How Twilio's $3.2 billion Segment acquisition transforms the company

Twilio's $3.2 billion purchase of Segment is a shot across the broader customer relationship and engagement software industry.

The acquisition, announced officially on Monday, gives Twilio a customer data platform (CDP) to combine with its broader communications platform as a service and customer engagement tools. As a result, Twilio can now be connected to every touch point customers have with their end users.

Twilio's plan is to turn the customer engagement data into actionable insights with intelligence about touch points and communications.

What's more interesting is that Twilio with Segment will be able to combine customer data and interactions for intelligence on everything from marketing, data warehousing, communications and analytics tools. Twilio will ultimately do battle with Salesforce and Adobe to be the connective tissue between customer data and the enterprise technology stack.

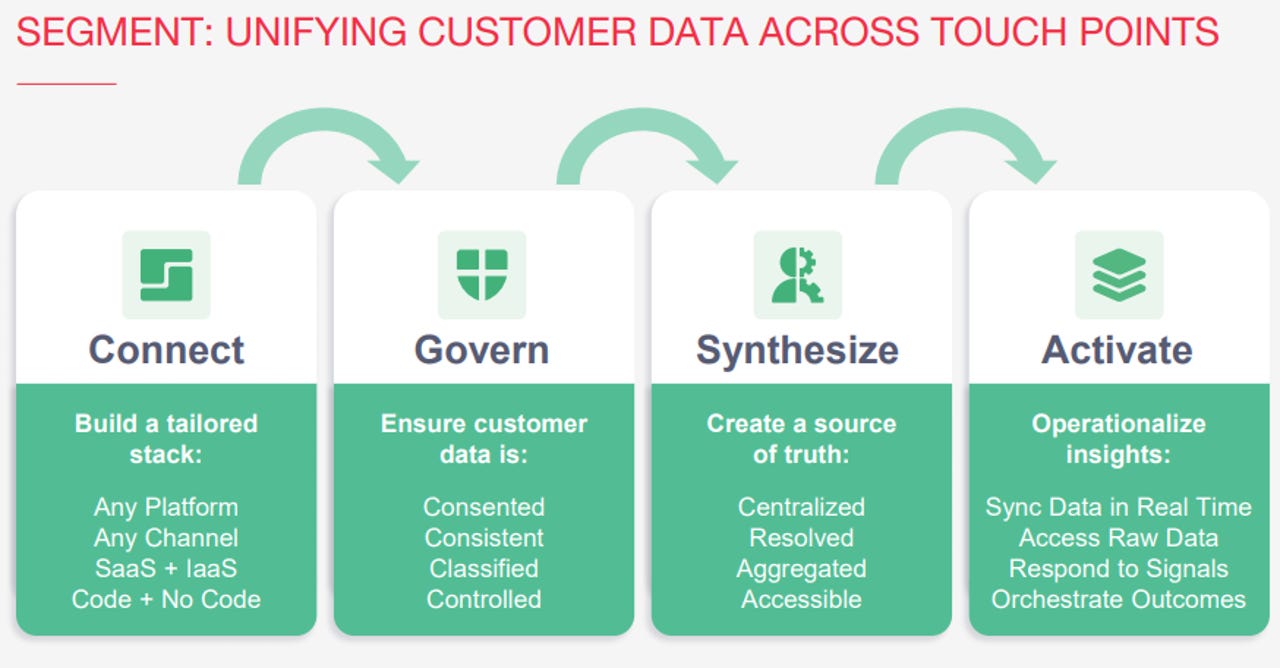

Here's what Segment aims to do:

Twilio CEO Jeff Lawson said the company with Segment can "create more personalized, timely and impactful engagement across customer service, marketing, analytics, product and sales."

On a conference call with analysts, Lawson outlined the big picture behind the Segment deal:

We started Twilio about 13 years ago to make communications accessible to developers as building blocks because we saw how important communications was to help businesses create great experiences for their customers. But communications itself is not the goal. The end goal is great customer engagement. Customer engagement is all the touch points that companies, particularly B2C companies have with their customers. It's the stuff that makes customers love companies. When their communications are targeted, relevant and personalized to you, we, as consumers, we love it.

Lawson added that data about customers is usually spread across many different systems.

Segment CEO Peter Reinhart said the company's CDP platform is channel agnostic and aims to ensure that customer data meets the "4Cs: complete, correct, consented and compliant."

Cowen & Co. analyst J. Derrick Wood said in a research note:

By giving Twilio control of this data & data ingestion layer, this should up-level Twilio's ability to build a customer profile and provide it with a more robust Customer Engagement Platform--one that is more customer-data rich and one that can leverage this intelligence throughout Twilio's multi-channel communications engagements. Acquiring Segment would also give Twilio: new routes-to-market with IT, Data Engineer, MarTech & Product Manager buyers; a new data consumption-based revenue stream; and the components to build out a more comprehensive Marketing Automation or Customer 360 solution alongside synergies with SendGrid.

JMP Securities analyst Patrick Walravens said that Segment is one of the leaders in the customer data platform market, which is splintered, but includes companies like Exponea, CleverTap, Tealium and Amperity. Walravens said that like Twilio, "Segment also targets developers and has an API-driven platform."

Indeed, Twilio on a conference call highlighted Segment's 9% market share in the fragmented CDP market, according to IDC.

Here's a look at Twilio's stack and how Segment fits in:

Nevertheless, Twilio will see competition from a few giants such as Salesforce, Microsoft and Adobe. With a focus on communications channels, Twilio is hoping to have a new spin on the market. For instance, this slide from the acquisition presentation makes it clear that Twilio and Segment are going to bump into a few big guns in marketing, customer service and sales.

Lawson was asked multiple times about competition with Salesforce and Adobe. He said that Twilio and Segment are different since they operate more at the infrastructure layer instead of applications. Lawson also said that Twilio and Segment are more creating a new market than battling giants.

With regard to any other particular competitor, like, obviously, I can't speak to what their strategic priorities are or what they might do. But what I can say is that, our playbook is pretty well-known. We (give) power developers the best infrastructure (and) break down what historically had been monolithic systems into more flexible, agile building blocks and so that they can get started very easily. And then as they expand, allow us to share in the success when our customers succeed in using our products. And I think that's how we will continue to execute for the foreseeable future. And I think Segment has a similar pricing and building a philosophy that we do.