Smart grid players extend their influence beyond the pilot phase

When it comes to real market potential in the green tech space, smart grid-related technology is right up there. In any given week, I could post a half-dozen blogs about developments in this world. Echelon, in particular, has had a very busy summer, inking a new deal in Denmark, expanding its presence in Russia and also establishing a foothold in India with a company that will sell its Networked Energy Services advanced metering system.

In Denmark, Echelon will gain a footprint through an infrastructure deal with utility SEAS-NVE signed by its reseller Eltel Networks A/S as well as additional technology integrators that will handle other software components of the deal. The project deployment is supposed to begin in the fourth quarter with completion scheduled for the end of 2011. The technology will reach about 390,000 customers, and revenue to Echelon is projected to be $40 million.

In Russia, Echelon is working with reseller Engineering Center EnergoAuditControl on project that was significantly extended in June from 100,000 networked meters to a total of approximately 180,000 meters. The company said the deal extension is worth about $6.8 million. Here's more about the relationship.

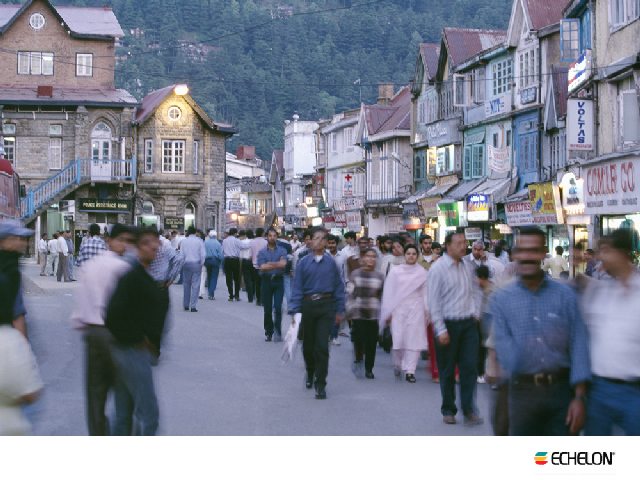

Finally, in India, Echelon has signed a deal with technology integrator HCL Infosystems, which is its first reseller in this very populous, fast-growing world economy.

One of HCL's mainstay customer segments is utility companies, which seems like a smart move given India's goal of providing electricity to every household by 2012. This will take a roughly $100 billion investment in technologies for generation, distribution, transmission, monitoring and so forth, according to Echelon. The meter market in India is estimated at 100 million nodes.

All together, Echelon says it has shipped 1 million meters worldwide. Aside from the countries I've already mentioned, the company has a footprint in Italy, Denmark, Sweden and the United States.

Rivaling Echelon in terms of actual meter deliveries is Trilliant, which so far has shipped more than 750,000 devices for advanced metering applications. The company is working with more than 100 utility companies, so far. Some examples include Louisville Gas & Electric (a subsidiary of E.ON U.S.), which is working with Trilliant on a demand-based pricing system, and Hydro One Brampton, which is in the process of installing a smart metering system. Here's a good article that gives you a better sense of Trilliant's background. I'm keeping my eye on both them and Echelon, since their technology has a maturity that shouldn't be overlooked.

Another company that has my interest is SensorTran, a spinoff of a project that originated at NASA. I spoke with CEO Kent Kalar a couple of weeks back about the company's background and intended target market. What makes SensorTran unique is that it focuses on monitoring the actual distribution system, that tangle of cables that gets our electricity to the place it needs to go. It has deployed its distributed temperature sensor technology at about 100 sites, according to Kalar, and has interested in Korea, Japan and China. Pilots include some work with Austin Energy, BC Hydro and Puerto Rico Electric Power Authority.