Intel's second quarter delivers; Cheap laptop demand up

Updated: Intel on Tuesday reported second quarter earnings of $1.6 billion, or 28 cents a share, on revenue of $9.5 billion, up 9 percent from a year ago. The results topped Wall Street expectations.

According to Thomson Financial, Intel was expected to report earnings of 25 cents a share. As for the outlook, Intel was also solid. It projected fiscal third quarter revenue between $10 billion and $10.6 billion with gross margin of 58 percent. Intel was expected to earn 34 cents a share on revenue of $10.08 billion for the September quarter.

For the full year (statement), Intel projected gross margin of 57 percent and research and development spending of $6 billion.

The reaction to Intel's quarter was minimal in afterhours trading possibly over concerns about gross margins. CEO Paul Otellini noted that "demand remains strong for our microprocessor and chipset products in all segments and all parts of the globe.”

Here are the highlights from Intel's conference call:

- Unit shipments of Atom chip expected to ramp in the second half. "Our manufacturing execution is outstanding," said Otellini. The big question from analysts was focused on how margins will increase if Atom volume picks up and mobile Internet devices, which could be confused for cheap laptops, sell well.

- Otellini noted that Atom won't replace Celeron as a brand. He also returned to Intel's theme that mobile Internet devices are a new category that won't swipe sales from laptops.

- The Dunnington six core processor on track for the next quarter.

- "We are very aware of the global economic conditions," said Otellini. "We are watching this very carefully."

- Otellini said that Intel's market share should be on the rise judging from mobile shipments.

- Otellini noted that Intel's recent deal with Dreamworks was due to the company's roadmap and software optimization efforts. AMD had been Dreamworks partner.

- Cycle times for busy seasons like back to school have gotten shorter. As a result, the delay of Celeron 2, which launched today, should not impact sales in the next quarter too much.

By the numbers:

- Gross margins for the quarter were 55.4 percent, up from 53.8 percent in the first quarter, but below the midpoint of Intel's previous guidance. Demand for lower-priced notebooks hurt average selling prices. Wall Street was hoping for margins of about 56 percent. This point is key given analysts are watching pricing pressure from AMD. It's also notable consumers want cheaper laptops instead of those loaded ones.

- Intel is sheltered from turmoil in the U.S. In the second quarter, 51 percent of its revenue came from Asia-Pacific with 18 percent coming from Europe. Toss in a 10 percent revenue contribution from Japan and that leaves a mere 21 percent of sales coming from the U.S.

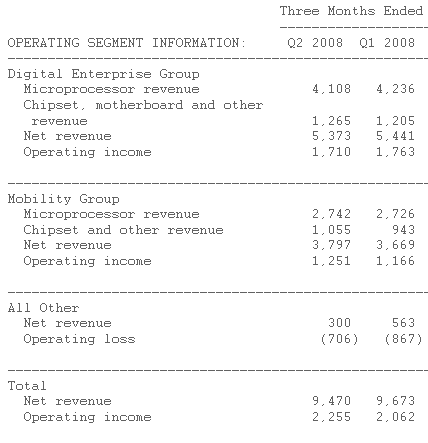

- The digital enterprise group had revenue of $5.37 billion, up from $4.84 billion a year ago. The mobility group had revenue of $3.8 billion, up from $3.3 billion a year ago. Here's the breakdown:

- R&D spending was $1.47 billion, up from $1.35 billion a year ago.

- Intel ended the quarter with cash and short-term investments of $8.39 billion.

- Inventory levels were $3.26 billion, compared to $3.27 billion in the prior quarter.

- Intel ended the quarter with 81,800 employees.