Intel's Q3 rides data center, IoT, corporate PC upgrades

Intel rode its data center and Internet of things units for growth as the corporate PC upgrade cycle continued apace.

The chip giant reported third quarter earnings of 66 cents a share on revenue of $14.6 billion, up 8 percent from a year ago. Gross margins came in at 65 percent, up from 64.5 percent a year ago.

Wall Street was expecting Intel to report third quarter earnings of 65 cents a share on revenue of $14.45 billion.

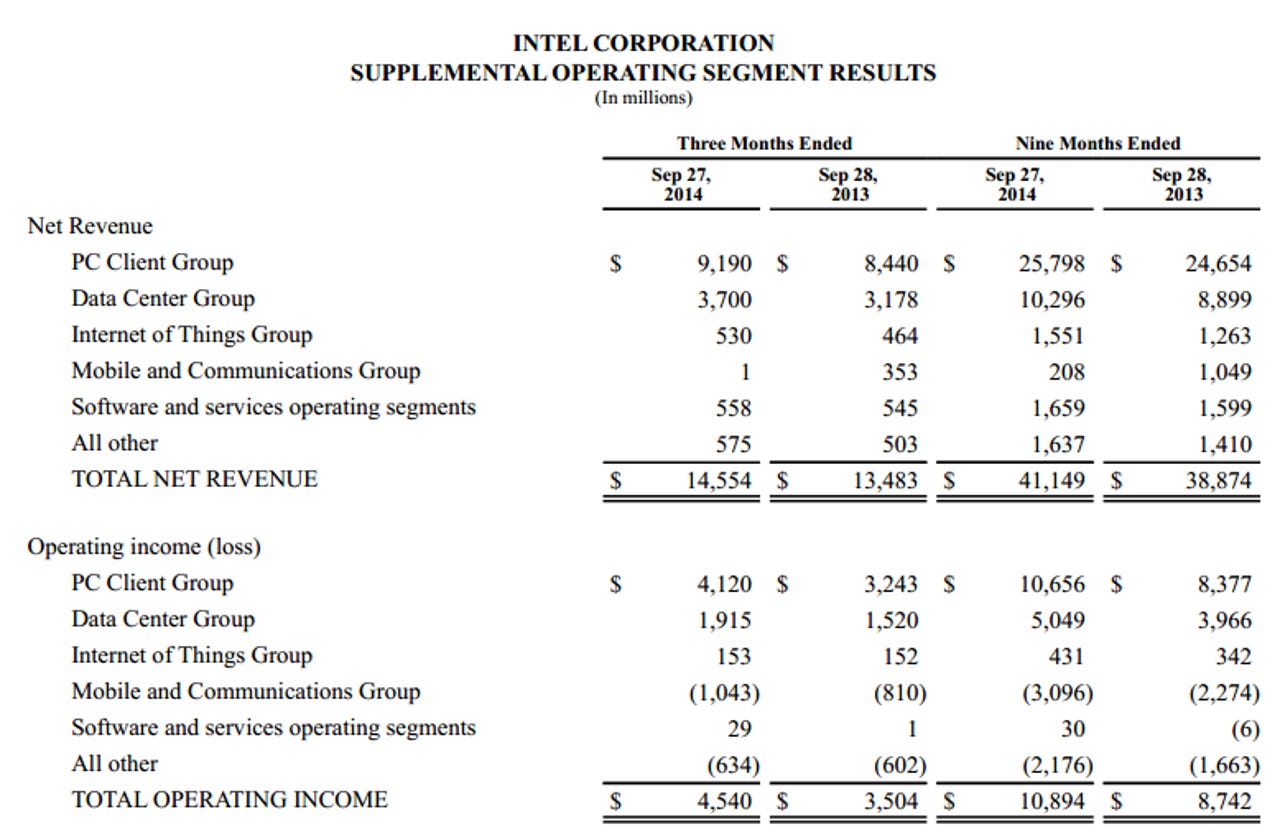

Intel's third quarter themes were consistent with the second quarter. PC client revenue was $9.2 billion, up 9 percent from a year ago. Data center revenue was $3.7 billion, up 16 percent from a year ago. And the Internet of things group delivered revenue of $530 million, up 14 percent from a year ago. Mobile revenue was negligible and software revenue was $558 million, up 2 percent from a year ago.

As for the outlook, Intel projected revenue of $14.7 billion, give or take $500 million with gross margins of about 64 percent. Wall Street was expecting fourth quarter revenue of $14.5 billion.

In prepared remarks, CFO Stacey Smith said:

Our net inventory levels rose modestly quarter over quarter as we are efficiently managing capacity while ramping Broadwell on 14nm. The worldwide PC supply chain appears to be healthy, with inventory levels appropriate in anticipation of the fourth quarter retail cycles.

Other key data points from Intel:

- For the nine months ended Sept. 27, Intel spent $8.55 billion on research and development.

- Intel ended the third quarter with $6.6 billion in cash and short-term investments.

- The company ended the quarter with 105,600 employees.

- PC processor units in the third quarter were up 8 percent from a year ago, but average selling prices were down 4 percent. Server processor volume was up 6 percent compared to a year ago and average selling prices were up 10 percent.