Rupert Murdoch shows that news isn't dead

The death of newspapers is much reported these days, but the continuing life of the companies that operate newspapers is underreported. Rupert Murdoch’s News Corp. offered $60 a share for Dow Jones this week, a 71 percent premium on the price of shares in the publisher of The Wall Street Journal before the unsolicited bid was announced.

One doesn’t pay a premium for a dying company. Rupert Murdoch doesn’t pay a premium unless he has to in order to win a deal. So, we can safely assume that publishing the news is still a good business. In a recent research report published by The Kelsey Group, I showed that newspaperUnfortunately for newspaper companies, they began the digital era by discounting their online inventory to retain print business. companies increased automotive revenues $180 million in 2006 because the shift from print to online is driving increased online spending at newspaper sites.

Unfortunately for newspaper companies, they began the digital era by discounting their online inventory to retain print business. Even though the volume of online ads—both display and classified—has increased, the newspapers have grown their online revenue from an artificially low baseline. If they had valued online ads the same way that pure-play online companies did in the 1990s, instead of giving away online inventory as a loss leader to keep lineage in print newspapers, the situation would seem much less grave.

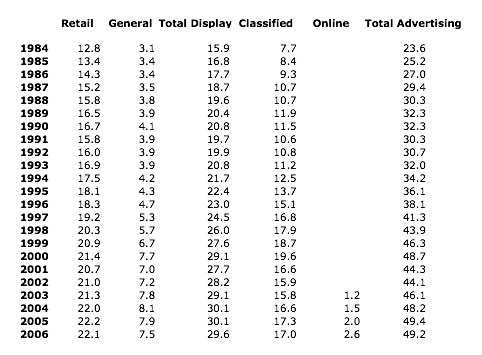

According to the Newspaper Association of America (NAA), total advertising revenues have continued to rise, with the exception of the years following the stock market crash and 9/11, since the 1980s. Last year, for example, total print ad revenue was down slightly, by approximately $800 million, but up $1.8 billion overall when online revenue was factored in. Online revenue was not even counted separately by the industry until 2003.

The economic disconnect, however, is starkly evident in the small online revenue numbers reported by the NAA. Although most newspaper publishers now sell cross-media advertising packages, online revenue still accounts for only five percent of the total ad revenue at these companies. Publishers continue to discount online ads to preserve their print business.

Problem is, there is no print business growth, only an inevitable decline. Print won’t go away, it will simply be far less efficient and a negative for the bottom line if publishers don’t start to treat their online inventory as the prime real estate they have to sell.