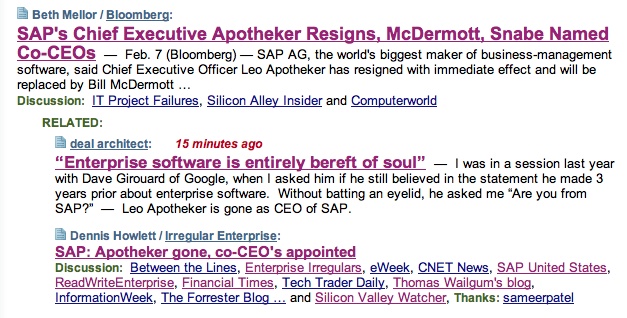

SAP: the challenges ahead

It's started. Speculation around whether SAP ex-CEO Leo Apotheker jumped or was pushed, a trawl through past failures, an implied writing off of SAP because its strategy seems muddled and as for SaaS? Pfft.

This is what SAP insiders are telling me. The last few weeks have seen an increase in internal email traffic around various policies and technologies accompanied by people re-aligning themselves. In other words, this has been on the cards for a while (no surprise) especially given it is widely known Leo's internal staff ratings were poor. Power play? You bet, and with the goal of positioning the tech/product groups in control. As one person said of the latest announcement in this context: 'It all makes sense.'

Did he jump? Very unlikely. Most likely he realized the poisoned chalice he'd been asked to hold was one from which he could no longer sup. It only needed a faint nod from co-founder Hasso Plattner as his cue to go. Like him or otherwise - I like the fellow - he deserves our respect. Not our vilification. Onwards.

I can't find a single Wall Street analyst who thinks anything other than the wheels are falling off SAP. It's a classic case of panic now, think later. That should be a reason in itself for tomorrow's (today's my time) analyst conference as an opportunity for newly minted co-CEO's Jim Snabe and Bill McDermott to put a stake in the ground. I'm not holding my breath. I am however anticipating some hostile questioning. What next?

Larry Dignan points to three things SAP should be considering. In turn:

Buy up software as a service companies. SuccessFactors, Workday and others up-and-coming threats. SAP has its own SaaS adventure in Business ByDesign, but a series of acquisitions would eliminate future threats and bring in fresh blood to the management bench.

The companies mentioned are HR related with some financials overlap. SuccessFactors has a market cap of $1.2 billion, well within SAP's cash flow. But sufficiently attractive to make it a target? Workday isn't on the block but even if it was, engineering wise it is a world apart from SAP's technology base with overlap.I can't see much 'fresh' blood coming from the latter as all execs are past PeopleSoft alumni. But...Jim and Dave Duffield share similar personalities so you never know. Even so, soes SAP need another SaaS monster on its plate?

To me, those are interesting suggestions but non-strategic. At least in the short/medium-term. I still think SAP should take a tilt at either Software AG or TIBCO. Software AG, at a cap of €2.2 bn is within cash flow and helps SAP solve technical problems at the middleware level along with getting good services expertise. TIBCO, at a market cap of $1.52 bn is also digestible. Playing in engineering spaces that help the middleware story and augment both BPM and some of the 'social' elements in SAP's story could make a lot of sense.

If SAP is to go on a spending spree then it needs to act quickly and decisively. Last year's maintenance issues were a distraction that kept Leo from spending the war chest the company had built.

Streamline the implementation process. SAP executives have said repeatedly that they’d go after consultants that don’t add value. The problem: That’s tough to do when consultants are a big part of the sales equation.

Vinnie Mirchandani has made that call. Zia Yusuf had this challenge but backed away. He's gone. When Vinnie, Mike Krigsman and I met Jim at the Influencer Summit, this was one of the challenges we repeated. Here's the problem I identified at the time. Some of us have proposed that SAP refresh the certification program. The big consulting operations are kicking hard against that idea. Surprised? It will mean they will have to field consultants that know their stuff instead of body shopping with wet behind the ears trainees. That's a cost they are reluctant to bear but is exactly the kind of issue critics want answered. The flip side is that SAP education revenue is plummeting. In a recession that's to be expected but the rate of fall is alarming, especially given Jon Reed reports that upgrade and product skills are in demand (PDF, p.10.)

Give us a technology vision. Oracle CEO Larry Ellison has been able to simplify the company’s message. With the acquisition of Sun, Ellison’s wants to sell complete systems. Oracle wants to be T.J. Watson’s IBM. Before the Sun detour, Oracle sold its middleware vision (while it took your maintenance and support dollars). In contrast, SAP’s message is muddled. What does SAP stand for and can the company effectively communicate it?

SAP has been oscillating around Java for a while. Shall we, shan't we? Word is that emphasis is back on Java for tools. Vishal Sikka has a slew of ideas including getting SAP more attuned to agile development, cloud and mobile. That's in line with what was said at last December's Influencer Summit. SAP is getting serious about open source. All these will please the more progressive 'eggheads' but internally, Vishal and Jim, buttressed by Hasso Plattner, will need to make clear cases for these that collectively, Walldorf can 'get' and accept as the way forward.

Someone has to butt heads and put an end to the ongoing power plays between Palo Alto and Walldorf. It's a canker that tears at the heart of engineering stability. Some have said: 'Where's Shai (Agassi) when you need him.' Thankfully, he's running a car making business. The last thing SAP needs right now is a disruptive force of that kind, even though the sentiment implies that the new team won't move the company needle. We'll see.

I'll throw another in the ring. Would SAP please stop pimping 12Sprints and concentrate on more important issues? 12Sprints may be a fun thing to put a social stake in the ground but it attracts far too much speculative chatter. It represents a massive distraction to more important business and engineering topics even if it does play well with the Enterprise 2.0 mavens. More important, it is not well aligned to what SAP's customers are really interested in: stability and a sensible roadmap that allows fast track innovation around the slower moving core. How about:

- What's going to happen around distribution of Business ByDesign? SAP resellers are contacting me asking this question and getting few answers. This is not a new problem but SAP needs to start feeding news on this topic. They also need to accelerate development of the SDK. Again, nothing much to report. Otherwise, ByDesign runs the risk of being another damp squib when it comes out at SAPPHIRE.

- All-in-One has proven a decent solution for the mid-market and reseller/developers are generally OK with it. But they need much more support in getting market visibility.

- Solution Manager needs attention. Some of us deride it as '5 miles wide and an inch deep.' That's something of an overstatement. As a core part of SAP's justification for enterprise support and a key plank in lifecycle management, it needs to deliver value in which customers draw confidence. In the alternative, SAP needs to give more support to partners like IDS Scheer that are adding value either directly or indirectly with upgrade and implementation solutions.

It's always easy for us armchair quarterbacks to make these kinds of statement. We don't have to finesse a large workforce nor a discomfited customer base. It's to be hoped the new team will be seen as a safe pair of hands. More after we see how they perform at the upcoming analyst call.