LogMeIn's IPO: The VCs made money. Will you?

LogMeIn, which offers on demand remote access software, goes public today at $16 a share and is getting a nice round of applause from the folks following the venture capital world. After all, LogMeIn raised $107.2 million or so in a stock market that stinks.

LogMeIn shares closed up 25 percent to $20.02 (MoneyWatch quote, news from around the Web).

The Wall Street Journal says hats off to Integral Capital Partners, an investor in LogMeIn and OpenTable. Others see the LogMeIn IPO as one of those fabled economic "green shoots" everyone is looking for. And while we're at it, let's cheer for the underwriters too. Congrats J.P. Morgan, Barclays Capital, Thomas Weisel, Piper Jaffray and RBC Capital. Rest assured the buy ratings will appear in a few weeks from those aforementioned firms.

The rest of us, however, really don't give a hoot about this circle of congratulations. Do you buy LogMeIn or not?

Here's my analysis of the LogMeIn prospectus:

The good:

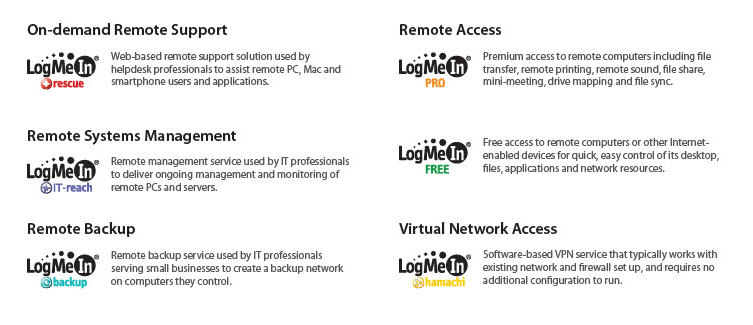

LogMeIn has 70 million connected devices and offers a bevy of services for PC rescue, remote management, backup and virtual network assess.Here's the roster:

LogMeIn has a big market to tackle: The midsized company to SMB market. And there's plenty of runway: As of March 31, LogMeIn had 188,000 paying customers, up from 122,000 a year ago. There are also 22.1 million registered users with LogMeIn.

The average selling price isn't half bad. LogMeIn says in its prospectus.

We sell our premium services on a subscription basis at prices ranging from approximately $30 to $1,900 per year. During the three months ended March 31, 2009, we completed over 120,000 transactions at an average transaction price of approximately $153 and generated revenues of $17.2 million, as compared to $9.9 million in the three months ended March 31, 2008, an increase of approximately 73%.

Intel is a partner. In 2007, LogMeIn cut a deal with Intel to built in LogMeIn connectivity to its components. Intel is also an investor.

LogMeIn just turned profitable. For the three months ending March 31, LogMeIn reported net income of $1.5 million on $17.2 million in revenue, up from $9.9 million in the same quarter a year ago. LogMeIn turned its first profit in the third quarter of 2008. For 2008, the company lost $7.75 million on revenue of $51.7 million.

The bad:

It competes with Citrix and WebEx. Citrix is the primary competition for LogMeIn and it is entrenched in the enterprise and can extend downstream relatively easily. WebEx is another potential worry since it's owned by Cisco. LogMeIn also expects to compete with "current or potential services offered by Microsoft and Apple."LogMeIn has to convert customers to premium services. The company has 188,000 paying customers out of more than 22 million registered users. LogMeIn has to continue to convert those free riders.

IT spending. LogMeIn does have an on-demand model, which in theory benefits from the recession but it plays in the SMB space, which requires a lot of evangelizing.

SMBs are flighty. This passage sums it all up.

We market and sell a significant amount of our services to SMBs. SMBs are challenging to reach, acquire and retain in a cost-effective manner. To grow our revenue quickly, we must add new customers, sell additional services to existing customers and encourage existing customers to renew their subscriptions. Selling to, and retaining SMBs is more difficult than selling to and retaining large enterprise customers because SMB customers generally:

- have high failure rates;

- are price sensitive;

- are difficult to reach with targeted sales campaigns;

- have high churn rates in part because of the scale of their businesses and the ease of switching services; and

- generate less revenues per customer and per transaction.

In addition, SMBs frequently have limited budgets and may choose to spend funds on items other than our services. Moreover, SMBs are more likely to be significantly affected by economic downturns than larger, more established companies, and if these organizations experience economic hardship, they may be unwilling or unable to expend resources on IT.

Bottom line: LogMeIn looks promising and is definitely worth a spot on the watchlist. Buying on an IPO launch, however, rarely pays off.