Intel: Stuck in smartphone, PC rut

Intel's second quarter wasn't so bad and the company cut its third quarter outlook in a move that surprised few analysts. But what's worrisome is the chip giant still doesn't have answers for a declining PC market and lack of smartphone and tablet traction.

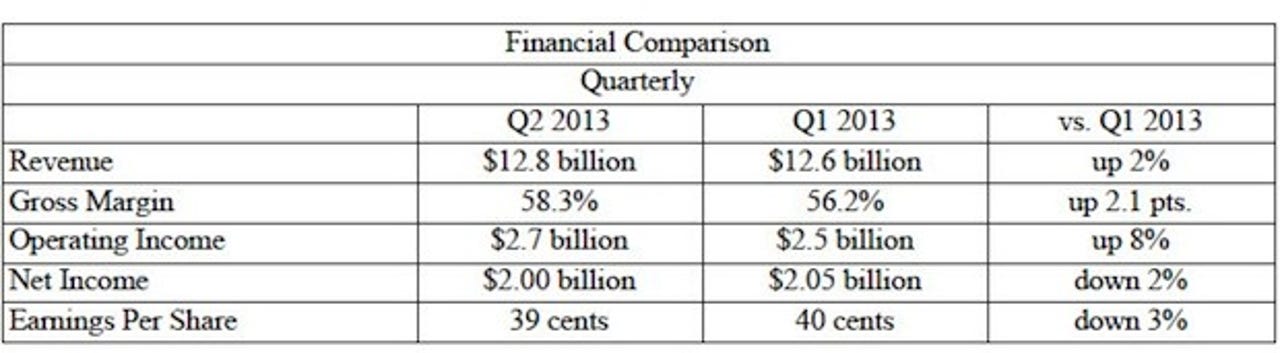

The company reported second quarter earnings of 39 cents a share on revenue of $12.8 billion. Earnings were in line, but sales were light. Intel projected third quarter revenue of $13.5 billion, which was short of expectations.

On a conference call, CEO Brian Krzanich outlined his goals and said that Intel's ability to run both x86 and Android software will help it gain share in tablets. Krzanich was confident that Intel could get mobile traction.

"You'll look back and say wow, it's obvious that the Atom line has truly become strong and they've got share in the tablet space," he said.

Also: Intel's Krzanich outlines mobile goals following first quarter as CEO | Intel reports mixed Q2: Revenue light, earnings in line

Analysts weren't so sure. Here's a sampling:

Piper Jaffray analyst August Gus Richard:

With its new, low-end Atom processor, Bay Trail, the company is gaining traction in cheap notebooks and tablets, but we believe this is at the expense of higher-end core processors. Intel is late to the smartphone market and we believe high-end smartphone sales are starting to roll over. Intel is far behind its competitors in terms of cost and integration in smartphones, in our view. We do expect Windows 8.1 to drive a corporate upgrade cycle next year, creating a bounce in PC demand.

Cowen & Co. analyst Tim Arcuri:

On the plus side, second quarter and third quarter EPS guide both in-line, but on the flipside, even a slightly lowered full-year still requires a very big fourth quarter; we remain skeptical.

Jefferies analyst Mark Lipacis worried that Intel revenue could fall going forward as it aims to grab mobile share and cannibalizes its more lucrative PC chips.

Now that $350 tablets have taken share from $650 notebooks, as Intel and Microsoft have kept their pricing flat, we think a step-function decline in the ASPs from Intel and Microsoft is what is needed to drive unit growth again. The step function ASP drop may not be made up by increased unit sales, and Intel may suffer revenue declines as it transitions to a mobile-centric supplier of MPUs.

JMP Securities analyst Alex Gauna said:

We remain near-term cautious due to: 1) slow and still unconvincing progress in establishing a meaningful smartphone or tablet presence, 2) our view that Haswell and Windows 8.1 will prove too expensive and too uninspiring to stem eroding PC trends, and 3) our belief that Intel will need to cannibalize its Core product line with lower-cost Atom alternatives and reset gross margin targets lower to stem share losses to ARM.

Add it up and Intel needs to show traction in smartphones and PCs to get folks interested again.