HP keeps up strong PC sales amid slumping worldwide shipments

Worldwide PC shipments continued their downward trend for the second quarter of 2017, according to the latest data from Gartner and IDC. While the overall market remains in a slump, HP managed to improve its year-over-year sales and keep its position as the top PC vendor for the second quarter in a row.

Worldwide PC shipments totaled 61.1 million units for Q2 2017, according to Gartner, representing a 4.3 percent decline from Q2 2016. That makes Q2 the 11th straight quarter of declining shipments.

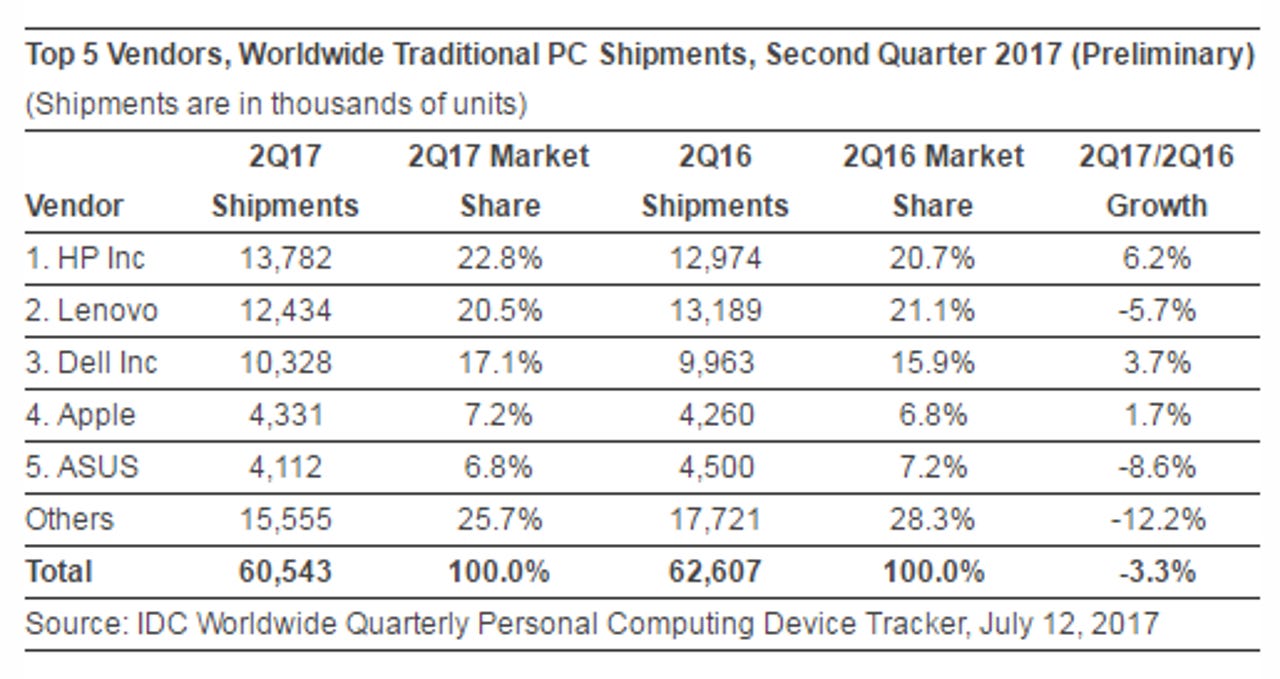

IDC had similar tallies, reporting that worldwide shipments of traditional PCs totaled 60.5 million units, for a 3.3 percent year-over-year decline.

While the overall market shrunk, HP managed to post 6.2 percent year-over-year growth for Q2, according to IDC, giving it nearly 23 percent market share for the quarter. Gartner reports that HP posted 3.3 percent growth compared with a year prior, giving it five consecutive quarters of year-over-year growth and nearly 21 percent market share.

Lenovo remains the No. 2 worldwide vendor, but IDC reoprts its shipments shrank 5.7 percent globally, in part because of signiifcant slowing in North America. Gartner said Lenovo shipments shrank 8.4 percent with declines in all key regions.

Dell took third place, growing 3.7 percent, according to IDC. Gartner showed Dell coming in third with 1.4 percent growth for Q2, its fifth consecutive quarter of year-over-year global shipment growth.

Shortages of key components such as solid state drives continued to have a negative impact the market, though IDC contends the issue was less of a problem than it has been in prior quarters. IDC research manager Jay Chou said in a statement that the market is trending toward stabilization.

"Despite recent issues wrought by component shortages and its effect on system prices, we expect the momentum of commercial market replacements will contribute to eventual market growth," he said. "Consumer demand will remain under pressure, although growth in areas like PC gaming and the increasingly attractive portfolio of sleek Windows-based systems will help push the consumer market to stabilize as well."