Majority of Facebook's Australian-derived revenue is booked overseas

Facebook has revealed that a majority of its revenue raised in Australia is booked overseas.

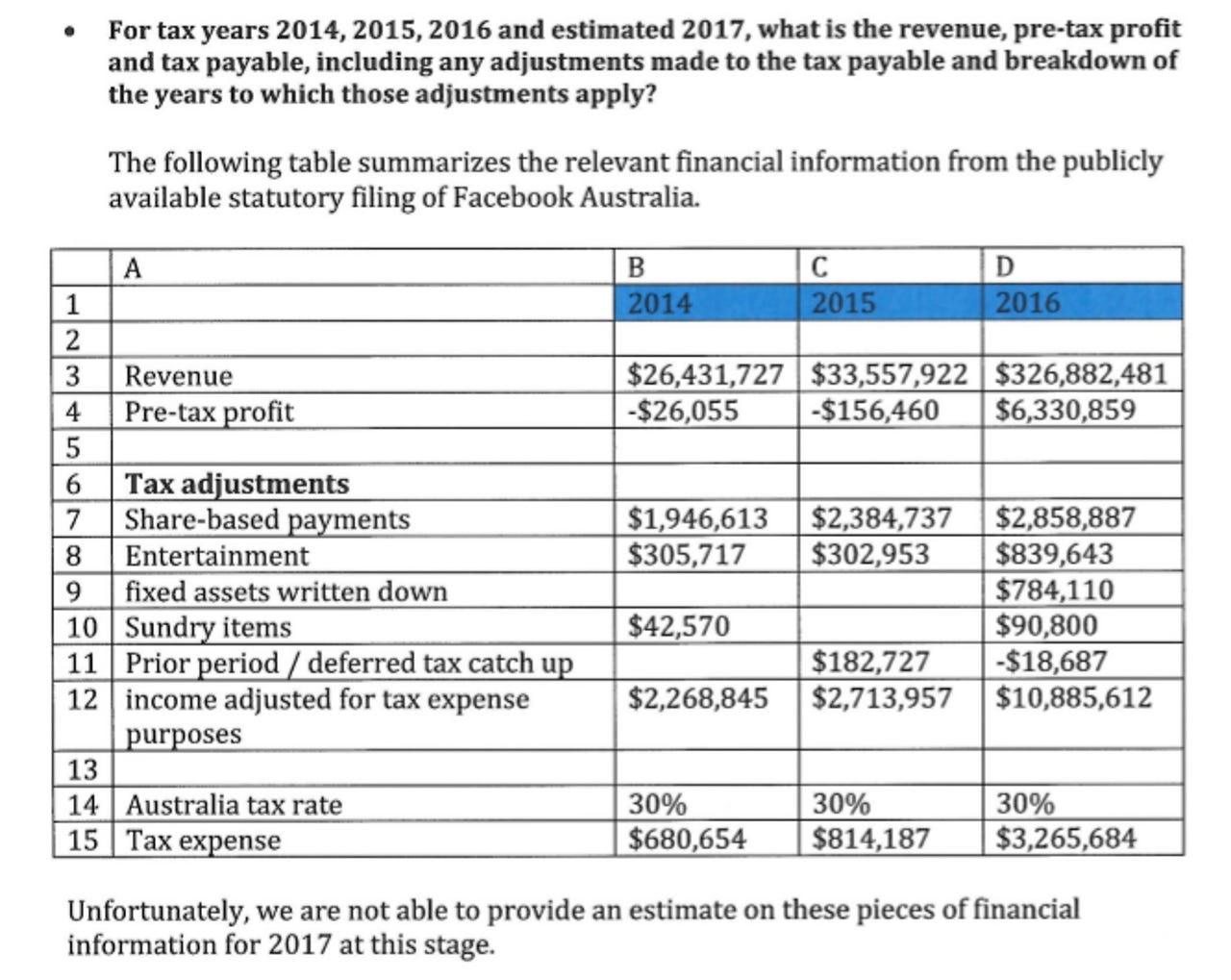

In response [PDF] to the Senate Standing Committee on Economics looking into corporate tax avoidance, the social network detailed its Australian tax details for fiscal years 2014 to 2016, and provided a glimpse of where it recognises global revenue.

From 2014 to 2016, Facebook increased its local Australian revenue from AU$26 million to AU$327 million, and at the same time, increased the amount of company tax it paid to the Australian Taxation Office (ATO) from AU$681,000 to AU$3.27 million.

For 2016, Facebook said AU$492 million in revenue from Australian customers was recognised by its Irish and American offices.

Facebook had previously told the committee it only books revenue in Australia that was derived from Facebook's local sales team in Sydney and Melbourne, and did not include Australian companies or people who bought ads on the social site without interacting with the local sales arm.

At the same time, the ATO explained that Facebook's behaviour is not against any laws.

"They have a presence in Australia and the sales that that presence directly supports must be returned in Australia -- that's how the MAAL [multinational anti-avoidance laws] works. It says if you have sales that are going offshore, and you have activities in Australia, and those activities directly support those sales, then you must return those sales in Australia," ATO deputy commissioner Mark Konza said in August.

"However, the converse must also be true, obviously, senator, and that is if you have some of your sales which are not being directly supported, then you are under no obligation to return them in Australia."

Facebook is currently being audited by the ATO.

In July, the social network reported net profit of $3.9 billion on revenue of $9.32 billion for the second quarter.

Last week, Google responded to the committee and confirmed the amount of tax it paid in fiscal 2016. That year, the search giant booked AU$1.14 billion in local revenue, made AU$121 million in pre-tax profit, and paid AU$33 million in tax.

The revenue recognised, tax paid, and pre-tax profit were all more than double its 2015 numbers.

Similarly, Microsoft disclosed numbers to the committee that reflected its February ASIC filing.

Apple was not as helpful as the other companies, and only detailed the tax paid between 2014 and 2016, as well as tax adjustments.

In January, filings showed Apple Australia booked AU$7.5 billion in revenue, with only AU$3.7 million left in net profit after AU$128 million owed to the tax office was paid.

Apple Australia managing director Tony King told the committee in August that the local company records all sales in Australia, and has done so for decades.