Google earnings: "Excellent" quarter; momentum of display, mobile highlighted

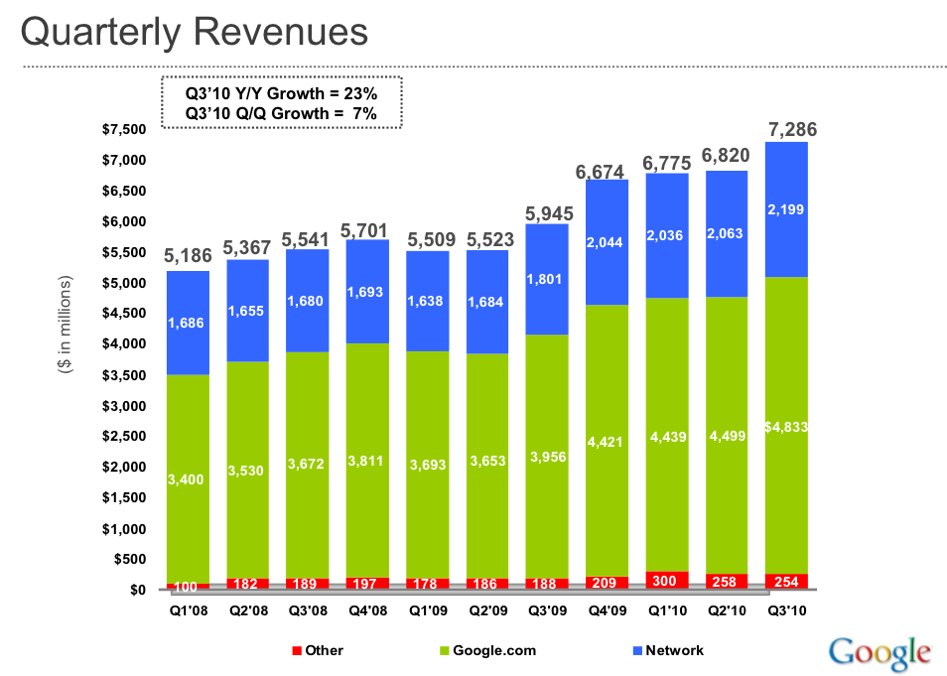

Google beat Wall Street's estimates for its third quarter, reporting a net income of $2.46 billion, or $7.64 per share, up from $5.89 from the year-ago quarter. Revenue, excluding traffic acquisition costs, was $5.48 billion, up from $4.38 billion a year ago. (Statement, Preview)

Wall Street had expected earnings of $6.69 a share on revenue of $5.27 billion.

In a statement, Google CEO Eric Schmidt said the company had an "excellent" quarter. He said:

Our core business grew very well, and our newer businesses -- particularly display and mobile -- continued to show significant momentum. Going forward, we remain committed to aggressive investment in both our people and our products as we pursue an innovation agenda.

On a call with analysts today, the company was practically giddy about the growth that it's seeing in every category of the company, a result of the growth in a so-called "digital economy."

Aside from the hard financial numbers, the company shared some key figures for three parts of the business - display advertising, YouTube and mobile.

Jonathan Rosenberg, Senior Vice President of Product Management, said display is seeing an annual run rate of over $2.5 billion - that's non-text display and YouTube ads, as well as those on the double-click platform - and referred to it as the next "multi-million business" after search. "We are clicking on all cylinders in display."

YouTube, he said is monetizing more than 2 billion views per week, an increase of more than 50 percent on a year-over-year comparison.

Finally, mobile is on an annualized run rate of $1 billion, with a growing number of people accessing Google's products and services via mobile, he said. In addition, those uses of things like search and maps and mail are happening on Android phones.

And, he said, all of these business categories are growing. "We are on this growth agenda at full throttle," Rosenberg said.

Rosenberg noted that there's momentum in both the core and emerging businesses. Search, he said, "is more important than ever," highlighting the launch of Google Instant during the quarter. He did note that speculation that Instant was a way to make money was off-base, noting that Instant isn't really big-impact contributor to Google's bottom line. Instead, it's all about trying to improve the search experience. "Doing search well is even harder than ever... Search remains one of the most challenging computer science" problems, he said.

Finally, the company went to great lengths to talk about the employees. Worldwide headcount was up by about 1,500 people, now at 23,331, up from 21,805 at the end of the last quarter. Most of those jobs have been in engineering and sales - and the company said that the "explosive growth in the digital economy has created a war for talent in our industry," noting that the trend is somewhat "out-of-sync" with what's happening in other segments of the economy.

He said the company is exploring how to "attract and retain" the best talent. "The differences between the winners and the losers will be determined by who we can attract and who we can retain."

Shares of Google were down slightly in regular trading, closing at $540.93. Shares were on the rise in after-hours trading.