Micron says memory demand strong thanks to cloud, mobile, IoT

Cloud computing, mobility and the Internet of things are equating to quite the tailwind for memory demand. Just ask Micron Technology.

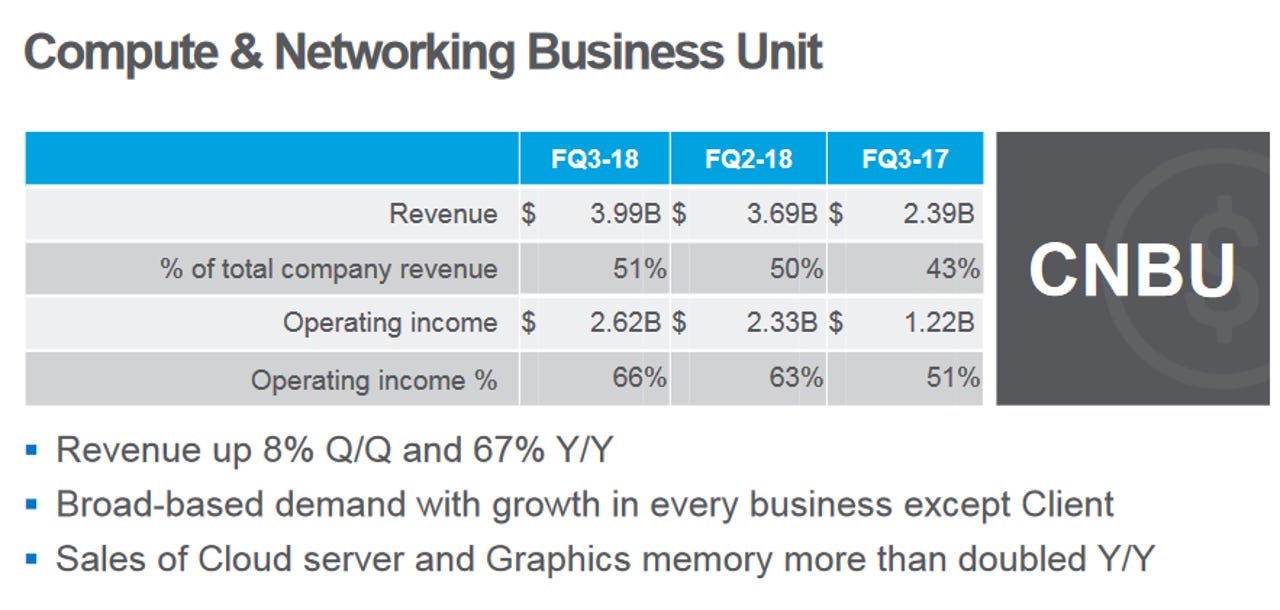

Micron on Wednesday reported third quarter revenue of $7.8 billion with net income of $3.82 billion, or $3/10 a share. Non-GAAP earnings for the quarter were $3.15. Those results were better-than-expected as was Micron's outlook. For the fourth quarter, Micron projected revenue between $8 billion and $8.4 billion with earnings of $3.30 a share give or take 7 cents a share.

The Micron results come just as concerns about memory demand were appearing. Micron allayed those fears and then some. Here's why:

Memory in smartphones is only going higher. "Revenue from high value mobile NAND nearly doubled quarter over quarter, enabled by the ramp of eMMC and eMCP products to multiple smartphone OEMs," said Micron CEO Sanjay Mehrotra.

Cloud service providers are ramping up memory requirements.

Mehrotra added:

Data center trends are also driving momentum for Micron's DRAM and NAND solutions, with combined revenue up 87 percent year-over-year. In the third quarter, ongoing demand for our memory and storage solutions in cloud computing was a key highlight. Our DRAM and NAND revenue from cloud customers increased sequentially by 33 percent and 24 percent, respectively.

And IoT is driving healthy memory demand. Micron just qualified a 64-layer 3D NAND surveillance grade microSD card, designed for smart surveillance deployments that put AI on edge devices. Low power auto DRAM also looks promising.

Micron has also been moving up the storage stack to selling enterprise drives instead of just components.

The demand for data is translating to more opportunities for Micron and its memory portfolio.