How Google falls: Unprofitable in 2009

I've been a Google skeptic for a long time. Each"blow-out" quarter reported only increases my scepticism, because every time revenue increases, so do costs. Except for a single critical year, 2005, when the company's momentum drove advertisers to it in droves, costs have increased faster than revenues. In 2006, costs and revenue grew at almost the same rate, based on a 72.76 percent increase in revenue and a 71 percent increase in costs.

So, let's look at how, facing risingDespite having raised revenue to $39.1 billion in 2009, Google could produce a loss of $2.3 billion that year. costs for access to content, particularly video content on its YouTube service, Google could fall from a $3.9 billion profit in 2007 to a $2.3 billion loss in 2009.

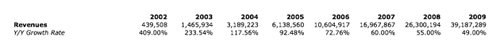

First, to the top-line figures for the past five years and the next three. Google's revenue growth has followed a familiar trajectory for fast-growing companies as the law of large numbers reduces the potential growth rate each year. Here's the line score for that period:

Everything looks great. Revenue jumps 60 percent this year to $16.9 billion and reaches $39.1 billion by 2009. For a company that didn't exist a decade before, this is incredible growth and something really extraordinary in the history of business, along the lines of the achievements of Wal-Mart and Microsoft.

In that time, Google has become more dependent on advertising and, as we know, has begun spending heavily to acquire sites that will drive traffic it can monetize itself rather than paying out AdWords fees to third-party sites. Likewise, it has branched into offline endeavors, such as magazine and radio advertising. In these two areas lie the makings for Google's return to Earth. Since 2002, Google's share of revenue from advertising has increased from 93.49 percent to 98.94 percent. For purposes of this analysis, I assume advertising will never exceed 99 percent of revenue at Google, but it could:

Two factors will contribute to an increased cost of content and/or traffic at Google. First, with competition from Yahoo's Panama and other upstarts, Google's going to be forced to share more with third-party sites in order to retain access to inventory. I know this sounds counter-intuitive because the AdSense system is built on an auction model, but what will change is the share of revenue retained by Google, as the market maker.

The company will have to be the best place to earn revenue for content creators, so it will have to give more to them compared to competitors. Even if this is a short-term challenge as Google fights off intruders on its territory—which I think it will be—the cost of traffic acquisition will probably rise from 31 percent of revenue in 2006 to approximately 36 percent of revenue this year and next, after which it may begin to fall, again.

Google's other cost, the content it uses on its own sites, is set to skyrocket because those sites increasingly rely on talent that has not been compensated in the past—hence YouTube's plan to share revenue with video creators—and content owned by major media companies. If we take the example of the Google's reported take from the pirate movie sites EasyDownloadCenter.com and TheDownloadPlace.com, which generated $1.1 million in ad revenue from pirated movies and paid Google $809,000 of that amount for serving the ads, it's easy to see how high Google's content costs could go. The studios will want half that money, and the starting point of the negotiation will be much higher.

I project that Google's cost of revenue for its own sites will increase from nine percent in 2006, when it had already started creeping up, to as much as 19 percent of revenue in 2009:

So far, we've accounted for costs totalling about half the revenue anticipated in the next three years. As of 2006, the costs of research and development, sales and marketing, and general and administrative operations consumed 27 percent of Google's revenues. But the company has been nearly doubling headcount every year. Moreover, as it branches into more sales channels, such as radio, newspapers and television, as well as begins the ongoing process of acquiring rights to programming, it faces substantially higher sales and G&A costs, because world-class sales and legal talent doesn't come cheap.

Which leaves R&D. Google has done an enormous amount of original research and development, but it has also shown an increasing willingness to buy technology and audience share, as it did with dMarc Broadcasting, a radio ad insertion provider for which it paid $1.13 billion in 2006, and the $1.6 billion YouTube deal. Managing the reporting and distribution of royalties across multiple media will take many billions more in development efforts.

All together, these increased back office and development expenses are likely to increase Google's total costs and expenses, including traffic acquisition costs, from $7.05 billion, or 66.5 percent, in 2006 to $41.5 billion in 2009. But the percentage increase annually will still be relatively close to the historical median (83 percent) and should not exceed an 85 percent growth rate at any time in the next three years:

Yet, despite having raised revenue to $39.1 billion in 2009, at that level of expenses, Google would produce a loss of $2.3 billion that year.

For a look at a larger image of the complete spreadsheet discussed in this posting, please visit the image gallery.