conditions must take into consideration a multitude of factors. As a result, rather than reaching an overarching, industry-wide determination with respect to whether there is “effective competition,” the Report complies with the statutory requirement by providing a detailed analysis of the state of competition that seeks to identify areas where market conditions appear to be producing substantial consumer benefits and provides data that can form the basis for inquiries into whether policy levers could produce superior outcomes.

The big message here is that the FCC isn't going to make blanket statements about competition. The FCC report may also set the stage for more nuanced actions. For example, the FCC could look at the App market specifically or spectrum allocations going forward.

Related: Prepaid models about to alter wireless carrier dynamics