RealNetworks CEO Kimball has a master plan (and it revolves around SaaS)

RealNetworks may be the largest stealth software as a service player around.

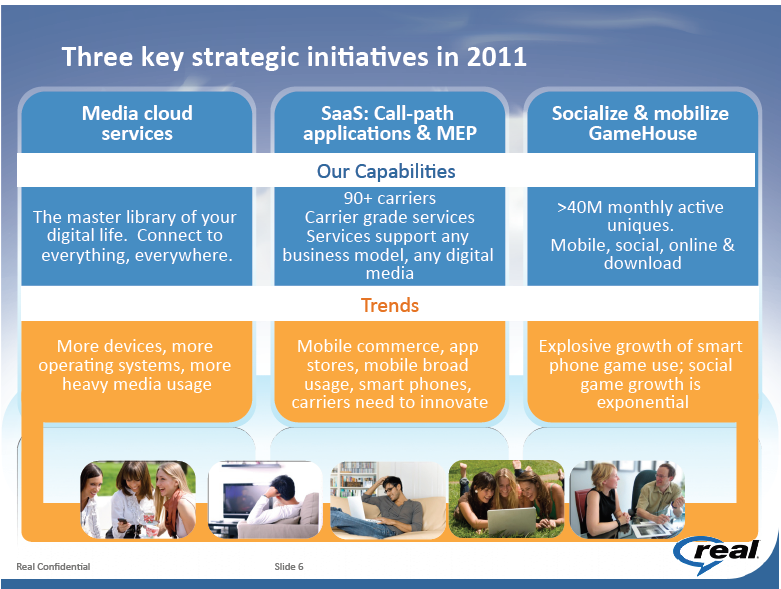

And SaaS, which isn't as glamorous as media players, streaming music and video, is essentially RealNetworks' untold story. It's unclear why RealNetworks hasn't talked up its SaaS credibility until recently, but the company has the mojo to make white-label on-demand services the linchpin of CEO Bob Kimball's turnaround. "We've spent the first nine months of the year being inwardly focused to get the company in the right size and structure," he said.

Let's put SaaS thing into perspective. Kimball oversees a company that had roughly $50 million in revenue from "core products" in its most recent quarter. If you read the footnotes, you find that "core products" largely consists of deals with 90 wireless carriers to offer stores. RealNetworks is behind MetroPCS' music store. Ditto for Verizon's Vcast music store. Toss in Sprint. AT&T too. RealNetworks also sells ringtones behind the scenes for carriers.

A $40 million to $50 million in revenue quarter for a SaaS company is considered solid. That range is on par for most SaaS companies, excluding Salesforce.com of course.

Add it up and RealNetworks has 37.5 million SaaS subscribers (that stat doesn't include Rhapsody). With that backdrop, we caught up with Kimball to talk about the company's turnaround. Disclosure: I had basically written off RealNetworks for dead. At the least, I considered it a zombie company. And I'm not alone. RealNetworks' market cap is only about $100 million more than its cash position.

Kimball's mission in this interview (not that he knew it at the time): Convince me I should care about RealNetworks.

Here's a look at the key issues surrounding the company, a recap of Kimball's chat and my take.

Is RealNetworks more than the RealPlayer? And for that matter do players matter anymore? Kimball said that RealPlayer accounts for roughly 10 percent of the company's revenue. Most of these sales come from advertising, sales of SuperPass, which is a declining business, subscriptions to a 24-7 broadcast of Big Brother (owned by ZDNet parent CBS) and payments from being a big distributor of Google's Chrome browser and Toolbar. That latter point was a bit of a shocker. "RealPlayer has come a long way. It has a simple, more elegant design and the challenge is doing less better," said Kimball. "Players aren't as relevant as they used to be, but we need to provide more value." Kimball noted that users have downloaded more than 1 billion videos from its RealPlayer download browser add-on. RealPlayer also supports more than 100 mobile devices.

What are the company's core themes? Kimball said the company is aligning itself around mobile broadband usage, supporting multiple operating systems and the proliferation of Internet-connected devices. Video over mobile broadband and social gaming are other areas that "play nicely where we are strongest."

That mobile connection is critical for Kimball. Why? Kimball said RealNetworks has relationships with more than 90 carriers and can help telecoms support multiple applications and operating systems. "It's a mobile multiscreen world," said Kimball. "While there's sex appeal in iPhone and Android, the reality is that these carriers have 100 devices to support." RealNetworks provides video and music services to AT&T and Verizon. So what's the strategy on mobile? Kimball said the plan is to be "iTunes for all devices." RealNetworks' white-label SaaS stores for carriers---you won't find the Real brand anywhere---support ringtone sales, al a carte music stores, subscriptions, ads and microtransactions. Kimball said RealNetworks can play a key role as carriers seek to serve customers on any screen---not just the smartphone.

Sounds good, but why doesn't RealNetworks have more than 37.5 million SaaS subscribers if it has relationships with 90 carriers? Kimball said the challenge for RealNetworks is becoming more involved with the end-user sale. Here's how RealNetworks traditionally handled the SaaS sale. RealNetworks provides a service to carriers. Carrier slaps an icon on the screen, say the Vcast store, and that's it. But if the carrier puts 17 clicks---a real statistic---between a ringtone sale and the end user, RealNetworks (and the carrier) aren't going to light up the revenue growth. Kimball said that growing RealNetworks' SaaS footprint via new services such as video can boost revenue. The good news: RealNetworks has an addressable market of about 700 million subscribers.

The biggest hurdle to grow RealNetworks' SaaS business is sell-through to the consumers. "We've had too much focus on selling into the carrier, but part of our job has to be selling through to the end user and making it easier," said Kimball. "We haven't put any wood behind that. We are a blue-chip provider for a lot of these services, but need to spend more time on getting subscriber uptake." On a related front, RealNetworks has plans for a cloud media management service.

Does RealNetworks have an image problem? "The brand generally has neutral awareness among consumers, but there's an image problem with the technorati," he said. "RealNetworks has evolved over time, it's not the same company as it was in 2000, 2005 or even 2009. We're going to have a deep focus on making products people love. Everyone here wants to create something cool and interesting. Management needs to enable that and clear the way for employees to build something cool and compelling," said Kimball.

Was Kimball successful in garnering my continued interest? Yes. The SaaS story is one worth telling and could provide years of growth ahead. You could say I'm a sucker for a good SaaS story. Now RealNetworks just has to execute.