How the latest twist in the Oracle v SAP lawsuit is a win for Oracle

So SAP wasn't so sappy after all? It seems that SAP has successfully managed to get a number of the more outlandish claims made by Oracle tossed out of the case it made against the company in regard to the TomorrowNow debacle. From IDG News Service:

In an Aug. 5 joint pretrial statement, Oracle said it was entitled to billions of dollars in damages for copyright infringement, unjust enrichment and other alleged infractions. But SAP has said the true amount of damages is "tens of millions, at most."

The 25-page ruling by U.S. District Court Judge Phyllis Hamilton "serves to narrow the scope of damages and help focus this case," SAP said in a statement Wednesday.

"SAP is committed to compensating Oracle for the harm the limited operations of TomorrowNow actually caused," SAP added. "That compensation must be reasonable and it must be tethered to reality and the law."

Interesting. When I commented on the pre-trial statements I suggested that it is:

...a demonstration that SAP is continuing with the post-Apotheker clean up. It’s another problem that every now and again becomes a headline. By taking this action, SAP is attempting to deflate the litigious balloon and get on with the job of making sales without requiring executive distraction.

Sources very close to events (as they say) reckon I am bang on the money. That's nice to know but the real proof will be in the eating of humble pie by SAP as evidenced in whatever check it ends up writing to Oracle. I'd love to be a fly on the wall when Larry Ellison, CEO of Oracle gets that in his hands.

I am much more interested in Oracle's position.

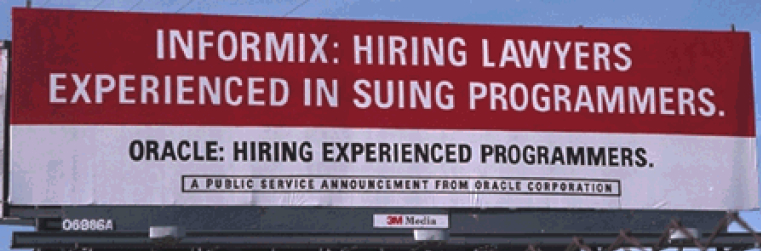

The other day a kind reader sent me to a presentation made by Paul Senatori way back in June 2001 that talks about competitive intelligence, the ways in which Oracle could build a CI machine, spread FUD and come up with all sorts of schemes to outwit the competition as part of the general sales process. It looks authentic and having done a bit of digging I have no reason to assume it isn't.

It provides excellent insights into the way Oracle executives take their cue from Larry Ellison and his oft noted love of warfare metaphors. In the legal arena we're seeing one such manifestation of that modus operandi. The good news for competitors is that it has made Oracle highly predictable. The bad news is competitors aren't Oracle and often have no credible way to respond.

In reviewing the detailed judgment handed down yesterday, I saw elements of what is emerging as a predictable pattern. It goes something like this:

- Amass a ton of information about your target competitor taking cues from Senatori's methodology plus a few other tricks

- Wait for them to do something silly (in the TomorrowNow case, get into dodgy downloads, in the Google case, look for patent infringements)

- Whack them with a massive lawsuit that includes throwing everything but the kitchen sink at it

- Sit back, prevaricate, make your victim squirm through protracted and diversionary legal manoeuvring

- Start the settlement process

- Pocket the eventual check

All of which is not the point. Think about it for a moment. It must cost Oracle millions and millions of dollars to mount these legal challenges. In the TomorrowNow case, SAP contends the final settlement should run in the 'tens of millions.' The worst case scenario might be $100 million. That's chump change in both SAP and Oracle terms. It's almost a rounding error given their size. So Oracle makes a small profit out of its harrying SAP through the courts. That's not the point either.

Oracle's real game plan is disruption. Divert management attention away from the critical problem of competitive sales by bringing attention to the competitor as a bad guy who did something heinous. Do you think that doesn't get used in a sales situation? Check out Senatori's presentation and look how Oracle has a history of positioning itself as superior tied to financial incentives. Better still - remember this:

It is a tactic that Oracle still deploys.

It's really saying this to prospects: 'We are so good and can show it that if you don't get what we think you'll agree is super value then we'll pay you (name whatever figure Larry is throwing on the table at the time.) Oh and by the way, look what a rotten egg Mr (insert name of competitor here) is. Look how badly he behaves. Doesn't that suck?' If I am a less than well informed buyer I might easily fold to that argument.

Oracle makes sure you know how good they are by ensuring that its positioning is compelling and backed up by a compliant analyst community prepared to take their money in return for reverential silence or a positive spin. Analyst statements in turn are quoted by a press that (largely) doesn't have time or experience to get into what's really happening. Voila! Next deal please.

The beauty of this strategy is that while these cases rumble on, Oracle doesn't have to say much in the public domain. I cannot recall any financial analyst asking about these issues on quarterly earnings calls. Back to the IDG piece.

SAP makes a short statement, Oracle says nothing. Google is now jumping up and down, Oracle is saying nothing. I want to get to Oracle on the Google thing and am refused. Oracle doesn't think they can have an objective discussion with me because I am rude to them. What they really mean is I won't suck it up without putting some questions they likely can't answer. The fact I'd willingly report their side of the story doesn't factor in. From its perspective, objective means agreeing with Oracle. See how that works?

In recent times, Oracle has put a neat twist on this that means media stands almost no chance of getting past the PR gatekeepers. In any statements, Oracle is using its PR as the spokespeople. That makes it difficult to know who to ask for a conversation.

In all of this, competitors don't know how to react. They don't work hard enough at competitive intelligence to figure out Oracle's game and even when they do, they tend to bitch and moan because they think it is a bad way to do business. One lesson should be obvious: Oracle plays hardball. If you don't play hardball back they'll mess with your business. I'm not making any judgment on that, merely stating what's going on.

Tom Wailgum takes the view that SAP has raised a white flag to Oracle and surrendered the case. If you're sitting in Oracle's shoes that's exactly what you were hoping for. You're effectively helping people like Tom confirm what you want him to communicate: a weak SAP compared to a more muscular Oracle. It might seem distasteful but in the buyer's eyes, it sows seeds of doubt about SAP's competitive ability. It has nothing to do with product and everything to do with positioning.

It means that in some scenarios Oracle doesn't even need to have a decent offering. It just has to look more viable. Given the IT industry's general obsession with technological superiority it means that competitors are forced to take their eye off the ball or look in the wrong direction.

Tom goes to David Rowe, global SVP marketing and alliances at RiminiStreet and gets him to back that up by saying:

"The SAP case is unrelated to the Rimini Street case and will have no bearing on Rimini Street's litigation against Oracle. SAP has strategically chosen to focus on its primary business challenges and has—since the beginning of the litigation with Oracle—elected not to invest the time and effort to fight and win the TomorrowNow case."

He goes on to get the plug in that (by implied contrast) RiminiStreet wont be bullied by Oracle. Of course not. It's their business that's at stake.

You can argue at this point that Tom is providing RiminiStreet with the option to swipe back and hey - guess what? Tom didn't get a response from Oracle either.

When you see Oracle playing the legal card, don't be fooled. In an earlier piece I argued that Oracle is now suing its way to world domination. What I didn't say is that in launching these cases, Oracle, among other things, is learning what goes on inside its competitors walls through the legal discovery process while at the same time assiduously disrupting the competitors' business. The same goes the other way but given Oracle's massive CI effort, it doesn't matter.

Think I'm wrong? Yesterday I had a good conversation with Model Metrics. They have an important announcement in the mobile space next week. One of the platforms they're centering upon is Android. While they don't know what the implications of the Google case will be for them, they do believe there is significant demand for Android devices in the vertical markets they serve.

There was an awkward few moments silence when I asked about the problems the Oracle v Google case might bring them. They don't know. Viewed from Oracle's perspective, that's a useful tidbit. Oracle is not only disrupting Google, but any developer organization that wants to hang its hat onto the Android platform. Now Oracle can go sow more FUD around cloud computing and the mobile space while strategizing how they'll get their place at the mobile table.

Tom Wailgum playfully thought that Larry's next move might be 'v The World.' Viewed through my lens that might not be far off the mark. He also thinks the SAP case is a soap opera. I can only imagine Larry Ellison giggling at that idea. It is far from a soap opera. It's much more like a gothic slasher movie where you know everyone gets killed. It doesn't have to be that way and when you look at what Oracle actually achieves, I sometimes wonder whether it was worth all the effort. Here's a few steps you can take:

- Next time you are at an industry event, see if you can spot the Oracle competitive intelligence agent. They've plenty in the field.

- Ask yourself why so few other vendors do the same thing.

- In negotiations be prepared to understand that Oracle gathers huge amounts of information about your business and that of industry competitors. It's informatinoal advantage is a weapon it can and will deploy.

- Understand that Oracle has many years experience honing the way it presents in a persuasive manner.

- Dig deeper into the headline deals and promotions. They don't always stack up.

- Make sure you understand the assumptions and context made by supporting analysts.

- Understand that every move Oracle makes on the sales chessboard has purpose and meaning. That may not always be in your best interests.

Images courtesy of the Paul Senatori presentation