PC shipments climb in Q3, Gartner and IDC report

Research firms Gartner and IDC have released their latest shipment data on the global PC industry, and the numbers are a welcome, positive spin for PC vendors after years of continued decline.

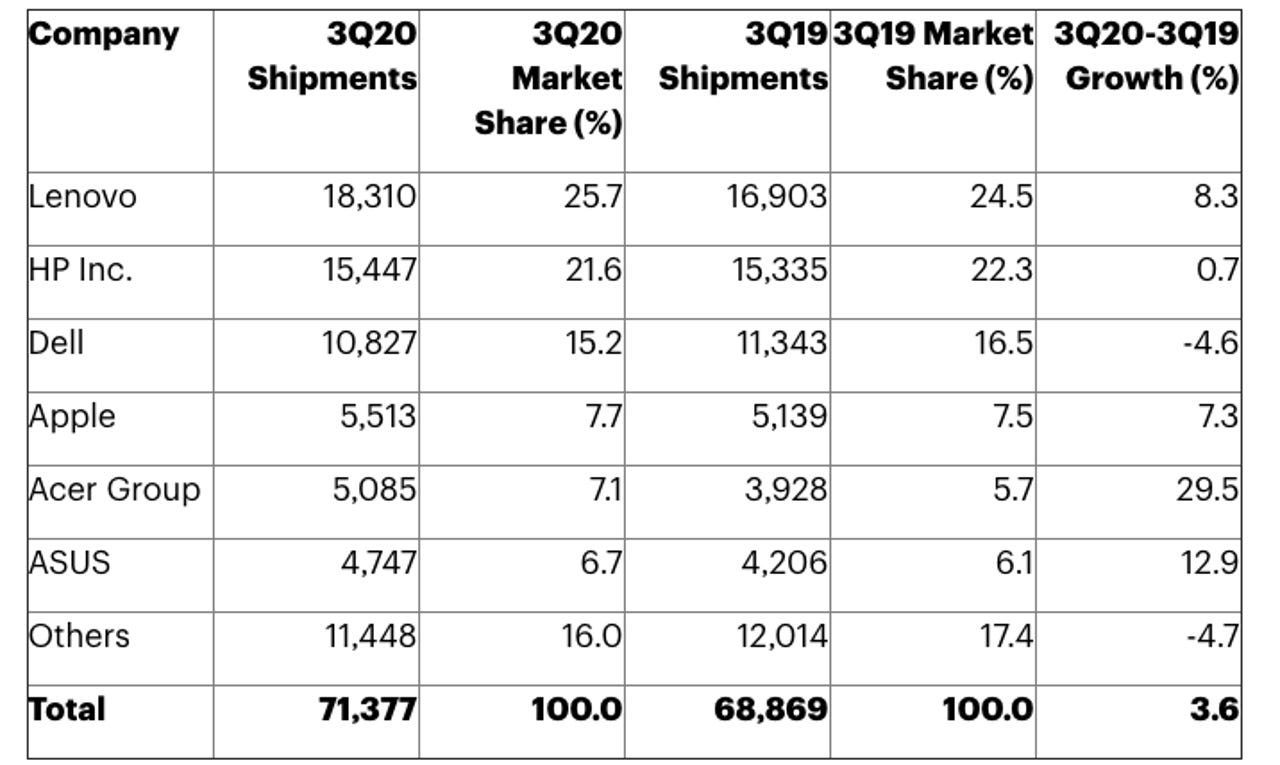

According to Gartner, PC shipments in the US increased 11.4% in the third quarter of 2020 -- the strongest growth in the US in a decade. Worldwide, PC shipments totaled 71.4 million units, an increase of 3.6% year over year.

In the US, according to Gartner, HP was the top vendor with nearly 30.8% market share, followed by Dell with a 25% market share. The list of top vendors was rounded out by Lenovo, Apple, and Acer. Gartner's data includes desk-based PCs, notebook PCs, and ultramobile premiums (such as Microsoft Surface), but not Chromebooks or iPads.

Nonetheless, Gartner noted that Chromebook shipments grew by roughly 90%, with demand driven by distance learning due to the pandemic, especially in the US market.

Gartner's PC shipment totals.

Mobile PC growth was particularly strong, noted Mikako Kitagawa, research director at Gartner.

"Mobile PC demand in the U.S. market surged as the shift from desktop to mobile PCs became a common practice across public and private businesses, even with many companies partially bringing their workers back to the office," said Kitagawa. "PC demands in the US were also backed by the gradual economic recovery throughout the quarter, including a rebound in employment and an improved consumer confidence index."

IDC analysts found that PC shipments totaled 81.3 million units worldwide during the third quarter, an increase of 14.6% year over year. However, IDC points out that PC vendors entered the quarter with a backlog of unfulfilled orders due to pandemic-related shortages on PC parts and components.

"Consumer demand and institutional demand approached record levels in some cases," IDC's Jitesh Ubrani said in a statement. "Had the market not been hampered by component shortages, notebook shipments would have soared even higher during the third quarter as market appetite was yet unsatiated."

HP and Lenovo vied for the top spot among vendors in Q3. According to IDC, Lenovo carried 23.7% of the global market with more than 11% growth, while HP claimed 23% of the market to take the second place spot. Dell, Apple and Acer round out the top five vendors on IDC's list.