Nvidia's tale of two processors: Tegra struggles, Tesla ramps

Nvidia is generally seen as a mobile and PC graphics processor company. Perhaps it's time to start valuing Nvidia as an enterprise player since its professional graphic processor units increasingly end up in servers and workstations.

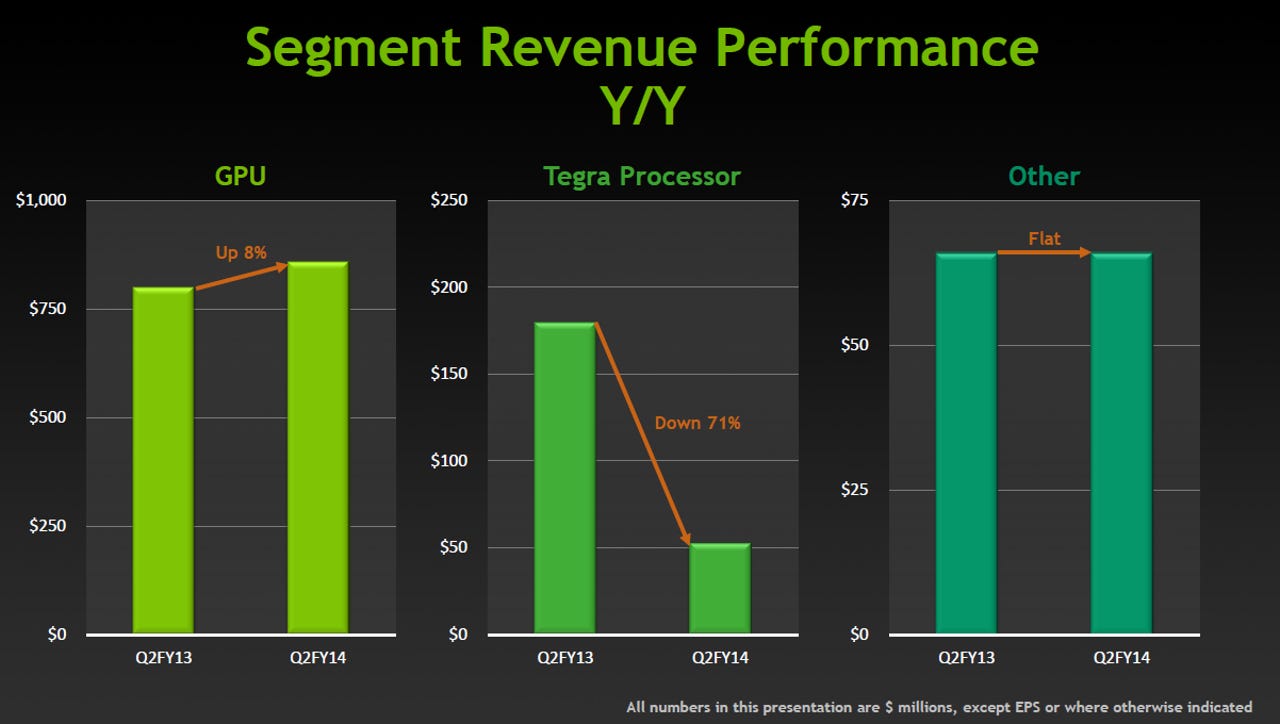

On the surface, Nvidia's second quarter was solid. The company topped expectations and delivered an outlook that was a bit below Wall Street's expectations but nothing to freak out over.

Behind the scenes, however, Nvidia is in transition. Let's look at the moving parts:

- Nvidia's Tesla business delivered its best quarter. Stifel Nicolaus analysts Kevin Cassidy summed up Nvidia's ongoing Tesla investment and the payoff today. "We believe Nvidia's 5 year plus investment in moving its GPU architecture into servers/HPC/data centers is beginning to drive new revenue growth," he said in a research note. Indeed, a few years ago it was hard to see Nvidia as a high-performance computing player. Today, Nvidia is a data center player. The good news for Nvidia: Data centers provide much higher profit margins.

- The company's graphics processor business for PCs is holding its own, but PC sales are weak and it's unclear if they'll bounce back. Nvidia still depends heavily on its GPU business.

- Tegra is sucking wind. Nvidia got into a battle with Qualcomm and appears to be getting thumped. Sure, Tegra has had some design wins and fared well previously. The Tegra revenue was down 49 percent sequentially in the second quarter. There are fewer Tegra-based tablets being shipped. Nvidia executives expect that the second half will look much better as new tablets and smartphones hit the market with Tegra. The company is also aiming to move Tegra into new markets---notably Nvidia's Shield gaming system and automobiles.

Karen Burns, Nvidia's interim CFO, said on an earnings conference call:

To date, we have established a proven market position for Tegra that we will build on. Largely with Tegra 2, we've generated $360 million in revenue in fiscal 2012 from smartphones and tablets alone. Largely with Tegra 3, we grew revenue 50% to $540 million from these devices in fiscal 2013. With Tegra 4, we are expanding our reach to other large markets where visual computing matters, such as auto navigation systems, TV set-top boxes, and new desktop form factors like all-in-one and smart monitors.

The problem: Analysts aren't buying that Tegra 4 can shine. Shield, Nvidia's gaming platform, will move Tegra units, but tablets will need to sell. CEO Jen-Hsun Huang said:

This was our Tegra trough quarter. We had talked about that before, the transition between Tegra 3 and Tegra 4. Because we pulled in two very important projects -- Tegra 4i with our integrated 4G modem and Logan, which incorporated our mobile Kepler GPU. As a result of that, Tegra 4 was a little later than our typical cycle. So we had a gap-out and we expected Q2 to be the trough. We expect next quarter to be up substantially. And as Karen mentioned earlier, however, there were some disappointments this year. Some projects that we worked on that we had spent a lot of effort on, didn't pan out as we expected. It is relatively well-known now, but nonetheless, it didn't meet our expectations. But overall, I would say that Tegra 4 is going to ramp up very nicely this coming quarter. There's tablets from ASUS, Toshiba and HP. There's SHIELD that's ramping up. And there are new devices that are going into production that are quite exciting.

Huang's not-so-subtle point: Microsoft's Surface didn't do that well and took Tegra units with it. Some analysts are already wondering if Nvidia needs to punt on Tegra. Evercore Partners analyst Patrick Wang was blunt:

Nvidia remains in a transition phase as the future of Tegra looks murkier than ever and missed even our conservative estimates. We believe management should revisit Tegra priorities and perhaps scale back efforts in the highly competitive tablet / handset market. Tier 1 devices (Apple, Samsung) are still out of reach and management is capitulating on these efforts, in some sense, by looking at the IP licensing route. Intense competition and brutal ASP pressure in Tier 2 / 3 devices could make it hard to justify the ROI.

At least Wang things that Nvidia's move to put Tegra in autos makes sense.

What's unclear is whether Nvidia can build on its enterprise strength. There's an argument that Nvidia's GPU business is peaking. Meanwhile, AMD and Intel are looking to thwart Nvidia's data center encroachment.

For now though, Nvidia's move to be a server player has paid off nightly. At the very least, Nvidia's high-end GPUs have smoothed out a lot of rough edges on the mobility front.